View sample economics research paper on monetary policy and inflation targeting. Browse economics research paper topics for more inspiration. If you need a thorough research paper written according to all the academic standards, you can always turn to our experienced writers for help. This is how your paper can get an A! Feel free to contact our writing service for professional assistance. We offer high-quality assignments for reasonable rates.

Inflation targeting (IT) is a framework for the conduct of monetary policy, under which the monetary authority announces a medium- or long-run inflation target and then uses all available information to set its policy instrument, the short-term nominal interest rate, so that this target is met. Short-lived deviations from the inflationary target may be acceptable, especially when there may be a short-run trade-off between meeting the target and another welfare consideration, for example, the output gap—the difference between actual and potential output. Hence, although the central bank commits to meeting a certain inflationary target, in practice, IT takes a less rigid form, with the central bank exercising some discretion over the path of actual inflation toward its target. Recently, dozens of central banks around the world have introduced IT as their operational paradigm. Numerous studies indicate that this policy has been successful in achieving macroeconomic stability at no longrun cost in terms of lower real activity. Many central banks that have not explicitly subscribed to IT have been shown to follow it implicitly.

Academic Writing, Editing, Proofreading, And Problem Solving Services

Get 10% OFF with 24START discount code

IT provides a way for the central bank to communicate its intentions to the public in a clear, unequivocal manner, making the conduct of monetary policy more transparent and predictable. Transparency allows the public to hold the central bank accountable for its policy actions. In fact, in some countries, inflation-targeting central banks are subject to intense public scrutiny from the legislative bodies. Predictability of monetary policy allows the central bank to manage public inflationary expectations and better anchor them around the inflationary target; this allows the central bank to achieve macroeconomic stability more effectively.

Alan Greenspan (2004) has famously posited that “the success of monetary policy depends importantly on the quality of forecasts” (p. 39). In practice, monetary policy affects macroeconomic activity with a lag, hence forming accurate forecasts of the future macroeconomic activity is of paramount importance. Several IT central banks are reforming their communications procedures to make their macroeconomic forecasts, as well as projections of the nominal interest rate path to meet their stated objectives, publicly available.

Although, historically, central banks have paid close attention to a large number of macroeconomic variables, there are several reasons for the central bank to focus on only one variable as its target and to make inflation that variable. The central bank generally has only one independent instrument: the short-term nominal interest rate. With this single instrument, the Tinbergen principle states that they can achieve their target for only a single variable. Even though they may rightly care about many macroeconomic variables, they would need new tools to move each one independently. Furthermore, theoretical literature focusing on the role of forward-looking (rational) inflationary expectations formed by the public has shown that central banks that take a particularly tough stance against inflation may generate better macroeconomic performance in the long run (Rogoff, 1985). Inflationary conservatism on behalf of the central bank moderates inflationary expectations and brings about full employment at a lower rate of inflation.

Beyond its theoretical advantages, IT succeeds in practice with lower, more stable inflation and more stable real activity. As more countries adopt the IT framework, the evidence in its support grows. After New Zealand in 1990, a cascade of developed and developing countries followed, including relatively large economies, such as Canada and Brazil, and relatively small ones, such as the Czech Republic and Israel. Although the largest central banks, the European Central Bank (ECB) and the U.S. Federal Reserve, have yet to adopt IT explicitly, in practice, their monetary policy conduct seems to match the IT framework quite closely, with Ben Bernanke, the Chairman of the Federal Reserve, known as an early vocal proponent of explicit IT. Its growing popularity clearly signals the merits of adopting IT as the paradigm for the conduct of monetary policy.

This research paper’s assessment of modern IT first traces its historical roots, exploring both the antecedent monetary frameworks and the developments in economic theory that motivated its present-day form. We then discuss how IT is implemented in practice and the preliminary empirical evidence from the countries that have adopted it. To conclude, we offer suggestions on how the IT consensus might grow and its prospects as a unifying framework for monetary policy.

