Sample Inheritance Of Economic Status Research Paper. Browse other research paper examples and check the list of economics research paper topics for more inspiration. iResearchNet offers academic assignment help for students all over the world: writing from scratch, editing, proofreading, problem solving, from essays to dissertations, from humanities to STEM. We offer full confidentiality, safe payment, originality, and money-back guarantee. Secure your academic success with our risk-free services.

1. Introduction

Economic status is transmitted from parents to offspring. The perpetuation across generations of a family’s social class, or their position in the distribution of income, is generally thought to reflect the combined effects of the genetic and cultural transmission of traits, such as cognitive functioning, that contribute to economic success, as well as the inheritance of income-enhancing group memberships and property. The superior education enjoyed by the children of higher status families contributes to this process of economic inheritance. While recent research has illuminated important aspects of this account, the factors contributing to the extent of intergenerational transmission of status and the ways that genetic and cultural transmission and the inheritance of property and memberships contribute to this process remain obscure.

Academic Writing, Editing, Proofreading, And Problem Solving Services

Get 10% OFF with 24START discount code

First, the extent of intergenerational economic status transmission is considerably greater than was thought to be the case a generation ago, with some intergenerational correlations of parent–offspring income exceeding Francis Galton’s original estimate (two-thirds) for height (Galton 1889, p. 97). Second, the genetic inheritance of traits contributing to the cognitive skills measured on IQ and related tests explains very little of the intergenerational transmission of economic status, even if the heritability of IQ is quite high. Third, the combined genetic and cultural inheritance processes operating through superior wealth, cognitive levels, and educational attainments of those with well-off parents, while important, do not fully explain the intergenerational transmission of economic status. This research paper will identify some as yet overlooked individual traits that enhance economic success in the members of both generations and are transmitted across generations.

2. The Intergenerational Transmission Of Economic Status

Economic status may be measured in discrete categories—by membership in hierarchically ordered classes, for example—or continuously, by earnings (wages and salaries), income (earnings plus income from property and other sources), an occupational prestige index, or wealth.

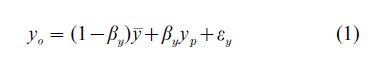

Continuous measures of status—like height in Galton’s example—allow a simple metric of persistence, the intergenerational correlation coefficient ρ, the square of which measures the fraction of the variance in this generation’s measure of economic success that is statistically associated with the same measure in the previous generation. The persistence of economic status is measured using a first order Markov process

We use subscripts ‘o’ and ‘p’ to refer to offspring and parental measures, respectively, so yo is an individual’s economic status, adjusted so that its mean, y, is that of the parental generation, βy is a constant, yp is the individual’s parental y, and εy is a disturbance uncorrelated with yp. In this setup, inspired by Galton’s treatment of height, and extended in Goldberger (1989), regression to the mean is measured by 1-βy. Little explanatory power is gained by using higher order Markov processes to take account of the effects of earlier generations (Warren and Hauser 1997, Behrman and Taubman 1989). The intergenerational correlation is

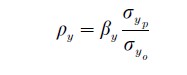

where σy is the standard deviation of y. if y is the natural logarithm of wealth, income, or earnings, the standard deviation of y is a common measure of inequality. Thus, if inequality is unchanging across generations, so σyp =σyo, then ρy =βy. In the empirical work reviewed below earnings, income, wealth, and other measures of economic success are measured by their natural logarithm unless otherwise noted. Thus, βy is the percentage change in offspring’s economic success associated with a one percent change in parents’ economic success.

Early studies following the work of Blau and Duncan (1967) estimated intergenerational correlations for income or earning among men in the US to be in the neighborhood of 0.15, leading Becker and Tomes (1986) to conclude that:

Aside from families victimized by discrimination, regression to the mean in earnings in the United States and other rich countries appears to be rapid … Almost all earnings advantages and disadvantages of ancestors are wiped out in three generations (S32).

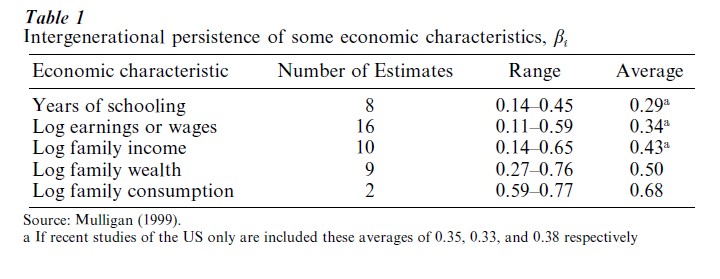

But the appearance of such high levels of mobility was an artifact of two types of measurement error: errors in reporting income, particularly when individuals were asked to recall the income of their parents, and transitory components in current income uncorrelated with underlying permanent income (Bowles 1972, Bowles and Nelson 1974, Atkinson et al. 1983, Solon 1992, Zimmerman 1992). The high noise to signal ratio in both generations’ incomes depressed the intergenerational correlation, and when corrected using a variety of methods and distinct data sources, the intergenerational correlations for economic status appeared quite substantial, as is indicated by the data in Table 1. Another useful survey of these data is Bjorklund and Jantti (1999), and the discussion in Mulligan (1997) and Solon (2000). Estimated intergenerational correlations generally rise with age, are greater for sons than daughters, and are greater when multiple years of income or earnings are averaged. Behrman and Taubman (1989) using the Michigan Panel Survey of Income Dynamics find that the estimated intergenerational correlation of parental income and offspring earnings is 0.58 when 18 years of earnings are used compared to 0.37 for a single year.

