Sample Market Areas Research Paper. Browse other research paper examples and check the list of research paper topics for more inspiration. If you need a research paper written according to all the academic standards, you can always turn to our experienced writers for help. This is how your paper can get an A! Feel free to contact our research paper writing service for professional assistance. We offer high-quality assignments for reasonable rates.

1. Market Area as Territorial Expression

A market is the set of actual or potential customers of a given good or service supplier. These consumers may be characterized according to any of a number of sociodemographic dimensions, including their age, their gender, their lifestyle, as well as their location relative to the supplier’s own geographic position, to the position of other suppliers, and to the position of other consumers. The territory (or section of the geographic space) over which the entirety or majority of sales of a given good or service supplier takes place constitutes this supplier’s market area. The same concept is also known as ‘trade area,’ ‘service area,’ or ‘catchment area’ across various fields of social and behavioral sciences.

Academic Writing, Editing, Proofreading, And Problem Solving Services

Get 10% OFF with 24START discount code

In modern economic systems, in which production and consumption have uncoupled, consumption (demand) is rather ubiquitous in the geographic space, while production and distribution functions (supply) are limited to a few locales. The incongruity in the spatial organization of demand and supply is mediated by the mobility of economic agents: market places emerge when consumers are mobile, home delivery requires suppliers to reach out to their customers, while periodic markets take form in sociocultural environments where production and consumption agents are mobile. In all cases, the concept of market area serves to capture the notion of territorial expression of a supplier’s clientele. It applies to retailers and service marketers as disparate as grocers (Applebaum 1966), health care providers (Fortney et al. 1999), and library branches (Jue et al. 1999).

Goods and service providers are known to seek common locations in the geographic space so as to share into externalities created locally by their agglomeration or clustering. Towns throughout the world, many cities, spontaneous urban retail clusters and business districts, even planned shopping centers, owe their existence to such agglomerative forces. Because it is commonplace for many or all businesses belonging to these geographic clusters to serve customers from the same communities, the narrow definition of market area given in the previous paragraph can be extended to clusters of goods and service providers.

Why firms become located where they do is the central question of location theory. An early school of thought pioneered by Von Thunen approached this question as a least-cost problem. On the other hand, the market-area analysis school emphasizes demandside considerations by framing the locational decision of the firm as a search for site(s) that command the largest number of customers. It is a straightforward consequence that, for a given spatial distribution of consumers, the size and shape of a firm’s market area are indicative of the success of the firm at that site. The market-area analysis school provides the economic underpinnings for a substantial theoretical body on the processes of spatial organization of firms in consumer-oriented industries (Greenhut 1956), but also of market places and settlement locales into hierarchical systems (Christaller 1933, Berry and Parr 1988). The market area approach continues to provide the tenets for applied research in retail location analysis (Ghosh and McLafferty 1987), public facility planning (Thisse and Zoller 1983), and spatial planning (Von Boventer 1965).

2. Economic Underpinnings

It was remarked above that a firm’s market area is the territorial expression of the firm’s clientele. The market area is far more than an ex-post map depiction of a purely aspatial microeconomic process that defines customer-supplier relationships. In his 1880s work, the German economist Launhardt (1882) is credited with unveiling the novel idea that a firm’s success in selling its output in a market economy is shaped by considerations of transportation cost and of position of competing firms, one relative to another in the geographic space. In fact, it has only recently been established that the very same ideas were articulated four decades earlier by the German economist Rau (1968) in a little known letter to his colleague Quintelet. Let us consider initially the simplified case of a single firm supplying a single good to a population of identical consumers scattered over a certain geographic territory. If each consumer is assumed to have an identical demand curve that is elastic to the good’s ‘real price’ (sale price plus transportation cost), individual demand drops with distance from the firms location. The monopolistic firm’s market area extends outward to the circular perimeter where demand falls to zero. This distance is known as the range of the good. The market beyond this point remains unserved by the firm; a situation that may raise serious social equity concerns if basic needs of the population remain unmet as a result. For the sake of increasing its sales and reducing its unit production cost, the firm may decide to serve consumers outside the normal market area. It may accomplish this according to several modalities. One approach involves absorbing part of the real price applied to more distant consumers. Any spatial pricing system aimed at accomplishing this goal subsidizes remote consumers and discriminates against nearby buyers. Similar economic circumstances are commonplace when several firms at different locations compete for consumers. Since firms have more control over their nearby customers, they may seek to discriminate against them, whereas consumers at the margin of market areas may enjoy lower prices ensuing inter-firm price competition.

