View sample Psychology and Economics Research Paper. Browse other research paper examples and check the list of research paper topics for more inspiration. If you need a religion research paper written according to all the academic standards, you can always turn to our experienced writers for help. This is how your paper can get an A! Feel free to contact our research paper writing service for professional assistance. We offer high-quality assignments for reasonable rates.

Economics without psychology has not succeeded in explaining important economic processes and ‘psychology without economics’ has no chance of explaining some of the most common aspects of human behavior (Katona 1951).

Academic Writing, Editing, Proofreading, And Problem Solving Services

Get 10% OFF with 24START discount code

Psychology as the science of human behavior naturally also encompasses the study of economic behavior. From this perspective, there is a considerable overlap between the two disciplines of psychology and economics, as manifested in such subdisciplines as economic psychology, behavioral or psychological economics, economic cognition, and other hybrids. Despite this multiple overlap, both disciplines use rather different approaches, rest on entirely different assumptions, and focus on different phenomena of interest. This research paper first portrays the points of contact and difference between psychology and economics. A generalized exchange assumption is then identified as a theoretical interface connecting both disciplines. The implications of this basic exchange assumption afford an organizing framework for a review of empirical research findings.

1. Comparison Of The Two Disciplines

1.1 Points Of Contact

As disciplines psychology and economics are multiply interrelated. Both serve each other as explanans and explanandum. First and foremost, psychological theories and knowledge have been amply applied to explain problems genuinely studied in economics. Vice versa, economic theory has also been applied to some fields located traditionally more within the realm of psychologists rather than economists. In most general terms, one might say that both disciplines meet in the area of decision making.

Psychological theories and knowledge help to explain how scarce resources are handled so as to satisfy needs. This approach focuses on psychological mechanisms and processes underlying consumption, investment, saving, and other economic behavior. Although early classics of economic theory explicitly or implicitly acknowledged psychological variables, there was no attempt to incorporate the psychological research systematically. Only Katona (1951) recognized that purely economic variables such as income insufficiently explain economic behavior such as consumption. He assumed that psychological variables such as affect, attitudes, expectations, and others intervene between economic stimuli and consumer reactions. Until today, the study of consumer behavior including marketing and advertising has remained by far the most successful and most pervasive application of psychology to economic behavior. This is particularly so in the area of consumer information processing (CIP), which exclusively relies on psychological theory. CIP deals with how consumers attend to, encode, store, and retrieve product relevant information and how they integrate this information to arrive at a judgment or choice. Examples of other interdisciplinary applications are fiscal psychology, that deals with attitudes towards taxes and the behavior of tax evasion, environmental behavior such as energy conservation or contingent valuation, pricing in business, household saving, and investing.

Whereas psychologists study stock market behavior, Gary Becker (1976) applied a purely economic approach to explain marriage, crime, and having children—all behaviors that have traditionally been of more interest to psychologists than to economists. By assuming a maximizing utility behavior, stable preferences, and a market equilibrium—the key assumptions in economics—a wide range of human behaviors can be integrated and explained in terms of costs and benefits (Levinger 1965).

Another point of contact concerns the impact of economic variables on states and behaviors that are significant for the individual’s well-being such as poverty, debt, or unemployment as related to happiness, physical and psychological health, and suicide. Conversely, more psychological variables such as achievement motivation or religious conviction can have an impact on economic success.

1.2 Points Of Difference

As described above, psychology and economics differ not so much in their content domains but in the research methods and theoretical premises and frameworks. First of all, whereas psychologists study individual behavior, the research object of economists are markets, not individuals or even households. This distinction is most important as other major disagreements and often seemingly irreconcilable differences stem from it. Economists presuppose that markets behave rationally, following rules that maximize utilities. Although individuals may not adhere to these rules—as psychology has shown over and over—the assumption is that irrationalities on the individual level will cancel each other on the market level, resulting in rational markets. This assumption is unrealistic from psychology’s view. A whole research tradition has accumulated evidence for how individuals deviate from normative rules not at random but in a systematic fashion. Given such systematic biases in judgment and decision-making, cancellation at the aggregate level becomes an illusion.