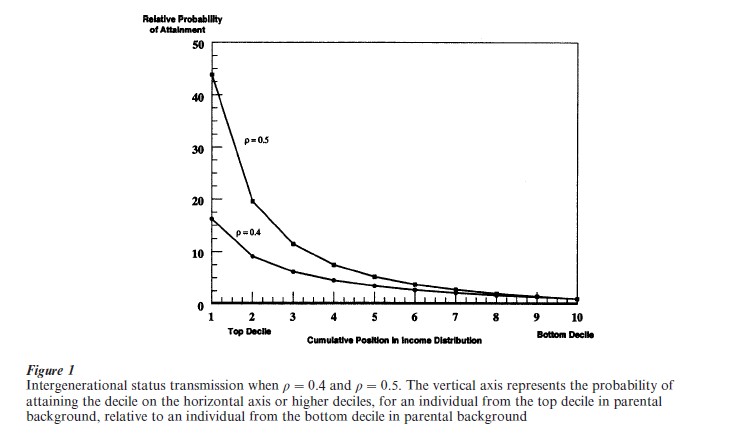

Unlike the entries in a transition matrix, µij, which indicate the extent to which one’s prospects are conditioned by one’s origins, the intergenerational correlation, ρy, is relatively difficult to interpret. However, the degree of conditioning implied can be illustrated by given values of ρy assuming that the underlying relationship is linear in yo and yp and that both are distributed normally. Figure 1 represents the transition probabilities implied by these assumptions and two different correlation coefficients, ρ=0.4 and ρ=0.5. The horizontal axis represents cumulative position in the income distribution, and the vertical axis represents the probability that an individual in the highest (first) decile of parental income attains at least this position divided by the probability that an individual in the lowest (10th) decile of parental income attains at least this position.

It can be seen, for instance, that an individual whose parents are in top decile is roughly 44 times as likely to attain a position in the top decile as an individual whose parents are in the bottom decile when ρ=0.5, and 16 times as likely when ρ=0.4. Similarly an individual whose parents are in the top decile is about 20 times as likely to attain a position in the top quintile as an individual whose parents are in the bottom decile when ρ=0.5, and nine times as likely when ρ=0. Studies allowing for nonlinear effects in Eqn. (1) suggest that our assumption of normality may lead these figures to understate the actual degree of persistence in the tails of the income distribution (Corak and Heisz 1999, Cooper et al. 1994).

The role of various forms of inheritance in the transmission process is now considered. Equation (1) is merely a summary of the results of a number of distinct processes having little in common except that they result in parent–offspring similarities for traits statistically associated with the degree of economic success in both generations. While candidates for the list of income generating traits with strong parent– offspring similarity are many, there are few for which both economic relevance and parent–offspring similarity have been empirically demonstrated. Among these are cognitive performance, the level of schooling, and ownership of wealth, each illustrating distinct transmission processes.

A common measure of economic success, income— that is, the sum of labor earnings (wages and salaries) and returns to assets—is treated as a phenotypic trait influenced by the individual’s genotype g, environment e, and ownership of income earning assets. Genotypic and environmental influences jointly determine individual skills and other traits relevant to job performance, sometimes termed ‘human capital.’ Among the environmental influences are cultural transmission from parents, schools and other learning environments. Income, human capital, and assets are transformed to their natural logarithms, and then all variables normalized to have zero mean and unit variance, represented by y, l, and k, respectively. Here and below, y is total income, while y is earnings from labor, represented as a return to human capital. So

![]()

![]()

which imply the reduced form

![]()

where ε`y is a disturbance uncorrelated with the independent variables, and the constants ω, h, βle and π give the effect in standard deviation units of a standard deviation change in the relevant variable. Thus hy2 is the heritability of earnings, namely that portion of the variance of individual earnings that would be explained by the variance of g, were e and g uncorrelated.