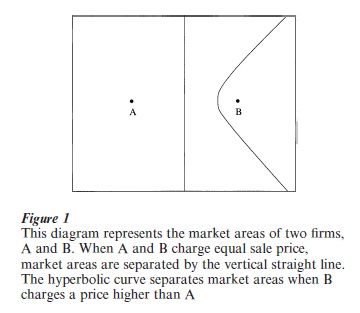

When a second firm whose geographic position is different from the first one also supplies the same good, the situation becomes more complex. Each firm commands sales in the same circular market area if they are located far enough away from each other (i.e., over twice the range of the good). Firms enjoy monopolistic profits that may entice new firms to start business. New competitors can be expected to locate in the interstitial space between monopolistic market areas so as to command the largest possible sales. This leads us to the alternative condition where firms find themselves close enough to each other to create competition at the edge of their monopolistic market areas. The introduction of a competitor establishes another type of boundary line where real prices are equal. The economic significance of this boundary is considerable because it delineates the market areas of competing firms, and consequently determines their sales and profits. Remarkably, as indicated by Isard (1956), this boundary is optimal and socially efficient. Working with Launhardt’s (1882) assumption that firms do not charge the same sale price, the boundary line is a hyperbolic curve defined by the equation of the difference of sale prices to the difference of transportation costs to firm locations. The American economist Fetter, who independently discovered the same economic principle, coined the phrase ‘Economic Law of Market Areas’ (1924).

Figure 1 illustrates the law of market areas under two different conditions. When firm B charges a sale price higher than that of firm A, firm A has a cost advantage over B that translates into a larger market area. The market boundary is hyperbolic and closer to B than to A. In the special case where firms charge identical sale prices, neither competitor has a special advantage. The two market areas are equal and are separated by a boundary line that is a degenerated hyperbola equidistant from the two firm locations.

As indicated above, free entry of firms affects the size and shape of market areas. Christaller (1933) and Losch (1954) argued that free entry would compress the circular market areas defined by the range into hexagons forming a lattice covering the entire territory. Their theory of spatial organization was also extended to encompass multiple goods—from the most to the least ubiquitous—to which corresponded multiple overlapping layers of hexagonal market areas. One area of deficiency of this theory was to underrate mutual interdependencies between markets for different goods and their territorial expression, the market areas. Demand-side linkages between markets are particularly meaningful to market-driven industries. One such linkage is created by consumers’ effort to reduce the transactional cost of shopping by means of combining the purchase of several goods on the same shopping trip. Multipurpose shopping, as this practice is called, reduces the geographic dispersion of firms where these goods are purchased. Because of enlarged market areas, sites where a larger range of goods is marketed are consequently placed at an advantage over others.

3. Spatial Analysis

The previous section introduced the possibility of polygonal, hyperbolic, and circular market areas. The question arises now what shapes are possible and what conditions bring them about. Since market areas constitute a model of the geography of demand, knowledge of geometric and topologic properties of market areas (Hanjoul et al. 1988) may shed some light on various issues of interest to urban and regional scholars such as the life cycle of business districts, people’s modality of usage of the urban space, or the quality of geographic accessibility to amenities (e.g., social services, health, and cultural facilities).

