Sample Rational Choice And Organization Theory Research Paper. Browse other research paper examples and check the list of research paper topics for more inspiration. If you need a religion research paper written according to all the academic standards, you can always turn to our experienced writers for help. This is how your paper can get an A! Feel free to contact our research paper writing service for professional assistance. We offer high-quality assignments for reasonable rates.

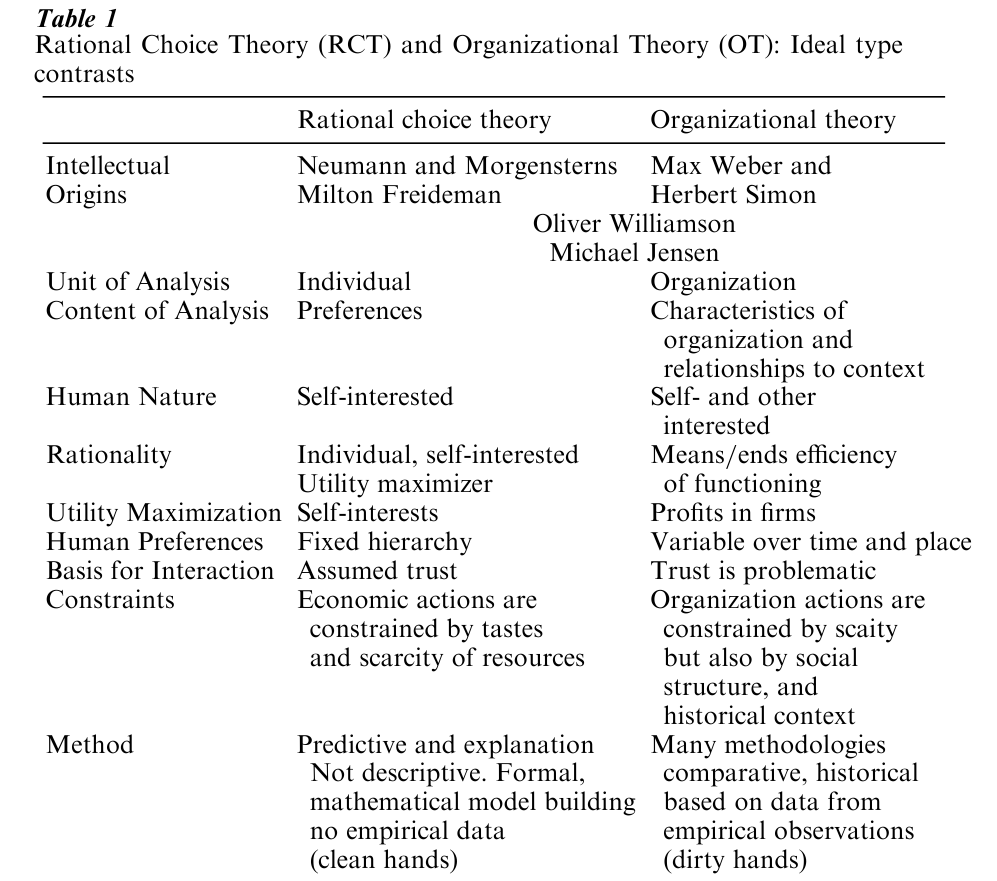

Rational Choice Theory (RCT) and organizational Theory (OT) are two different, yet—in the works of some neoclassical economists, rational choice sociologists, and economic organizational theorists—closely related theories. Rational choice theory is used by economic organizational theorists as a method of aggregation. Specifically, it is used when it is necessary to link the change in actions of individuals with change in characteristics of organizations. However, organizational analysts generally take a broader view in which organizational context, organizational structure, and individual actions interact and move together to change organizational functioning. Such a perspective does not rest on the assumption that aggregated individual choices explain organizational behavior. In some cases, organizational theory explains how individual actions articulate with structure. In other cases, organizational theory does not deal with individual actions. Rather, it deals with articulating relationships between and among organizational and contextual characteristics.

Academic Writing, Editing, Proofreading, And Problem Solving Services

Get 10% OFF with 24START discount code

The purpose of this analysis is to compare RCT with OT. Rational choice theory is based on the premise of self-interested utility maximizing actions/choices of individuals. Organizational theory is based on the premise of organizational rationality, the efficient functioning of organizations through means/ends relationships. Organizational economic theory, which consists of transactions cost economics and agency theory, forms an indirect link between the

RCT and OT. First, differences by defining the origin and premises of RCT and premises of Organizational Theory are elaborated. This is followed by demonstrating the link between the two, as developed in the premises of transaction cost analysis and agency theory. Although transaction theory holds to the premises of organizational efficiency, it finds the premise of self-interest utility maximization problematic. On the other hand, while agency theory holds the premise of self-interested, utility maximizing individual choice of RCT, and finds the guiding premise of organizational theory, the efficient functioning of firms, to be problematic. Thus, even the economic organizational theories, which purport to link RCT and OT are able to do so only if they accept either the RCT premises or the OT premises. As one set of premises are assumed, the other becomes problematic and becomes the questions to be examined in the analysis. No organizational theory has successfully integrated RCT and OT.