Historical Background

In 1931, faced with the global depression and speculative attacks on its currency’s gold peg, the Swedish Riksbank began a 6-year experiment with price level targeting (PLT), the first and only of its kind. Just as the gold standard was renounced, the bank promised price stabilization “using all means available.” Like modern IT, PLT sought to commit monetary policy to a single nominal goal. The Riksbank was a likely pioneer, given the country’s economics tradition. As early as 1898, Knut Wicksell, a Swedish economist, discussing the role of the monetary instrument, recommended that the discount rate should move with the price level to dampen its volatility. When its PLT policy was first formulated, the Riksbank was given instrument independence—that is, it could use interest rates any way it saw fit to meet the price level target set by the government.

The price-targeting regime was, however, conceived in a very different context than that faced by the modern IT adopters. In the depressed economic conditions of the 1930s, deflation was a serious risk, and even though many feared inflation after Sweden eschewed the gold standard, adhering to the price level target was also meant to fight deflation that crippled the rest of the world. Indeed, from 1928 to 1932, Swedish prices declined steadily in line with the rest of the world but then rose slowly for the rest of the decade, and though unemployment peaked in 1933, output stayed comparatively strong through the 1930s.

As a proto-targeting regime, the Swedish experiment differed in several ways from modern IT. By committing to hold a specific price level, excess inflation has to be compensated with periods of deflation. In contrast, modern IT does not compensate for inflationary buildup in prices, as long as the rate of inflation returns to the target. The Swedish experiment was initially meant to be only a temporary break from the gold standard. They announced the policy with the caveat that it was a temporary measure, but without a strict ending date. Modern inflationary targeting, on the other hand, can be successful only in the long term, because much of its performance depends on how well the central bank can build credibility and manage the public’s inflationary expectations. To further muddle policy design, the parliament gave the Riksbank its targeting mandate but did not communicate a quantitative target, nor even a price measure (i.e., CPI, wholesale prices, etc.). And while an IT central bank today uses forecasts to communicate its intentions, the Riksbank never published these. The Riksbank’s PLT experiment ended in 1937 when monetary and fiscal policies were reorganized along Keynesian lines to pursue aggregate demand stabilization.

Keynesian thinking dominated policy right through the 1960s, and policy prioritized full employment above price stability. Fitting its diminished importance globally, monetary policy was squeezed into a tight framework after World War II. World prices were anchored to the dollar, which hypothetically was convertible to gold. Central banks still worried about inflation but believed that it could be easily traded off against unemployment in a fashion that did not change over time. A coordinated action of taxing, spending, and discount rate manipulation would pinpoint a position on the so-called Phillips curve, an empirical regularity characterizing the trade-off between inflation and unemployment that policy makers felt could be exploited to match social preferences with respect to these two variables.

The major question became gauging what combination of evils, unemployment versus inflation, would be most socially tolerable. Not surprisingly, the generation that still remembered the Great Depression was more sensitive to unemployment. The popular press was sure of the economists’ prowess, proclaiming in a 1965 Time cover story that successful policy could coax an economy to full employment. The story was titled “We Are All Keynesians Now,” a quote from Milton Friedman1, but it never mentioned policy’s role in guiding inflationary expectations. In the 1950s and 1960s, macroeconomists rarely objected to linking unemployment and inflation with some linear relation and estimating the equation’s coefficients. This led to a natural policy prescription that anytime lower unemployment is desired, inflation should be allowed to increase. The working assumption was that inflation would move along a static Phillips curve, given the rate of unemployment.

An undercurrent of economists in the 1960s and a deluge in the 1970s called to question the status quo that had developed up until then. Accelerating inflation in the United States spread across the world, and the economics profession began to question whether these reduced-form equations really were as time invariant as Keynesians claimed. They tried to ground macroeconomic relationships in models of rational individuals and found Keynesian economics critically incomplete and misleading. The result was a Phillips curve incorporating inflationary expectations that became central in explaining the dynamic macroeconomic evolution.