Using Eqn. (4), the intergenerational correlation ρy can be decomposed, yielding additive terms expressing the contribution of each of the above variables. Let ruv be the simple correlation between variables u and v. The intergenerational correlation coefficient can be expressed as

![]()

where rjyp is the simple correlation of the parental economic status measure (yp) with some another variable j, and βyo j is the normalized regression coefficient of the variable j in an equation like (7) below, predicting the current generation’s economic status ( yo). Then if parent–offspring similarity in g, e, and k are the only sources of parent–offspring similarity in y (i.e., ε`yp is uncorrelated with ε`yo), the intergenerational correlation of incomes can be decomposed as follows

![]()

expressing three fundamental mechanisms of intergenerational transmission of economic status: genetic, cultural and asset-based. What can be said about the relative importance of each? To answer this question we consider particular components of the genetic and environmental influences on economic success.

3. The Role Of Genetic Inheritance Of Cognitive Skill

Both the similarity of parents’ and offspring’s scores on cognitive tests and the statistical association of test scores and earnings are well documented. This suggests an appealing explanation of the process of intergenerational status transmission via inheritance of cognitive skills.

Correlations of IQ between parents and offspring are substantial, ranging from 0.42 to 0.72, the higher figure referring to average parental vs. average offspring IQ (Bouchard and McGue 1981). The contribution of cognitive functioning to earnings has been established using survey data to estimate the natural logarithm of earnings y as a function of a measure of parental economic and/or social status yp, years (and perhaps other measures) of schooling s, and performance on a cognitive score c—often, in US data sets, the Armed Forces Qualification Test (AFQT), a cognitive test developed to predict vocational success—as well as an error term and other variables, such as work experience, race, and sex, which will not be covered here. This equation may be written in a normalized form as

![]()

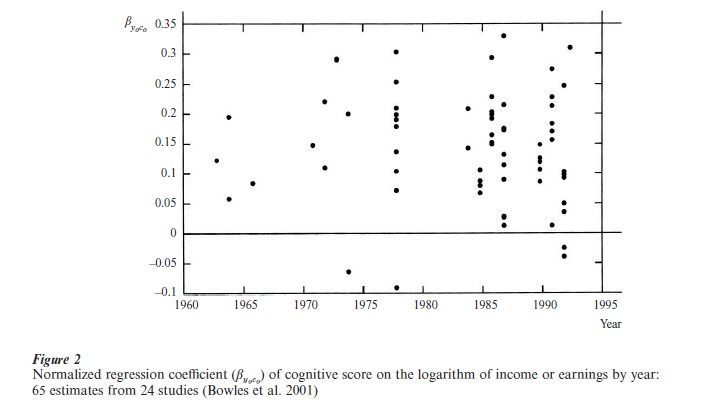

Sixty-five estimates of βyoco have been located, appearing in Fig. 2. The mean of these estimates 0.15, indicating that a standard deviation change in the cognitive score, holding constant the remaining variables, changes the natural logarithm of earnings by about one seventh of a standard deviation. By way of contrast the mean value of βyoso is 0.22, suggesting a somewhat larger independent effect of schooling. We checked to see if these results were dependent on the weight of overrepresented authors, the type of cognitive test used, at what age the test was taken and other differences among the studies and found no significant effects (Bowles et al. 2001).

Does the fact that measures of cognitive functioning are robust predictors of individual earnings, along with the similarity of the cognitive scores of parents and offspring imply a major role for genetic inheritance of cognitive ability in the process of intergenerational economic status transmission? To answer this question one needs to understand the determination of schooling (so ) and offspring cognitive scores (co ) which appear as the independent variables in Eqn. (7). Suppose hc2 is the heritability of cognitive skill and that the relevant processes are described by

![]()

![]()

where all variables are expressed in normalized form, εco and εso are error terms uncorrelated with the independent variable in their respective equations.

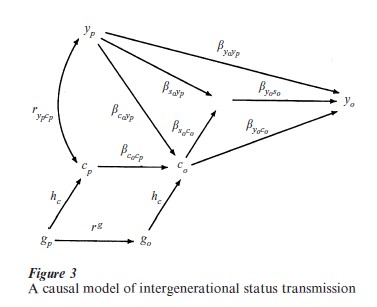

The cognitive test ideally would be taken by an adolescent just prior to the minimal school leaving age, thereby being a good predictor of adult cognitive functioning while still having an effect on the level of schooling attained. Figure 3 illustrates the causal model implied by Eqns. (7)–(9).

Equation (5) allows a decomposition of ρy showing that the genetic inheritance of IQ contributes to the intergenerational status transmission process because it results in a correlation of parental income with offspring cognitive level rcoyp, which in turn affects offspring income both directly (βcoyo) and indirectly via its effect on the level of schooling attained (βyosoβsoco). Using Eqn. (5) to decompose rcoyp one has

The genetically transmitted portion of this correlation is the term rypcphc2/2, since the direct part rg from gp to go is just the genetic relatedness of parents and natural offspring, which is 1/2. Summing the direct and indirect effects one obtains the contribution of genetic inheritance of IQ to intergenerational transmission of earnings

![]()