Psychology is inductive whereas economics is deductive. Psychologists observe individual behavior in order to test hypotheses concerning the underlying mediating processes. Although these hypotheses are often derived from higher-order theories, these theories are typically domain-specific and controversial, rather than universal and commonly shared. Economists on the other hand are more interested in predictors rather than causes, are more interested in outcomes rather than processes, and share widely accepted key assumptions such as utility maximizing behavior. Based on these key assumptions, economists deduce formalized models to predict particular outcomes. Whether the predictors are causally relevant at the individual level is only of interest to the extent that such causal mediators result in accurate models.

Clearly, this juxtaposition describes the extremes. Economists and psychologists have developed some common ground, combined interests, and a fruitful dialog, mainly incorporating psychology into economic decision making. Some of this work will be reviewed in the following. However, given that psychology is mainly concerned with individual behavior and economics with aggregate behavior, it is interesting that the mediating link—how individual behavior translates into aggregate behavior—has largely been neglected by both sides and their respective interdisciplinary approaches. Aggregate behavior, however, is clearly not simply aggregated individual behavior. For example, although consumer sentiment predicts consumer spending at the aggregate level—and is indeed a better predictor than income or other economic variables—it does not do so at the individual level.

Research methods constitute an additional source of divergence. Psychological research relies mainly on highly controlled experiments mostly conducted in the laboratory. The experimental situation is quite often rather different from the setting where the corresponding behavior naturally occurs. In particular, economists have questioned whether the use of deception in experiments leads to valid research inferences. Nevertheless, a considerable part of economic research has adopted the experimental method from psychology, with and without deception.

2. Exchange Rules As An Interface For Research In Psychology And Economics

The common denominator of most empirical research in the interface of psychology and economics lies in the assumption of a basic exchange paradigm that governs all kinds of research topics such as pricing, marketing, consumer choice, fairness of negotiation, coalition formation, investment, etc. The ultimate goal of economical exchange is to minimize the total input to actions and transactions and to maximize the total output combined over several dimensions or resources (money, effort, time, security, etc.). Within this paradigm, success means to obtain high output from low input, failure means that the output is low relative to the input. Fairness means that different parties’ (actors,’ companies’) output–input ratio is balanced. Note that in order to calculate an output–input ratio, it is essential that resources of all kinds be translatable to a joint scale so that effort can be paid in money, security can be traded against reduced profit, information costs are compensated by higher quality, and innovative ideas increase product quality, market price, and organizational efficiency (i.e., reduce workload and coordination loss). Only when all these different kinds of resources can be exchanged and can compensate each other, different action alternatives or decision options can be represented on a monotonic preference scale. Monotonicity or equivalence is indeed a precondition for all rational behavior within this basic exchange paradigm.

The rationality principle that underlies models of economic behavior as well as the irrational tendencies emphasized in psychological approaches revolve around diverse aspects of monotonicity. Indeed, a review of research on psychology and economics can be organized in terms of rules and violations of monotonicity on the one hand and problematic aspects of the underlying normative monotonicity assumptions on the other.

3. Rules And Violations Of Monotonicity: Research Examples

3.1 Transitivity Of Preference

Any quantitative scaling of enonomic goods (e.g., products, shares, investment options, job applicants) a, b, c must fulfill the transitivity constraint: If a < b and b < c, then a < c. For instance, if the price that can be obtained for object b is higher than the price for a, and the price for c is even higher than for b, then c must also obtain a higher price than a. Otherwise, rules of exchange would either break down completely, or the joint scaling of prices, preferences, and attitudes would be severely complicated. However, in reality, this seemingly obvious normative rule can be violated systematically. Psychological models predict intransitivities under specified conditions. In a multi-attribute utility framework, each object a, b, c is characterized by multiple aspects, describing advantages or disadvantages. When comparing a pair or subset of objects, some aspects are more salient and receive higher weights than other objects. Intransitivities can arise when the preference of b over a and of c over b is due to different aspects than the comparison of a and c. For instance, when choosing among three meals in a restaurant, somebody may prefer b over a because b seems more delicious, and c over b because c seems even more delicious. But when comparing c to a, the price difference may become more salient, and a may now be preferred to c because a is less expensive.