In his celebrated presidential address to the American Economic Association, Friedman (1968) suggested that a monetary policy that actively tries to promote macroeconomic stability may actually disrupt it because of the poor quality of information available to policy makers. He suggested targeting monetary aggregates (by keeping money supply growth constant) to promote long-term stability. Friedman’s speech almost perfectly coincided with the breakdown of the Bretton-Woods system in the early 1970s, in whose wake central banks were forced to design new operational paradigms for the conduct of monetary policy. This sort of policy is an “intermediate target” because money supply is not a welfare criterion in itself but is a major determinant of inflation.

Money targeting had to be abandoned relatively quickly due to the unstable relationship between monetary and other macroeconomic aggregates. There is widespread consensus that the Federal Reserve pursued monetary targets only between 1979 and 1982. Instead, central banks have started searching for alternative frameworks for the conduct of monetary policy, and toward the 1990s, a number of central banks were poised to start IT.2 Before we document the adoption of IT by central banks around the world, we will lay out a simplified version of the theoretical framework that is frequently used for analyzing the design of an IT regime.

Implementing Inflation Targeting: Theory

A large body of recent theoretical literature has been dedicated to the study of monetary policy. Richard Clarida, Jordi Gali, and Mark Gertler (1999) and Michael Woodford (2003) provide a comprehensive overview of the issues and methods involved in studying monetary policy conduct from the New Keynesian perspective. The baseline version of the model has three sectors: households, firms, and the monetary authority. The first-order conditions from the household utility maximization problem give rise to the IS schedule that describes the equilibrium evolution of a measure of real activity or output gap, defined as the percentage deviation of actual output from potential, as a negative function of the real interest rate. By adjusting the nominal interest rate, therefore, the central bank can influence the level of real activity in the economy.

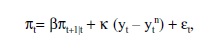

Monopolistically competitive firms set optimal prices for their output, with different firms resetting prices at different points in time, which gives rise to changes in relative prices of different outputs and hence welfare-loss-generating distortions that the policy maker is called to moderate.3 The first-order condition to this problem yields the New Keynesian Phillips curve (or the aggregate supply relation); a key feature of this structural equation is the presence of forward-looking, rational inflationary expectations. The baseline version of this Phillips curve takes the form

where πt is inflation, Bπ t+1|t is the expectation of next period’s inflation based on information available at the present time period, (yt – ytn) is the (log) difference between actual and natural (or potential) output—or output gap—and et is the cost-push shock. The output gap term can be motivated by changes in the firm’s labor costs, whereas the cost-push shock is by changes in the markup that firms charge in excess of their labor costs. The presence of the expected inflation term is due to price stickiness modeled by the firm’s potential inability to change prices optimally in the future. Anticipating future inflationary pressures then enters the firms’ current pricing decisions and makes it important for the central bank to engage in managing inflationary expectations, as moderating those will result in lower inflation in the present.

Finally, the central bank needs to determine how the nominal interest rate is set in order to close this three-sector model. There are two ways of thinking about the conduct of monetary policy that have been widely used in the recent literature. One is due to the insight of John Taylor (1993), who pointed out that the Federal Reserve seemed to set the nominal interest in response to inflation and output gap. A number of empirical studies have confirmed that following this so-called Taylor rule has characterized the conduct of monetary policy in the United States in the recent past quite well. A large body of theoretical literature has shown that Taylor rules deliver macroeconomic stability in a variety of models.

Another way that monetary policy has been modeled is by assuming that the central bank minimizes a discounted stream of weighted averages of squared deviations of inflation from its target level and output from its target level (set at the potential level of output). Lars Svensson (2002, 2003) has been a particularly strong advocate of thinking about monetary policy in terms of minimizing volatility of inflation and output around their target levels rather than the mechanistic approach exemplified by Taylor rules. (Svensson calls the former targeting rules, because they are built around inflation and output targets, and the latter instrument rules, because they explicitly define the value of the nominal interest rate in terms of the other variables.) This setup places the conduct of monetary policy into a dynamic setting and offers a richer variety of insights.