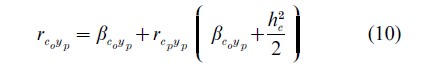

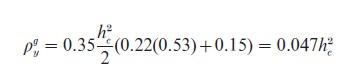

Representative values have already been introduced for βyoso (0.22) and βyoco (0.15). Estimates (Jencks 1979) of rypcp suggest a value of 0.35, and as an estimate of βsoco the preferred estimate of Winship and Korenman (1999) is taken, which is 0 .53. Therefore, ρyg=0.047 hc2 , indicating that even for hc2=1, the genetic inheritance of IQ accounts for a rather modest portion of the observed levels of intergenerational economic status transmission. The calculation is

This of course assumes there is no assortative mating of parents. If parental IQ phenotypes have correlation m, and if the heredity coefficient hc is the same for parents as for offspring, then rg=(1+h2m)/2. It follows that the maximum value ρgv could have, which occurs when hc=1 , is 0.047(1+m ). The considerably lower values for hc2 suggested by recent research of Devlin et al. (1997), Otto et al. (1995), and Plomin (1999) are consistent with the conclusion that one twentieth or less of the observed intergenerational status transmission is due to genetic inheritance of IQ. Some of the data used in this exercise are not estimated very precisely ( hc2 in particular) but the main point is robust with respect to reasonable alternative values.

Indeed it is thought that available estimates overstate the importance of general cognitive skill as a determinant of earnings for the simple reason that taking a test is more than a little like doing a job—the results measure performance, which is the joint effect of skill along with other contributors such as the disposition to follow instructions, persistence, work ethic, and other traits likely to contribute independently to one’s earnings. Eysenck (1994, p. 9) writes:

Low problem solving in an IQ test is a measure of performance; personality may influence performance rather than abstract intellect, with measurable effects on the IQ. An IQ test lasts for up to 1 hour or more, and considerations of fatigue, vigilance, arousal, etc. may very well play a part.

Thus, some of the explanatory power of the cognitive measure in predicting earnings does not reflect cognitive skill but rather other individual attributes contributing to the successful performance of tasks. The importance of the performance rather than capability aspect of the test score as a determinant of earnings is suggested Bishop (1991), who found a measure of computational speed on time tested exams to be a more robust predictor of earnings than two alternative measures—a normalized sum of academic tests as well as a measure of technical competence.

4. The Inheritance Of Wealth And Educational Attainment

The intergenerational inheritance of income-earning assets provides an alternative explanation that competes for simplicity with the inherited cognitive skills account. Table 1 shows that the intergenerational correlation for wealth status is quite substantial— within the range of parent–offspring similarity in cognitive scores—and that it exceeds the persistence of family income (to which it contributes) which in turn exceeds the persistence of earnings (which do not include income from property). While comparisons of imprecisely estimated parameters across differing data sets are notoriously unreliable, Mulligan (1997) uses a single data set and common methods for his estimates of persistence with respect to earnings, income, wealth, and consumption. His results confirm that consumption, wealth, and income regress to the mean more slowly than do earnings or wages.

These data are consistent with the inherited wealth account of economic status persistence, but for most individuals and families, income from property constitutes a negligible fraction of their total income. Only among the very well-to-do is property a major source of income. Correspondingly, very few individuals receive inheritances of significant magnitude. Mulligan (1997) estimates that estates passing on sufficient wealth to be subject to inheritance tax in the US constituted between two and four percent of deaths over the years 1960–1995.

Because wealth inheritance contributes to intergenerational income persistence, one would expect to find that persistence varies with the level of wealth of the individual’s parents. For instance, in a rare study with sufficient sample size to derive good estimates of persistence for different positions in the distribution of income (Corak and Heisz 1999) the degree of income persistence for the very rich was markedly greater than for the rest of the distribution, with ρy=0.8 for the top percentile.

However, the apparent simplicity of the inherited wealth account is misleading. The intergenerational persistence of wealth is not explained simply by bequests but reflects as well parent–offspring similarities in traits influencing wealth accumulation, such as orientation towards the future, sense of personal efficacy, work ethic, schooling attainment, and risk-taking. Some of these traits covary with the level of wealth: less well off people are more likely to be risk averse, to discount the future, and have a low sense of efficacy, for example (Bardhan et al. 2000, Fong 2000).

Like wealth levels, schooling attainments persist across generations although, as Table 1 indicates, less so. Nonetheless, father–offspring correlations for years of schooling reported by Behrman and Taubman (1989) are substantial (0.34, and would be closer to 0.4 were they corrected appropriately for errors in measurement). As in the case of wealth, the persistence of schooling attainments results from actions taken by parents and offspring, and these are influenced by beliefs and preferences that are themselves subject to intergenerational transmission. Some of the individual dispositions favoring high levels of school attainment are correlated with parental schooling levels and incomes, thereby fostering higher levels of educational attainment by the children of the well-educated. This tendency is exacerbated where the children of the less well off experience schooling as a hostile or unpleasant environment, and where their families, limited incomes and inability to borrow make the students’ potential labor services valuable to the family.