1. Rational Choice Theory: Origin And Premises

Rational Choice Theory originates in the British utilitarian tradition, via neo-classical economics. It is the core of classical economic theory. Although often qualified beyond recognition to meet conditional constraints of organizational analysts, it has been adopted in sociology (social choice) and in political science (public choice, game theory). In organizational theory and analysis, rational choice is most often used for the development of economic models of organizations. Transaction cost economics (TCE) and agency theory (AT) are the dominant economic organizational perspectives.

The premises at the basis of RCT as derived from neoclassical economic theory are: (a) self-maximizing individual utility driven actors, unconstrained by others and social norms (Coleman 1990, p. 503); (b) actors possess complete information and knowledge of their tastes, existing resources, the resources of others and market characteristics of the products and services they seek; (c) actors calculate and recalculate the changing conditions and act rationally; (d) however, preferences do not change, they are stable, and they are givens often implied from the very behavior they are to predict; (e) actors are not emotional, irrational, impulsive, habitual in their choices, they are rational; (f ) interaction is defined as an exchange between buyer and seller achieved when utility and cost converge in a market transaction of supply and demand equilibrium.

Rational choice theory (RCT) is an axiomatic system that provides a basis for making individual decisions/choices. The axioms of RCT define rational choice on the basis of choices between pairs of alternatives, which meet the axiomatic requirements of: consistency, transitivity, independence, continuity, and monotonicity. Consistency demands that it be possible for all the decision maker’s options to be ranked. The assumption of consistency is also called the assumption of connectedness. Preferences must be either equal or unequal. Unequal preferences can be rank ordered for comparison across the decision maker’s entire set of preferences. Transitivity is the assumption that if A is preferred to B, and B is preferred to C, then consistency requires that A is preferred to C (Green and Shapiro 1994, pp. 14–15). The distance between preferences or magnitude of preferences does not have to be known to the subject or the analyst. Independence assumes that all preferences are independent of all other preferences. The continuity assumption is that preferences hold across time and space. Rational choice theorists assume monotonicity—all decision rules and preferences are stable across individuals and time. Allowing for assumptions of interpersonal variation produces enormous tractability problems (Storm 1990, p. 126). Another assumption of RCT is that individuals ‘maximize the expected value of their payoff measured on some utility scale’ and that, usually, ‘numerical probabilities can be attached to different eventualities’ (Luce and Raiffa 1957, p. 50). Eventuality is calculated as the value of the outcome ‘weighted by the probability of achieving it’ (Elster 1986, Harsanyi 1986).

2. Organizational Theory: Origin And Premises

Rational choice theory and organizational theory are brought together by the term rational. However, the term has different meanings (Zey-Ferrell 1981) for RCT and OT. RCT is based on the idea that an individual seeks to maximize his/her utilities as they conduct organization business. The central tenant of rational choice is that individuals at all levels of organizations act selfishly based on their own preferences to maximize their utility. This is rational individual behavior. OT defines rational as the way in which economic organizations are designed—the most efficient method of organizing. This is rational organizational behavior.

Rationality in OT originates in Weber’s ([1922] 1968) concept of ‘rational bourgeois capitalism,’ which connotes the systematic organization of ideas, people, and resources in the interests of instrumental efficiency and effectiveness. Weber wrote that rationality and its accompanying bureaucratic organizational form, based on formalization of the rule of law and differentiation of functions, pervaded not only the modern economy, but public administration, the legal system, and religions. The rationalization of bureaucratic structures led to increased efficiency. In Weber’s model, organizational rationality and rationalization are essentially the same. This is not a (micro-level) individual process as it is in RCT. It is an organizational process or specification of mean/ends relationships based on systematic calculation and recalculation to achieve the most efficient organizational functioning. Subsequent analyses of organizations have assumed this rationality is the basis of organizations and developed theories around this premise.

3. Divergences Of Rational Choice And Organizational Theories

In addition to definitional divergence of the term rational, the most apparent divergence is the difference in the unit of analysis. RCT attempts to explain individual choice behavior. RCT is based on the utility maximizing behavior of individual choice, while OT is based on the assumption of efficiency seeking organizational design. OT explains behavior of organizations. The utility maximizing behavior of individuals and the assumption of efficiency-seeking organizational design are similar, but are at different levels of analysis. If the unit is the individual, the utility being maximized is individual owner or employee self-interest. If the unit is the organization, the utility being maximized is profitability. Profitability of the firm does not always translate into income or other self-interests of firm members. Likewise, rational efficient organizational functioning does not always maximize the self-interest of organizational members.