One such key insight is the problem of the time inconsistency of optimal policy, originally pioneered by Finn Kydland and Edward Prescott (1977) and Guillermo Calvo (1978). Suppose that the economy experiences a positive transitory cost-push shock. The central bank can moderate its instant inflationary effect by promising to keep output below potential in the future time period. This reduces inflationary expectations and (partially) offsets the effect of the cost-push shock. Hence in the present, this shock will generate lower inflation and a smaller decrease in output below potential. In a way, the central bank commits to spread the real-economic pain from the cost-push shock over several time periods, even when the immediate impact of the shock is long gone. Although this policy generates optimal outcomes over the long haul, it does run into short-run difficulties. In particular, in the time period following the transitory shock, the central bank has no incentive to make good on its promise to generate a recessionary environment, which helped moderate inflationary expectations—that is, it has an immediate incentive to renege on its contractionary promise because the effects of the shock have already dissipated. But if it discretionarily reneges on its promise, once another cost-push shock materializes, it will not be able to pursue a dynamically optimal stabilization policy with any measure of credibility, hence generating worse macroeconomic outcomes from there onward.

Another implication that emerges out of the dynamic targeting setup is that, especially given the long and variable lags in the transmission of monetary policy through the economy, it makes little sense for a central bank to set the nominal interest rate in response to a small number of contemporaneous variables in a predetermined, mechanical fashion. Furthermore, given the forward-looking nature of macroeconomic agents, what may matter more for the successful conduct of monetary policy is not the current level of the nominal interest rate but its projected path over some future time horizon. Identifying such a path is impossible without first postulating a dynamic objective over which the central bank wants to optimize.

In practice, these challenges make it virtually impossible for a central bank to achieve its target with current inflation, and instead, it will target expected inflation some periods into the future. Targeting future inflation also gives the central bank greater flexibility in considering output volatility as well. Woodford (2003) explains,

The argument that is typically made for the desirability of a target criterion … with a horizon k some years in the future is that it would be undesirable not to allow temporary fluctuations in inflation in response to real disturbances, while the central bank should nonetheless provide clear assurances that inflation will eventually be returned to its long-run target level. (p. 292)

IT central banks seem to exhibit their most meaningful differences by the length of this lag. More “flexible” IT regimes accommodate some real shocks and often will not return inflation to its target for much longer than their “stricter” counterparts who target the earliest feasible date. Svensson (1998) estimates that this time range for meeting the target is anywhere from 1.5 to 2.5 years. (As discussed below this “flexibility” opens these central banks to the criticism that their policy making is actually arbitrary.) More flexible IT regimes may allow the monetary authority to give some attention to unemployment or a real objective while still promising a certain level of inflation in the long run. Additionally, they may also allow greater instrument stability, as wide swings in interest rates may be painful in themselves. To show how the central bank balances these additional criteria, the terms that characterize their stabilization can be added into the central bank’s objective function with weights to show their relative importance. In a more strict IT regime, other concerns have relatively low weights, so that it may worry about large swings in these variables, but it still chiefly focuses on inflation stabilization.

Some critics of IT insist that insofar as the duration of actual inflation being off its target is uncertain, IT affords the monetary authority too much flexibility and is therefore destabilizing. For instance, in his criticism, Benjamin Friedman (2004) invokes the Tinbergen principle, which holds that with only one independent instrument, the variables relevant to monetary policy can be expressed in relation to one particular variable. This means that when a shock hits, and output and inflation are both off their desired level, the transition path of output is dependent on the path of inflation, so by choosing how long inflation may be out of the target range, the central bank implicitly chooses how output will respond. Since IT states the target for only one variable—inflation—and fails to communicate the central bank’s preferences with respect to other variables of interest, it may be viewed as too opaque. This critique, however, does not breach the consensus view that IT is successful in augmenting the central banks’ transparency, accountability, and success in mitigating business cycle volatility.