Because schooling attainment is persistent and has clear links to skills and perhaps other traits that are rewarded in labor markets, this human capital based account of intergenerational status transmission has strong prima facie plausibility, especially when deployed with the inherited cognitive skills account. Indeed, it was once commonly assumed that when adequate measures of schooling quality were developed the only effects of parental economic status on offspring earnings would operate through effects on cognitive functioning and schooling, with the direct effect of parental on offspring earnings vanishing, that is, βyoyp=0 in Eqn. (7).

But as the measurement of school quality has improved over the years, estimation of βyoyp have proven resilient. Note that βyoyp/ρy measures the importance of the direct effect of parental economic status relative to the total amount of intergenerational transmission. Mulligan (1997), controlling for a large number of measures of school quality as well as the AFQT and standard educational and demographic variables, finds that an estimate of parental income is an important and statistically significant predictor of the natural logarithm of the hourly wage rate in 1990 and 1991 in the National Longitudinal Study of Youth. A little more than two-fifths of the gross statistical association between parental and offspring economic success (ρy) apparently operates independently of the influences of these conditioning variables. Specifically, the effect of an estimate of the logarithm of parental income on offspring’s logarithm of income in a regression conditioned on measures of schooling quantity and quality, employment, and cognitive performance is between two-fifths and one-half of the estimated effect of parental income unconditioned on these variables. Mulligan’s work repeats the finding in Atkinson et al. (1983) for a sample with direct measures of incomes of fathers and sons in the UK in which two-thirds or more of the substantial inter- generational transmission of income status is independent, in the sense just defined, of the covariation of parental income with a range of measures of son’s schooling including the number of Ordinary and Advanced level exams taken, and the selectivity of the school. Finally, Bowles and Nelson (1974) found that between 33 and 60 percent of the covariation of parental economic status and respondent’s income (not its logarithm) was not accounted for by the statistical association of parental status with child- hood IQ of years of schooling.

It is possible, of course, that βyoyp measures the effects of wealth inheritance (none of the three studies includes measures of parental wealth or bequests) directly on earnings of indirectly via effects on unmeasured determinants of earnings, such as quality of schooling. But this seems unlikely given the very small number of individuals receiving any significant bequest in the samples in question. A more cautious interpretation is that it indicates an important gap in our understanding of how economic status is passed on from generation to generation: roughly half of the intergenerational transmission coefficient is unaccounted for. It is also true that typically one can statistically account for less than half of the variance of the earnings or income using the conventional variables described above, but this fact does not explain the limited success in accounting for the intergenerational correlation, as this measures only that part of the variation of earnings that can be explained statistically by parental economic status.

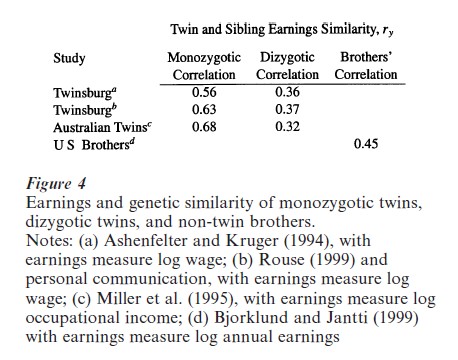

5. The Relative Importance Of Genetics, Culture, And Bequests

The face that the earnings and schooling attainments of identical twins (more technically, monozygotic twins, which is abbreviated to ‘mz’ in equations) appear to be substantially more similar than fraternal twins (or dizygotic, which is abbreviated to ‘dz’ in equations) suggests that genetically inherited traits other than cognitive skills may account for some of the intergenerational correlation of earnings. Taubman (1976) uses a sample of monozygotic and dizygotic twins to measure the relative importance of genes and environment in income determination. Figure 4 presents data from the Twinsburg, US sample, the Australian Twin Register, and the Panel Study of Income Dynamics (US). Direct inferences about the degree of heritability of income from these data are likely to be misleading for the following reasons. First, the identical twins appear to have shared more similar environments than dizygotic twins and other siblings (Loehlin and Nichols 1976), so environmental differences contribute to the greater similarity of the monozygotic twins. Second, the twin data are not corrected for errors in measurement. An adequate treatment of this problem requires information on the degree of correlation of errors, which seems likely to be higher for the identical than the other twins. If this supposition is correct, error correction would increase the monozygotic correlations by less than the dizygotic correlations. Third, the identical twins are all same-sex pairs, while the dizygotic twins include mixed-sex pairs, and sex contributes to the within pair difference in economic success. However the difference in the earnings correlation between monozygotic and samesex pairs of dizygotic twins in the NRC (Taubman 1976) sample and the Swedish Twin Registry (Isacsson 1999) is 0.24 (in both data sets). The brothers’ data set addresses this latter issue, but includes, as social siblings, unrelated members of the same household, so the genotypic correlation among them is less than 0.5. All three problems imply that the naıve calculation of heritability from these data will constitute an overestimate.