3.2 Independence Of Context

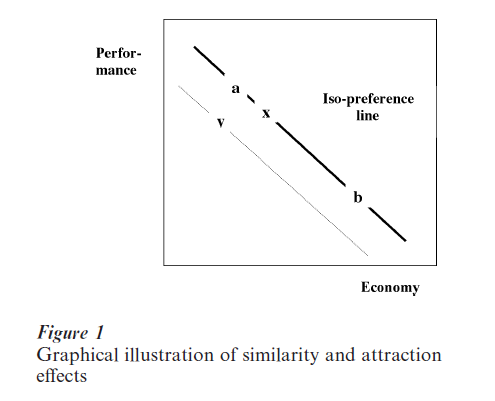

The independence principle implies that preference orders be invariant over context conditions; if a < b in context x, then a < b should also hold in context y. Again, empirical evidence and multi-attributive theories are in conflict with this premise of consistent exchange. Let a and b represent two cars the value of which is mainly determined by two attributes, performance and economy. Let a be superior in performance and b superior in economy. The relative advantage of either car in one attribute exactly compensates for its disadvantage in the other attribute so that a and b are represented on the same iso-preference line (Fig. 1). Given such a choice situation, the likelihood of consumers to choose b rather than a depends crucially on the presence of further alternatives. If the comparison is made in the context of a third car x that lies on the same iso-preference line but much closer to a than to b, then the context stimulus x becomes a rival for cars like a, inducing a tendency to prefer b over a. In contrast to this so-called ‘similarity effect,’ a context stimulus y that also lies close to a, but on a slightly inferior iso-preference line, functions like a decoy that serves to highlight the dominance of a over context stimuli and thereby increases the likelihood to choose a rather than b. This opposite influence of context has been termed ‘attraction effect’ (Huber and Puto 1983). Context effects like these have strong implications for marketing, consumer choice, and investment decisions involving similarly attractive multi-attribute options. For example, by including a new car in the range of an automobile manufacturer, the attraction of an already existing car may increase (attraction effect) or decrease (similarity effect).

3.3 Framing Of Decision Options

Verbal labeling or circumscribing of economic targets must not affect their monotonic ordering for rational exchange to work properly. However, countless studies demonstrate preference reversals as a function of mere verbal framing. Decisions under uncertainty often involve the choice between two largely equivalent options, a P-option with a relatively high probability of success but a relatively low outcome, and an O-option with a higher outcome in case of success but a relatively low success probability. The tendency to choose the more risky O-option depends strongly on whether the verbal framing focuses on positive or negative outcomes. If the decision problem is framed positively in terms of possible gains, a majority of people would show risk aversion and choose the more secure P-option. If, however, the same decision problem is framed negatively in terms of the possible losses, preference for the O-option becomes more likely.

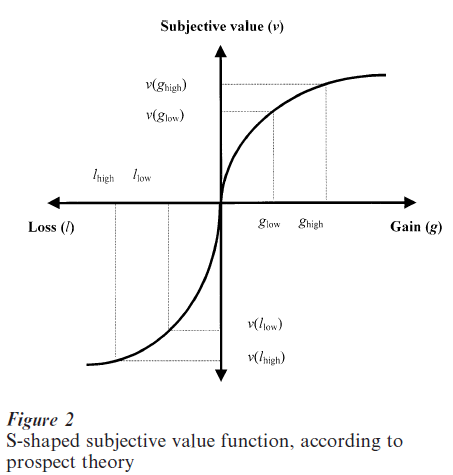

To account for such framing effects, psychologists and economists refer to prospect theory (Kahneman and Tversky 1984)—a very prominent model of economic choice. In particular, outcome framing effects are commonly explained by the assumption of an S-shaped subjective value function in which both the positive value of gains and the negative value of losses increase in a negatively accelerated fashion, as portrayed in Fig. 2. Twice as extreme an outcome is not worth twice as much, psychologically. The value of winning or loosing $200 is less than twice the value of winning or loosing $100, respectively. Such an Sshaped value function is consistent with the finding that positive outcome framing increases the tendency to choose the P-option (because the higher value of the O-option is worth less, due to the S-shaped function, than the higher probability of the P-option). Negative framing favors the choice of the O-option (because the higher negative outcome of the O-option is less extreme subjectively than the higher probability of the P-option).

3.4 Exchangeability And Compensability Of Resources

An essential premise of exchange is that qualitatively different resources can be exchanged and aggregated in a compound value function. Thus, when calculating the lower limit of the price for a product, the costs for development, production, advertising, and taxing have to be translated onto the same joint scale as the aesthetic appeal, the sonorous brand name, and the scarcity of the product. Monotonicity should not only hold within the singular components, but must also be conserved after exchanges involving different resources.