Although a tremendous amount of progress has been made in identifying the chief challenges of monetary policy making and demonstrating the benefits of IT, there does not exist a universal consensus on the exact methods for the implementation of IT. The next section reviews the recent experience of different countries whose central banks have adopted IT. Despite considerable differences in implementing this policy, the picture that emerges from our description points to its success in achieving macroeconomic stability.

Implementing Inflation Targeting: Practice

New Zealand was first to set an explicit inflation target for the medium run. The Reserve Bank of New Zealand (RBNZ) had a wide-ranging mandate from a 1964 law that charged it with “promoting the highest degree of production, trade and employment and of maintaining a stable internal price level.” Inflation stayed in double digits for most of the 1970s and 1980s, a cumulative 480% between 1974 and 1988. But by the time IT was introduced in 1990, a period of very high interest rates had inflation mostly under control. Ben Bernanke, Thomas Laubach, Frederic Mishkin, and Adam Posen (1999) believe that this timing was important to build confidence in the IT framework, as the public did not blame the new policy regime for the induced tight monetary conditions.

The inflation target was in fact a range set by the government that gradually fell from 2.5% to 4.5%, to 1.5% to 3.5%, and finally to 0% to 2% after December 1993. Though the government held the central bank accountable to keep inflation in the middle of a range it set, the RBNZ enjoyed instrument independence—that is, the central bank could independently choose its policy for interest rate and exchange rates. The IT framework in New Zealand also evolved to become less strict, in that deviations are now allowed to persist longer than the initial yearly horizon.

IT in New Zealand was also pioneering in the degree of transparency and the central bank’s communication of its decision making to the public. The RBNZ is legally required to produce a Monetary Policy Statement twice a year that outlines policy decisions. It also publishes forecasts in an Annual Report, other research in an annual Bulletin and a bi-annual Financial Stability Report. Starting in 1996, it has released a Monetary Conditions Index to summarize its forecasts.

Despite the eventual success of IT, the RBNZ did initially encounter some difficulties in its implementation. It first tried using “headline” or all-goods consumer price index (CPI) but found this too volatile. The RBNZ developed a concept of underlying inflation similar to a core measure to avoid including prices that were themselves sensitive to the first-round effects of a cost-push shock. Unfortunately, the core’s components changed occasionally, making it somewhat ad hoc, and its time series was marked by definitional breaks. The relatively tight, certainly by the standards of a small open economy, inflation target range of 0% to 2% imposed additional challenges, as the RBNZ was occasionally forced to produce large swings in the interest rate in order to meet its objective. Several times, inflation breached its ceiling, which was lifted to 3% in 1997. Still, the experiment with IT at the RBNZ has undeniably been a success, as chronic and volatile inflation seems safely in the past.

In 1991, Canada was next in the steady succession of IT adopters, following an announcement by the head of its central bank and the Minister of Finance but without a legislative mandate, unlike in New Zealand. Prior to adopting IT, Canada’s experience with inflation was less extreme than New Zealand’s, but the 1989 inflation rate of 5.5% was deemed unacceptably high. As the policy was adopted, the disinflation was accomplished by high interest rates and a sharper than expected cyclical downturn; on the upside, however, IT accomplished low inflationary expectations. According to Gordon Thiessen (1999), the Governor of the Bank of Canada from 1994 to 2001, inflationary expectations did not fall because the bank promised it but because low rates of inflation were “realized”; however, the promise helped to entrench these gains:

It is unlikely that the 1991 announcement of the path for inflation reduction had a significant immediate impact on the expectations of individuals, businesses, or financial market participants. On balance, I think that it is the low realized trend rate of inflation in Canada since 1992 that has been the major factor in shifting expectations of inflation downwards. But the targets have probably played a role in convincing the public and the markets that the Bank would persevere in its commitment to maintain inflation at the low rates that had been achieved.