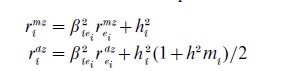

It may be of interest, nonetheless to see what this estimate yields. Assuming the degree of similarity of the environment influence on earnings and schooling attainments is identical for the two sets of twins, one can calculate the heritability of these phenotypic traits as hi2=2(rimz-ridz), where rimz and ridz are the correlations of the monozygotic and dizygotic twins for trait i. Estimates of hi and βiei are not very sensitive to assumptions concerning the degree of assortative mating, measured by the correlation of parental phenotypes, mi but depend critically on assumptions concerning the difference in the environmental correlations experienced by the dizygotic and monozygotic twins, reimz and reidz , respectively. Relaxing these assumptions requires that hi and βiei be estimated simultaneously, using the equations below, where the subscript i refers to the trait in question

The greater the difference in the environmental correlations, the lower is the estimate of hi2 and the higher is the estimate of β2iei. Correspondingly, larger values of mi increase the estimate of hi and decrease the estimate of β2iei. If the correlation for earnings-affecting environments for monozygotic and dizygotic twins are 0.8 and 0.7 respectively (rather than both being 0.8), and if mi=0.25, the estimates reported obtain. Twin correlations from Ashenfelter and Krueger (1994) for hourly wages and from Behrman and Taubman (1989) for years of schooling attained yield estimates of hi=0.4 both traits. Assuming that the correlation of parental genotypic and phenotypic income is hy itself, the estimated contribution genetic inheritance to the intergenerational transmission of these measures of status is just (rgh2y) or one-fifth. While this estimate may overstate its influence, it is not doubted that genetic inheritance plays a role, perhaps a substantial role in the intergenerational transmission of economic status, even if (as has been seen) this process operates substantially independently of the cognitive skills measured on available tests.

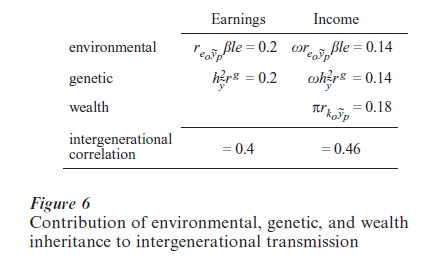

Similar methods yields estimates for the environmental effects. If the correlation of parental income and the environmental influences on offspring income is approximated by the correlation of parental (permanent) income or other measures of socioeconomic status with offspring schooling attainment, the estimate of reoyp is about 0.45. An estimate of βle2 is obtained from the Ashenfelter–Krueger twin data as (rmz-h2)/remz where remz, the correlation of monozygotic twins’ environments, is assumed to be 0.8, giving a value of 0.2. Thus, the environmental contribution to the intergenerational correlation of earnings (βlereoyp) is the same magnitude as the genetic contribution, namely 0.2, giving an intergenerational correlation for earnings of 0.4.

Note that βle =√0.2=0.45 is an estimate of the effect on earnings, in standard deviation units, of a standard deviation change in the environmental influences on human capital and hence on earnings, and may be compared with βys, the mean estimate of which (Bowles et al. 2001) is just half of βle, suggesting that while educational attainment captures important aspects of the relevant environments it is far from inclusive.

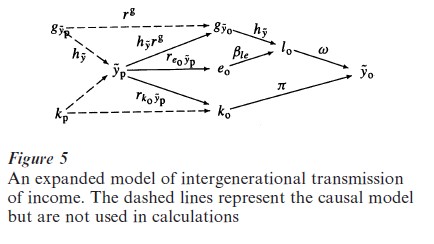

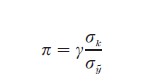

To complete the analysis we turn to the inter-generational correlation for income, including return to property, and thus take account of the inter-generational transmission of assets. Figure 5 illustrates the causal model of the determination of income underlying Eqns. (2) and (4), with the paths from yp through gyo and eo to yo depicting the transmission process for earnings addressed in the paragraphs immediately above. The contribution of wealth inheritance to the transmission process is simply the correlation of parental income and offspring wealth ( rypko) multiplied by the contribution of offspring wealth to offspring income, expressed as a normalized regression coefficient, π. An estimate of π is simply γ, the percentage change in income associated with a one percent change in assets suitably normalized. If the rate of return on one’s assets is constant, γ is simply the share of income from assets as a fraction of total income, (e.g., if the rate of return on capital is 7 percent, and the average capital holding is three times the average income, γ is about 0.2). Expressing π as a normalized regression coefficient we have

The inequality of property holdings is considerably greater than the inequality of earnings or of income, and as a result γ is likely to differ among families, with values approaching zero for the asset poor, and approaching unity for the very wealthy. This implies that importance of wealth inheritance in the inter- generational persistence of economic status is likely to differ by wealth level. If the variance of the logarithm of assets is four times the variance of the logarithm of incomes (the variance of a logarithm is a common unit free measure of dispersion) we have π=0.2(2)=0.4. Finally if rypko is midway between the intergenerational correlations for income (0.43) and for wealth (0.50), or 0.46, the property inheritance contribution to the intergenerational income correlation becomes 0.2(2)(0.46)=0.18.