It turns out that market areas may take any of a large number of different shapes depending on how the perceived cost of traveling over space is related to the physical distance. For instance, the hyperbolic areas mentioned earlier are related to a linear transportation cost function. When transportation cost increases as the square root of distance (i.e., the cost of the extra mile traveled drops as the trip gets longer), market areas are elliptic. Circles arise when transportation costs follow the log-transform of distance. In contrast to hyperbolae, circular, and elliptic market areas reveal that the firm charging the higher sale price manages to serve consumers behind its own location only if they are located rather close. In these conditions, distant consumers in fact have an economic advantage in bypassing the nearby firm to patronize the more distant and cheaper firm. This economic behavior stands in direct contradiction with common intuition on the matter, yet it can be proved to result from the decreasing marginal cost of transportation. The same fails to hold for a transportation cost that is linear in distance or increases more than proportionately with distance. It follows that firms cannot automatically treat consumers that are distant from competitors as a ‘safe’ market. How secure a geographic segment of the market is does not only rest on where the segment lies with respect to firms, but also on the structure of transportation costs.

Another interesting property of geographic markets is the inclusion of a firm location in its own market area. Intuition suggests that a firm, whatever the economic and geographic environment it is operating in, ought to be able to competitively serve consumers at its front steps. Mathematical arguments can be used to show that this expectation is sound in most prevailing conditions, namely when transportation costs conform to a concave function of physical distance. In the unlikely event of transportation cost rising at an increasing rate, the firm charging a higher sale price would fail to serve nearby consumers if it is close enough to its main competitor. Quite understandably, this situation translates into greater vulnerability to competitive pressures of the market place.

4. Behavioral Viewpoint

The perspective outlined in Sect. 2 of this research paper may be crucial to foster our conceptual understanding of market areas, but too often it fails the test of operational dependability for the simple reason that it assumes that a locale falls entirely into one or another market areas. Business practitioners and applied social scientists have argued that a firm’s ability to command consumers does not stop at the boundary of its market area, but rather that it extends past that boundary and into the areas imputed to other firms. The argument continues as follows. Because of a host of other factors explaining people’s choice of a firm and because of interpersonal variations in preferences, demand is best viewed as the outcome of a probabilistic process. The dominant paradigm is that of Spatial Interaction, according to which one’s attraction to a firm (i.e., likelihood to buy from this firm) is directly related to the attractiveness of this firm and inversely related to the travel cost to it. See Spatial Interaction, Spatial Interaction Models, and Spatial Choice Models for a more detailed treatment.

In this view, a firm’s market area is recast as the territory where attraction to this firm is greater that to any other firm. Since the 1930s, the approach has been known as Reilly’s Law of Retail Gravitation (Reilly 1929, Huff 1962) by analogy with Isaac Newton’s Law of Planetary Gravitation. Of course the operational concept of market area is richer than its strict economic counterpart discussed earlier. All the geometric and topological properties of market areas (Sect. 3) are still pertinent under the spatial interaction paradigm. The intensity of demand in and out of the market area adds an important dimension to the characterization of market areas. The principle of spatial interaction generates a pattern of decreasing demand intensity away from the firm location, the rate of which depends on the structure of transportation costs and on interfirm competition.

The spatial interaction approach to spatial market analysis recognizes that firm attractiveness may be a multifaceted notion shaped by price, service, and merchandising properties of the firm. It also recognizes that perceived attractiveness is what influences firm choices and that sociodemographics is a powerful mold of individual perceptions. The capability to segment consumers by their sociodemographic characteristics becomes handy when the study area is highly segregated socioeconomically. It is now commonplace to carry market analysis within the interactive computer environment offered by geographic information systems. Automated numerical and database manipulations provide an essential toolbox for spatially-enabled market analysis, also know as ‘business geographics.’

Consumerism and compelling marketing practices have replaced mass merchandising with ever more finely defined customer segments with their own wants and needs. Where sale price and travel cost used to be the driving forces, markets have become more fluid, uncertain, and varied than ever before. It should not be too much of a surprise therefore that the marriage of spatial interaction and conventional, microeconomic market area analysis has enhanced our grasp of contemporary spatial market systems. The greater propensity of firms to form spatial clusters can be ascribed to the disappearance of exclusive market areas stipulated by the spatial interaction paradigm (de Palma et al. 1985). Concomitantly, a countervailing transformation may manifest itself in the form of greater differentiation of firms from each other (Thill 1992) to better cater to the diversity of consumer segments.