Canada’s IT regime focuses on the medium-term inflationary expectations because they are particularly susceptible to short-run shocks as a small, commodity-exporting economy like New Zealand. Following the RBNZ, the Bank of Canada excludes volatile components from their “core” price index that, in its judgment, are transitory. If these excluded shocks are mean-zero, then headline and core will move together in the medium term. This flexibility allows a central bank to avoid the adverse output implications of contractionary policy and is common among other IT regimes.

Canadian policy makers also emphasized a dialogue with the public, which has become important for the transparency of IT regimes. To help formulate policy response to inflationary expectations, they follow the Consensus Forecasts of market economists compiled by the private Conference Board of Canada. They have also geared their own publications to be easily digestible. The Bank of Canada produces the Monetary Conditions Index, a summary statistic for price-level determinants, and uses more charts in their Annual Report to encourage public confidence in the Bank’s ability to meet its IT responsibilities.

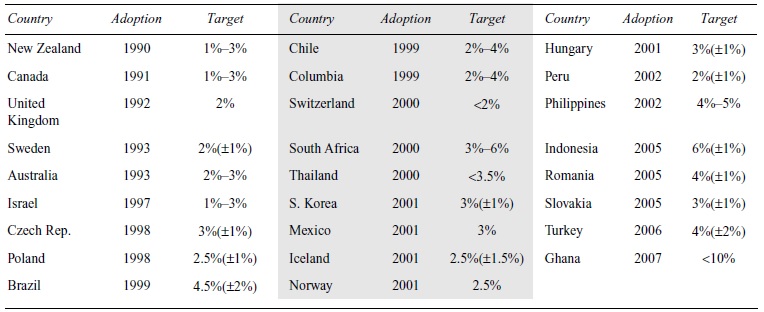

Following New Zealand and Canada, the ranks of inflation targeters swelled during the 1990s. The United Kingdom and Sweden experienced sharp downturns and high inflation in the early 1990s and adopted IT regimes shortly thereafter. On the other hand, Australia’s situation was similar to New Zealand’s—a 1991 recession reduced inflation before their IT regime was enacted. Thereafter, a slew of developing countries created explicit inflation targets, ranging from traditional inflationary basket cases, such as Israel and Brazil, to postsocialist economies, such as the Czech Republic and Poland. Each has its own idiosyncrasies: Some target all-items inflation (e.g., Israel and Spain), while others target an underlying or core measure (e.g., Australia and the Czech Republic). Table 37.1 summarizes the list of inflation targeters and the time of adoption of this policy.

The U.K. experience exemplifies the rationale for IT adoption in many industrialized countries. Following an inflationary bout in the 1980s, the British had stabilized their currency by tying it to the Deutsche Mark. But when large-scale speculation forced the authority to break their peg, the Bank of England experienced a great deal of exchange rate volatility and abruptly lost their intermediate target. To stabilize exchange rates and regain an anchor for price stability, they implemented a band for their medium-term inflation target and long-term goal of 2%. After Britain’s success, other developed countries, such as Finland, Spain, and Sweden, also adopted inflation targets in response to foreign-exchange pressure.

Transitional and middle-income countries often have more volatile macroeconomic conditions and so may have even more to gain from the stability that IT imparts. Brazil’s inflation has fluctuated wildly through its diverse monetary regimes. When its fixed exchange rate regime failed in 1999, it began IT as part of an International Monetary Fund program. In the market turmoil of 1997 to 1998, the Czech Republic’s exchange rate target became untenable, and it adopted IT. To fit the regime to postcommunist transition, the Czechs have introduced a net inflation index, which excludes administered, or controlled, prices. Poland and Hungary followed, trying to stabilize their inflation to better integrate with Europe. South Korea began its policy under considerable duress after its financial crisis in the late 1990s, whereas Israel was trying to lock in its already completed disinflation.