Economic organizational theorist define organizations as firms doing business in markets. Neoclassical economists begin with market assumptions and work backward to firms and individuals assuming that actors operating in firms act in ways consistent with the theory of the market. However, assumptions that hold for RCT do not hold for organizational actors. Let us take just one assumption, that of assuming that all actors have full information about costs. Because each of them knows the cost and adjusts the quantity of their purchase, it is reasonable to assume that the market will settle on an equilibrium. In organizations these assumptions are false. Many types of decisions are not afforded to each actor. The choices available to each actor are not the same. Some actors’ choices impose constraints on the choices available to others. Some actors do not know that a particular choice exists. For example, information about pending mergers and acquisitions. During mergers and acquisitions, parts of corporations maintain secrecy, not only from other firms, but from other units of their own firm and individual within their own units (Zey 1993, 1999). For example, securities firms are required by law to construct walls of secrecy, ‘Chinese Walls,’ between M&A units and traders to prevent insider trading. Information is also kept secret to prevent oppositional reactions to present and new allocations of organizational resources. Information is not equally distributed among or within organizational units for deliberate power-based reasons. Finally, the norms of organizational rationality, efficiency dictates that various units within an organization should not receive the same information, but only what is necessary for their organizational entity. For all units to receive all information would be inefficient.

4. The Link Between Rational Choice Theory And Organizational Theory

Although rational choice theory and organizational theory are based on different premises and units of analysis, one type of theory, organizational economic theory, has attempted to link the two sets of premises and units of analysis. There are two dominant perspectives in organizational economic theory transaction cost economics and agency theory.

Economic organizational theory, both agency theory (AT) and transaction cost economics (TCE), begins with the relationships between individuals and/organizations that are often conceptualized as events or transactions in which goods and services are exchanged (transaction cost analysis) and as contracts, which are agreements to conduct specific transactions (agency analysis). One is immediately aware that the unit of analysis is aggregated individuals. Transactions and contracts are aggregated either cross-section ally or over time. In contrast, OT deals with the properties and characteristics of organizations, not individuals.

Coase (1937) from whom Williamson elaborates his TCE, explains the origin of firms as alternatives to inefficient markets, while organizational theorists observe that people create organizations to generate income and power, to create larger empires with which they are identified, for themselves or groups to which they belong. Mergers to create new organizations often take place to take advantage of new technologies, to take advantage of tax changes, or to reposition the organization in a growing market. These changes may have little to do with rational economic organization or inefficient market functioning.

5. Convergence And Divergence Of Economic Theories Of The Firm And Organizational Theory

Transaction cost economics (TCE) and agency theory (AT), generally labeled economic organizational theories, have attempted to link RCT and OT and their different units of analysis and methods of theorizing through a set of assumptions that aggregate utility-maximizing individual behavior so that their behavior promotes organizational efficiency (profitability). However, survey research has demonstrated that not everyone has the same (or even individually consistent) utilities. Thus, the aggregation, specifically non-additive aggregation functions, of individual choices and action into organizational actions is not clearcut, because the complexity of the aggregation process often violates RCT assumptions.

Furthermore, the two economic organizational theories, AT and TCE, do not operate under the same premises. AT is based on the utility-maximizing individual of RCT (Jensen 1983, 1993, Jensen and Meckling 1976), while transaction cost economics assumes that humans are boundedly rational at best. AT attempts to explain why organizations are more or less efficient while TCE assumes that organizations are an efficient alternative to inefficient markets (Williamson 1975, 1985, 1996). The utility-maximizing behavior of organization sisefficiency-seeking organizational design. If the unit of analysis is the organization, and the utility being maximized is profit, then efficiency maximization is implied when income seeking is not compromised. Organizational theorists question these assumptions because organizations, even firms, are never constraint free and individuals within organizations do not operate under the same constraints.

Agency theory assumes that individuals are utility maximizers but does not assume that organizations are structured in the way they are because it is the most efficient method of organizing. This is demonstrated, not only in the assumption that managers and workers act as opportunistic agents—that is, not in the interest of the owners—but also by the preoccupations of agency theorists with governance and methods of controlling nonowners to maximize profits (returns to shareholders) to the owners (Jensen and Ruback 1983). Agency theorists and economic organizational theorists in general do not integrate into their analyses historical changes, which provide opportunities and constraints on individual and organizational actions as organizational theorists do. Jensen’s presidential address to the American Finance Association demonstrates that he had not until recently discovered Chandler’s work (1962, 1977, 1990) and that organizational forms which are most efficient change over time with each historical context in which they develop.