In these times where information technologies are quickly redefining the relationships between demand and supply in post-modern economies, the question naturally come whether electronic commerce (e-commerce) will bring the demise of the notion of market area. While no definite answer can be advanced at this time, partial arguments can be articulated as follows. As a rapidly increasing portion of postmodern economies is siphoned through e-commerce, more commerce takes on a new organizational structure wherein spatial relationships and territoriality may play a lesser role. New commercial relationships contribute to the emergence of a new geography, namely the virtual geography of information and communication flows on the network of computer servers. It has been argued that the notion of market area is not tied to the existence of a physical space and that it has bearing in the space framed by firm characteristics. In the same vein, the notion can be extended to the topological network of the information superhighway. Additionally, even the most optimistic projections on the expansion of e-commerce do not predict that it will entirely replace brick and mortar commerce. Hence, in all likelihood, face-to-face commerce and associated geographic markets will subsist. This is not to say that spatially-defined market will remain unaltered by the digital revolution. If evolution of the past decade gives any indication of future trends, the notion of market area will continue evolving in response to technologyenabled practices of target marketing towards increasingly entwined fields of interaction.

Bibliography:

- Applebaum W 1966 Methods for determining store trade areas, market penetration, and potential sales. Journal of Marketing Research 3: 127–41

- Berry B L J, Parr J B 1988 Market Centers and Retail Location. Theory and Applications. Prentice-Hall, Englewood Cliffs, NJ Christaller W 1933 Die Zentralen Orte in Suddeutschland. Gustav Fischer Verlag, Jena, Germany

- de Palma A, Ginsburgh V, Papageorgiou Y Y, Thisse J-F 1985 The principle of minimum differentiation holds under sufficient heterogeneity. Econometrica 53: 767–81

- Fetter F A 1924 The economic law of market areas. Quarterly Journal of Economics 39: 520–29

- Fortney J C, Lancaster A E, Owen R R, Zhang M 1999 Geographic market areas for psychiatric and medical outpatient treatment. Journal of Behavioral Health Ser ices and Research 25: 108–16

- Ghosh A, McLafferty S L 1987 Location Strategies for Retail and Ser ice Firms. Lexington Books, Lexington, MA

- Greenhut M L 1956 Plant Location in Theory and Practice: The Economics of Space. University of North Carolina Press, Chapel Hill, NC

- Hanjoul P, Beguin H, Thill J-C 1988 Theoretical Market Areas under Euclidean Distance. Institute of Mathematical Geography, Ann Arbor, MI

- Huff D L 1962 Determination of Intra-urban Retail Trade Areas. School of Business Administration, University of California, Los Angeles

- Isard W 1956 Location and Space-Economy. MIT Press, Cambridge, MA

- Jue D K, Koontz C M, Magpantay J A, Lance K C, Seidl A M 1999 Using public libraries to provide access for individuals in poverty: A nationwide analysis of library market areas using a geographic information system. Library and Information Science Research 21: 299–325

- Launhardt W 1882 Kommerzielle trassierung der verkehrswege. Zeitschrift fur Architektur und Ingenieurswesen 18: 515–34

- Losch A 1954 The Economics of Location. Yale University Press, New Haven, CT

- Rau K H 1968 Report to the Bulletin of the Royal Society. In: Baumol W J, Goldfeld S M (eds.) Precursors in Mathematical Economics: An Anthology. London School of Economics and Political Science, London, pp. 181–2

- Reilly W J 1929 Methods for the Study of Retail Relationships. University of Texas Bulletin 2944, Austin, TX

- Thill J-C 1992 Competitive strategies for multi-establishment firms. Economic Geography 68(3): 290–309

- Thisse J-F, Zoller H G 1983 Locational Analysis of Public Facilities. North-Holland, Amsterdam, The Netherlands

- Von Boventer E 1965 Spatial organization theory as a basis for regional planning. Journal of the American Institute of Planners 30: 90–100