3.5 Pricing And Choice

One apparent implication of the exchangeability of resources is that differences in attractiveness should correspond to differences in the price that can be obtained for products or goods. A preferred or chosen object should justify a higher price than a less preferred or not-chosen object. However, many experiments show a preference reversal such that whereas the Poption is consistently preferred to an O-option (of the same expected value) on a choice task, the O-option is preferred over the P-option on a pricing task (Slovic 1995). Although most people prefer the secure Poption when making a choice, they are willing to pay a higher price for the O-option—an often-replicated finding that cannot be derived from prospect theory. One interpretation for the disparity of pricing and choice, though not the only one, is that the pricing task makes the outcome dimension (typically indicated in monetary terms) more salient, whereas the choice task makes the probability of winning more salient.

3.6 Effort And Accuracy

Another implication of considering qualitatively different resources as exchangeable is that amount of work and effort can be paid in money and, likewise, that work load is commonly considered a positive monotonic predictor of quality or returns. Accordingly, investing additional work should increase, and must not decrease, the quality of a product or the accuracy of an organizational decision. Otherwise, the economical value of labor and effort expenditure would be negative, creating a severe exchange paradox. Nevertheless, at least under specified conditions, working or thinking too much can impair rather than improve rational decisions (Wilson and Schooler 1991).

3.7 Information Costs And Expertise

Extending the same principle to information costs, a related implication is that the value of a product, or the future gains to be expected from rational decisions, should increase monotonically with the amount of information gathered, or with the expertise of consultants and decision makers. Information costs, much like production costs, must be subtractable from the gross income on the same monetary scale.

Of course, there is ample evidence to support this plausible assumption as, for instance, evidence showing that the reliability of decisions (e.g., choices among job applicants, prediction of growth, market analyses) increases with the number of diagnostic indicators. However, there is also a notable body of opposite evidence pointing out the less-is-more principle. As Gigerenzer and Goldstein (1996) have shown in pertinent computer simulations, increasing the number of predictors and increasing the complexity and sophistication of algorithms may actually reduce the validity of predictions and decisions. This seemingly paradoxical result can be expected in highly uncertain environments when indicators are error-prone and fallible so that reliance on an increasing number of indicators often means increasing reliance on error variance. To understand the less-is-more effect, the logical principle of rationality has to be replaced by the notion of ecological rationality. Moreover, bounded rationality highlights the need to pit accuracy against information costs and effort load and to be content with ‘satisficing’ rather than optimal actions and decisions.

One particularly intriguing variant of the less-ismore effect pertains to personalized knowledge or expertise. The additional knowledge acquired by experts as compared with lay-people, and the increased costs of expert consultation, may not be justified by a corresponding improvement of products or decisions. For example, at the stock market, experts who are highly informed about shares and market rules may be outperformed by novices simply because experts try to utilize too many fallible indicators (Borges et al. 1999). At the same time, the degree of overconfidence is likely to increase with increasing expertise. Thus, as experience and qualification increases, subjective confidence may increase at a faster rate than accuracy and actual achievement (Yates et al. 1998).

3.8 Monotonicity Of Indices

Economical decisions must often rely on indices, such as the daily value of a share on the stock market, as an index of the corresponding company’s (potential) performance. It is commonly assumed that indices correlate highly with the corresponding true properties on the same monotonic joint scale. For instance, it is likely that those companies whose share value index recently outperformed the market are expected to be more successful in the near future than those companies that lately failed to match the market. Indices are thus often regarded as monotonic functions of underlying true properties. However, this seemingly plausible assumption fails to take statistical regression into account, which is the source of many illusions and erroneous predictions. Regression is an inevitable result of error variance. To the extent that the reliability of an index is less than perfect, high index values are more likely to overestimate and low values are more likely to underestimate the true attribute to be assessed. Therefore, high values (of shares at the stock market) can be expected to be less successful after a while, whereas low values can be expected to be more successful. Ironically, then, investing in funds that recently outperformed the market may lead to less profit than investing in recently less successful funds (Hubert 1999). Thus, the assumption of a positive monotonic relation between an index and the true value of the underlying attribute is counteracted by an inverse relation between the error component of the index and the underlying attribute.