Transaction cost economics assumes that organizations are structured in the way they are because it is the most efficient method of organizing, but TCE does not assume that individuals within organizations are utility maximizers. For example, in Williamson’s work, Markets and Hierarchies (1975), he assumes that organizations more efficiently eliminate (by management fiat) opportunistic (‘self-interested with guile’) individual behavior than market mechanisms. TCE theorists analyze uncertainty and asset specificity of transactions. Individual utility maximization is problematic because of the obvious tendency of rational actors to act opportunistically under conditions of uncertain and asset specificity. TCE, like AT ignores historical changes and processes which constrain and provide opportunities for organizations. Both contextual and organizational changes are ignored. Organizational change, especially transformational change cannot be explained by economic theories of the firm (see Zey and Swenson 1998, 1999). This is problematic because of the major transformations of firms at the turn into the twenty-first century.

In both Williamson’s transactions cost economics (1975) and in Jensen’s agency theory (Jensen and Meckling 1976), the idea of self-interest in contractual arrangements between and within organizations is problematic. Ultimately, questions of reconciliation of differential self-interest in the absence of trust, is impossible. Trust, rules of fairness, norms of reciprocity, and conflict, are non-existent and irrelevant in RCT and economic theories of the firm. They are essential to organizational formation and perpetuation.

Neither TCE or AT holds both the basic premise of RCT, self-interested, utility maximizing individuals, and the basic premise of OT, that firms are designed in the most efficient form of organizational design. Agency theory holds the former, while TCE holds the latter. Each finds the others basic premises problematic and grist for the mill of organizational analysis. Thus, economic organizational theory has not yet integrated rational choice theory and organizational theory. This author does not think it is possible to do so because of conflicting premises and different units of analysis.

Bibliography:

- Chandler A D Jr. 1962 Strategy and Structure: Chapters in the History of the Industrial Enterprise. MIT Press, Cambridge, MA

- Chandler A D Jr 1977 The Visible Hand: The Managerial Revolution in American Business. Belknap Press, Harvard University Press, Cambridge, MA

- Chandler A D Jr. 1990 Scale and Scope: The Dynamics of Industrial Capitalism. Belknap Press, Harvard University Press, Cambridge, MA

- Coase R 1937 The nature of the firm. Economica 4: 386–405

- Coleman J S 1990 Foundations of Social Theory. Belknap Press, Harvard University Press, Cambridge, MA

- Elster J (ed.) 1986 Rational Choice. New York University Press, New York

- Green D P, Shapiro I 1994 Pathologies of Rational Choice Theory: A Critique of Applications in Political Science. Yale University Press, New Haven, CT

- J C 1986 Advances in understanding rational behavior. In: Elster J (ed.) Rational Choice. New York University Press, New York

- Jensen M 1983 Organizational theory and methodology. Ac- counting Review 55(2): 319–39

- Jensen M 1993 Presidential address: The modern industrial revolution, exit, and the failure of internal control systems. Journal of Finance 48(3): 225–64

- Jensen M, Meckling W 1976 Theory of the firm: Managerial behavior, agency costs, and ownership structure. Journal of Financial Economics 3: 305–60

- Jensen M, Ruback R S 1983 The market for corporate control. Journal of Financial Economics 11: 5–50

- Luce D R, Raiffa H 1957 Games and Decisions: Introduction and Critical Survey. A Study of the Behavioral Models Project Bureau of Applied Social Research, Columbia University. Wiley, New York

- Storm G S 1990 The Logic of Lawmaking: A Spatial Theory Approach. Johns Hopkins University Press, Baltimore, MD

- Weber M [1922] 1968 Economy and Society. Roth G, Wittich C (eds.). Bedminster Press, New York

- Williamson O E 1975 Markets and Hierarchies: Analysis and Antitrust Implications: A study in the Economics of Internal Organization. The Free Press, New York

- Williamson O E 1985 The Economic Institutions of Capitalism: Firms, Market, Relational Contracting. Free Press, New York

- Williamson O E 1996 The Mechanisms of Governance. Oxford University Press, New York

- Zey-Ferrell M 1981 Criticisms of the dominant perspectives in organizations. The Sociological Quarterly 22: 181–205

- Zey M 1993 Banking on Fraud: Drexel, Junk Bonds, and Buyouts. Aldine de Gruyter, Hawthorne, NY

- Zey M 1998 Rational Choice Theory and organizational Theory: A Critique. Sage, Thousand Oaks, CA

- Zey M 1999 The subsidiarization of the securities industry and the organization of securities fraud networks to return profits in the 1980s. Work and Occupations 26: 50–76

- Zey M, Swenson T 1998 Corporate tax laws, corporate restructuring, and subsidiarization of corporate form, 1981–95. The Sociology Quarterly 39: 555–82

- Zey M, Swenson T 1999 The transformation of the dominant corporate form from multidivisional to multisubsidiary: The role of the 1986 Tax Reform Act. The Sociological Quarterly 40: 241–67