To calculate the contribution of go and eo to the intergenerational correlation of income one simply multiplies the contributions estimated above by the path from earnings (or human capital) to income. One needs to assume that hy ≈ hy and reoyp ≈ reoyp. This (following the above reasoning) is estimated as

If the variance of human capital is four-fifths as large as the variance of income, then ω=0.72. Of course this value would be close to unity for population groups with no source of income other than earnings (if γo=0, then σy=σl), and could be much smaller among the wealthy.

The implied contributions to the intergenerational persistence of income based on the above assumptions are genetic =0.14, environmental =0.14, asset based =0.18, giving an intergenerational correlation of 0.46 which, as one would expect, somewhat exceeds the analogous correlations for earnings alone. These results are illustrated in Fig. 6.

The substantial contribution of wealth inheritance to intergenerational transmission of economic status among the wealthy is unsurprising, and the mechanisms through which it works relatively transparent. The same cannot be said for the genetic and environmental contributions, for as has been seen, neither IQ nor schooling provides an adequate account of these influences. Thus, both genetic and environmental influences remain black boxes. We know they are important but we do not know why.

6. Conclusion

This research paper has shown that recent evidence points to a higher level of intergenerational transmission of economics position than previously thought. Moreover, although the level of intergenerational IQ inheritance is also considerable, the latter accounts for little of the former. Indeed, some combination of environmentally and genetically transmitted noncognitive personality traits probably account for most of the correlation between the economic positions of parents and children. Personality differences, like group membership, affect earnings and display parent–offspring similarity. They thus join the genetic and cultural inheritance of cognitive skills, property bequests, and other influences of wealth, and parent–offspring similarity in schooling attainments as aspects of the process of intergenerational transmission of economic status.

We do not know, of course, if a more inclusive view of the transmission process and of the traits being transmitted taking account of group effects, personality, and other aspects would substantially improve this empirical account of the intergenerational correlation. For many of the traits identified data are available that would permit an assessment of their importance in the transmission process.

However, for many of the personality variables, there is a lack good research on the transmission process. Heritability estimates for these variables are quite reliant on comparisons of monozygotic and dizygotic twins which may substantially over-estimate heritability, and consequently underestimate the role of vertical cultural transmission and other influences of siblings’ shared (family) environments. It is known that schooling contributes to cognitive functioning independently of genetic inheritance but that most of the contribution of schooling to economic success is unrelated to the learning of cognitive skills in school (Bowles et al. 2001, Gintis 1971). It seems likely that schools contribute to economic success in part by fostering personality traits rewarded in labor markets, rather than simply by enhancing cognitive functioning, but this appears not to be the case for either the Rotter Scale or the social maladjustment measures studied by Osborne.

Bibliography:

- Ashenfelter O, Krueger A 1994 Estimates of the economic return to schooling from a new sample of twins. American Economic Review 84(5): 1157–72

- Ashenfelter O, Rouse C 2000 Schooling, intelligence, and income in America. In: Arrow K, Bowles S, Durlauf S (eds.) Meritocracy and Economic Inequality. Princeton University Press, Princeton, NJ, pp. 89–117

- Atkinson A B, Maynard A K, Trinder C G 1983 Parents and Children: Incomes in Two Generations. Heinemann, London

- Bardhan P, Bowles S, Gintis H 2000 Wealth inequality, credit constraints, and economic performance. In: Atkinson A, Bourguignon F (eds.) Handbook of Income Distribution. North-Holland, Dortrecht, The Netherlands

- Becker G S, Tomes N 1986 Human capital and the rise and fall of families. Journal of Labor Economics 4(3): S1–39

- Behrman J R, Taubman P 1989 Is schooling ‘mostly in the genes’? Journal of Political Economy 97(6): 1425–46

- Behrman J R, Taubman P 1998 The intergenerational correlation between children’s adult earnings and their parent’s income: Results from the Michigan panel survey of income dynamics. Review of the Income and Wealth 36(2): 115–27

- Bishop J 1991 Achievement, test scores and relative wages. In: Kosters M (ed.) Workers and their Wages. AEI Press, Washington, DC, pp. 146–86

- Bjorklund A, Jantti M 1999 Intergenerational Mobility of Socioeconomic Status in Comparative Perspective. Stockholm University and Abo Akademi University

- Bjorklund A, Eriksson T, Jantti M, Raaum O, Osterbacka E 1999 Brother correlations in earnings in Denmark, Finland, Norway and Sweden compared to the United States, unpublished

- Blau P, Duncan O D 1967 The American Occupational Structure. Wiley, New York

- Bouchard T J Jr., McGue M 1981 Familial studies of intelligence. Science 212: 1055–9