Though the list of IT countries is 26-strong, the so-called G3—the U.S. Federal Reserve, the ECB, and the Bank of Japan—are notably absent. This is especially ironic given the Fed’s long, (mostly) successful history of pursuing price stability and the enthusiasm for IT of its chairman, Ben Bernanke, during his distinguished stint as an academic economist. Despite the lack of a formal commitment to a clear inflation target, there has arguably been a progression toward the IT framework and greater transparency. In February 1981, the Supreme Court defended the Fed’s right to secrecy, saying, “At bottom, the FOMC [has] concluded that uncertainty in the monetary markets best serves its needs” (Merrill v. Federal Open Market Committee). By 2004, Bernanke described an “ideal world” in which “the Federal Reserve would release to the public a complete specification of its policy rule, relating the FOMC’s target for the federal funds rate to current and expected economic conditions, as well as its economic models, data, and forecasts.” Presently, this ideal has not been reached.

Along with increasing its transparency, the Federal Reserve has been edging toward a de facto target range. In 2002, the term comfort zone appeared in a New York Times headline (Stevenson, 2002) and has subsequently been used by the Fed governors themselves to describe their desired inflation level. Still, they seem to lack credibility in this target, as admitted by Bernanke (2004): “Today long-term inflation expectations in the United States remain in the vicinity of 2-1/2 to 3 percent, above the range of inflation that many observers believe to represent the FOMC’s implicit target.”

Table 1 Inflation Targeting—Time of Adoption and Target Range

Although much of the Fed’s attention during the later part of 2008 was dedicated to the ongoing financial crisis, the minutes of the December 16, 2008, Federal Open Market Committee meeting reveal the participants’ deliberation whether “a more explicit indication of their views on what longer-run rate of inflation would best promote their goals of maximum employment and price stability.” The financial market turmoil drove the nominal interest rate toward its lower limit of zero. An explicit positive target rate of inflation may be needed to keep the nominal interest rate positive in the wake of large negative demand disturbances, such as a financial crisis. Matt Klaeffling and Victor Lopez Perez (2003), for instance, find that the presence of the zero bound implies that the optimal rate of inflation should be somewhat higher than in its absence, even if higher long-term inflation generates stronger macroeconomic volatility.

The ECB also does not consider its policy to be an explicit inflation target but has announced that an inflation rate below 2% is desirable. It promises to direct its policy to protect this bound. The legal basis of the ECB is also similar to an inflation target, as Article 105(1) of the treaty establishing the European Community mandates price stability as “the single monetary policy for which [the ECB] is responsible.” But, in keeping with the flexibility under IT, its Web site notes that the ECB “typically should avoid excessive fluctuations in output and employment” (ECB, n.d.). The de facto similarity to a flexible IT regime leads some commentators to discuss the ECB as if it were one, although its own leadership rejects the label.

Arguing from the position of an ECB board member, Jürgen Stark (2007) suggested that part of the reason why the ECB does not explicitly join the ranks of inflation targeters is in order to preserve institutional continuity with its predecessors. The new authority wishes to be seen as inheriting the German Bundesbank’s tenacity in controlling inflation. With its current strategy, Stark argues, the ECB has more flexibility in medium-term and long-term objectives and in communication strategy, as it can put less emphasis on forecasts. With a firm record of keeping its informal target, perhaps the ECB has already attained the credibility that an IT regime hopes to create.