3.9 Absolute And Relative Gains And Losses

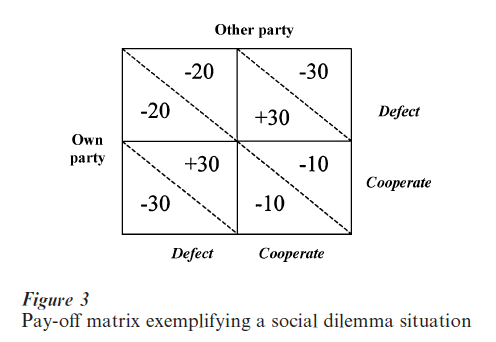

When the context, or state of the world, changes, monotonic orderings must be conserved, as already explained with reference to the independence principle. If decision option a yields a higher relative payoff than option b under condition x, and the relative payoff of a also dominates b under the complementary condition y, a is assumed to dominate b in general. Game theory is concerned with dramatic violations of this rule within social and economical dilemmas. The payoff structure of many negotiation and competition dilemmas is such that the payoff that one party gains from action a is higher than the payoff gained from action b, regardless of whether another party chooses strategy x or y. But although a > b given either x or y, it is wiser and more profitable to choose action b rather than a. Such a payoff matrix is shown in Fig. 3, with reference to an embargo situation involving two parties each having two options: to cooperate (not delivering any goods) or to defect (violating the embargo to increase own profit). The situation can be exploited if one defects and the other party cooperates (yielding a high + 30 payoff). However, if the other party also defects, violations of the embargo are sanctioned ( – 20). Nevertheless, defecting leads to higher payoff (i.e., lower embargo costs) than cooperating regardless of whether the other party defects ( – 20 vs. – 30) or cooperates ( + 30 vs. – 10). In spite of the relative dominance of defecting over cooperating, given both opponent strategies, cooperation can have a strong absolute advantage in the long run, just because defecting is likely to be reciprocated by the other party so that the absolute costs will be clearly higher ( – 20 or – 30) than when the other party cooperates ( + 30 or – 10). Therefore mutual fairness and solidarity is in the long run a more profitable strategy (moderate costs of – 10 for both parties) than reciprocal defection (stable pattern of – 20 for both parties).

4. Conclusion

The above examples represent only a small subset of possible monotonicity breaks. They illustrate that at the crossroads of psychology and economics interesting research problems emerge wherever the interchangeability principle is violated. This offers a rather fruitful perspective for the role of psychology in economic research. Economists often refer to psychology when the real data do not meet the theoretical predictions. The connotation is that psychology represents irrationality or some source of error which is responsible for the incongruency of economic models and real market behavior. However, the above examples demonstrate that violations of economic assumptions are not necessarily irrational. There may be good reasons for focusing on different features when comparing different products; the regressiveness of indices is an unavoidable problem; and the very fact that buying more information may sometimes lower the quality of decisions reflects the intrinsic uncertainty of the probabilistic world. Rather than attributing violations of rational norms to human deficits, these violations can be as well interpreted as reflecting unrealistic simplifications of the normative models used to investigate economic behavior.

Bibliography:

- Becker G S 1976 The Economic Approach to Human Behavior. University of Chicago Press, Chicago

- Borges B Goldstein D G Ortmann A LGigerenzer G 1999 Can ignorance beat the stockmarket? In: Gigerenzer G, ToddP M, ABC Research Group (eds.) Simple Heuristics that make us Smart. Oxford University Press, Oxford, UK, pp. 59–72

- Gigerenzer G, Goldstein D G 1996 Reasoning the fast and frugal way: Models of bounded rationality. Psychological Review 103: 650–69

- Huber J, Puto C 1983 Market boundaries and product choice: Illustrating attraction and substitution eff Journal of Consumer Research 10: 31–44

- Hubert M 1999 The misuse of past-performance data. In: Lifson L E, Geist R A (eds.) The Psychology of Investing. Wiley, New York, pp. 147–57

- Kahneman D, Tversky A 1984 Choices, values, and frames. American Psychologist 39: 341–50

- Katona G 1951 Psychological Analysis of Economic Behavior. McGraw-Hill, New York

- Levinger G 1965 Marital cohesiveness and dissolution: An integrative review. Journal of Marriage and the Family 27: 19–28

- Slovic P 1995 The construction of preference. American Psychologist 50: 364–71

- Wilson T D, Schooler J W 1991 Thinking too much: Introspection can reduce the quality of preferences and decisions. Journal of Personality and Social Psychology 60: 181–92

- Yates J F, Lee J-W, Shinotsuka H, Patalano A L, Sieck W R 1998 Cross-cultural variations in probability judgment accuracy: Beyond general knowledge overconfidence? Organizational Behavior and Human Decision Processes 74: 89–117