- Bowles S 1972 Schooling and inequality from generation to generation. Journal of Political Economy 80(3): S219–51

- Bowles S, Nelson V 1974 The ‘inheritance of IQ’ and the intergenerational reproduction of economic inequality. Review of Economics and Statistics 56(1)

- Bowles S, Gintis H, Osborne M 2001 The determinants of individual earnings: Skills, preferences, and schooling. Journal of Economic Perspectives, forthcoming

- Conlisk J 1990 Monotone mobility matrices. Journal of Mathematical Sociology 15(3–4): 173–91

- Cooper S, Durlauf S, Johnson P 1994 On the evolution of economic status across generations. American Statistical Association Papers and Proceedings 50–8

- Corak M, Heisz A 1999 The intergenerational earnings and income mobility of Canadian men: Evidence from the longitudinal income tax data. Journal of Human Resources 34(3): 505–33

- Dardoni V 1993 Measuring social mobility. Journal of Economic Theory 61: 373–94

- Devlin B, Daniels M, Roeder K 1997 The heritability of IQ. Nature 388: 468–71

- Eysenck H J 1994 Intelligence and introversion–extraversion. In: Sternberg R J, Ruzgis P (eds.) Personality and Intelligence. Cambridge University Press, Cambridge, UK, pp. 3–31

- Fong C 2000 Essays on endogenous preferences and public generosity. Ph.D. thesis, University of Massachusetts

- Galor O, Zeira J 1993 Income distribution and macroeconomics. Review of Economic Studies. 60(1): 35–52

- Galton F 1889 Natural Inheritance, Macmillan, London

- Gintis H 1971 Education, technology, and the characteristics of worker productivity. American Economic Review 61(2): 266–79

- Goldberger A S 1989 Economic and mechanical models of intergenerational transmission. American Economic Review 79(3): 504–13

- Hauser R M, Warren J R, Huang M-H, Carter W Y 2000 Occupational status, education, and social mobility in the meritocracy. In: Arrow K, Bowles S, Durlauf S (eds.) Meritocracy and Economic Inequality. Princeton University Press, Princeton, NJ, pp. 179–229

- Isacsson G 1999 Estimates of the return to schooling in Sweden from a large sample of twins. Labour Economics 6: 471–89

- Jencks C 1979 Who Gets Ahead? Basic Books, New York

- Kanbur R, Stiglitz J E 1986 Intergenerational mobility and dynastic in equality. Princeton Econometric Research Program Memorandum.

- Loehlin J, Nichols R 1976 Heredity, Environment, and Personality. University of Texas Press, Austin, TX

- Miller P, Mulvey C, Martin N 1995 What do twin studies reveal about the economic returns to education: A comparison of Australian and U.S. findings. American Economic Review 85(3): 586–99

- Mulligan C 1997 Parental Priorities and Economic Inequality. University of Chicago Press, Chicago

- Mulligan C 1999 Galton vs. the human capital approach to inheritance. Journal of Political Economy 107: S184–224

- Otto S P, Christiansen F B, Feldman M W 1995 Genetic and cultural inheritance of continuous traits. Working Paper No. 0064, Morrison Institute for Population and Resource Studies, Stanford University, CA

- Plomin R 1999 Genetic and general cognitive ability. Nature 402(2): c25–9

- Rouse C E 1999 Further estimates of the economic return to schooling from a new sample of twins. Economics of Education Review 18: 149–57

- Solon G R 1992 Intergenerational income mobility in the United States. American Economic Review 82(3): 393–408

- Solon G R 2000 Intergenerational mobility in the labor market. In: Ashenfelter O, Card D (eds.) Handbook of Labor Economics. North-Holland, Amsterdam

- Sternberg R J, Wagner R K, Williams W M, Horvath J 1995 Testing common sense. American Psychologist 50(11): 912–27

- Taubman P 1976 The determinants of earnings: Genetic, family, and other environments; a study of white male twins. American Economic Review 66(5): 858–70

- Thorndike E L 1919 Intelligence and its uses. Harper’s Monthly Magazine 140: 227–35

- Thorndike R, Stein S 1937 An evaluation of the attempts of measure social intelligence. The Psychological Bulletin 34(5): 275–85

- Warren J, Hauser R 1997 Social stratification across three generations: New evidence from the Wisconsin longitudinal study. American Sociological Review 62: 561–72

- Williams W M, Sternberg R J 1995 Success Acts for Managers. Harcourt Brace, Orlando, FL

- Williamson J, Lindert P 1980 American Inequality: A Macroeconomic History. Academic Press, New York

- Winship C, Korenman S 1999 Economic success and the evolution of schooling with mental ability. In: Mayer S, Peterson P (eds.) Earning the Learning: How Schools Matter. Brookings Institution, Washington, DC, pp. 49–78

- Zimmerman D J 1992 Regression toward mediocrity in economic stature. American Economic Review 82(3): 409–29