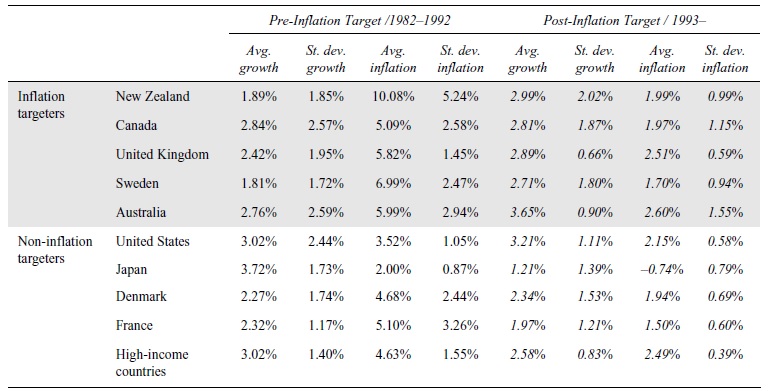

Many early adopters of IT have been quite successful under the new monetary regime, but it has proven difficult to take a definitive stance on its overall effect. Table 37.2 compares the summary statistics for measures of inflation and output growth for IT and non-IT countries. In the 10 years prior to IT, New Zealand averaged 10.8% inflation with a standard deviation of greater than 5%, 1.8% output growth with a standard deviation of 1.85%. From 1990 to 2006, inflation was below 2% with a standard deviation of about 1%, and growth was higher and less volatile, about 3% with a standard deviation of 2%. Similarly, since Canada stabilized its inflation target in 1995, inflation has been in its target 1% to 3% range almost continually, and its business cycles have been relatively mild.

Table 2 Real Output Growth and Inflation Volatility for Selected IT and Non-IT Countries

Even countries that have missed their inflation targets, as have many of the adopters in developing countries, have had relatively strong performances and have reformed their policy practices in the aftermath of IT adoption. The Czech Republic is a good example of this, as it severely undershot its target in 1998 and 1999. It later began targeting headline CPI, rather than a restricted core, and made the target more strict, by promising to hold it continuously rather than just at year’s end. In its first decade of IT, Czech output has been stable, averaging 4.1% with a standard deviation of 1.9%, and its inflation has been low and stable, averaging 2.1% with standard deviation 1.8%. Even when countries overshot their inflation targets, as Israel in 2002, the IT policy makers have been able to regain control. Despite very large exogenous shocks, the inflation spike was brief and has been within the target since, while real output growth has averaged over 5%.

Several attempts have been made to systematically study countries before and after implementing IT and to compare them to non-IT countries. This is complicated because in the 1980s, just before most targets were adopted, inflation and output performance was generally poor and volatile, while the 1990s were relatively prosperous and stable. It is difficult to isolate the IT effect from generally favorable world economic conditions in the experimenting countries. Laurence Ball and Niamh Sheridan (2005) use a panel regression approach with 20 Organisation for Economic Co-operation and Development countries, but find that an IT regime does not significantly improve the level or variance of output growth or inflation when they control for pre-IT conditions, which were generally worse in the adopting countries. However, Marco Vega and Diego Winkelried (2005), using a similar methodology but including developing countries into the sample, show that the policy regime choice does have a statistically significant effect. David Johnson (2002) finds that IT significantly reduced inflation expectations as measured by the average among professional forecasters. Frederic Mishkin and Klaus Schmidt-Hebbel (2007) find that IT reduces inflation levels and volatility and lowers interest rates, and this effect is stronger in industrial countries. More conclusive evidence about IT may only come with more practical experience and further academic effort.

Conclusion

The adoption of IT may very well be the most significant development in monetary economics over the last couple of decades. The number of central banks around the world that have officially adopted IT as the framework for their conduct of monetary policy has been steadily increasing. Although the time frame for evaluating the success of IT may be relatively short, the preliminary results that have emerged are encouraging. None of the IT adopters have abandoned this policy, and several central banks that have not formally announced IT as their policymaking framework have acted in a way that is fully consistent with it.

Although little theoretical literature on IT existed prior to New Zealand’s adoption of IT in 1990, the policy has been studied extensively in academia and in the central banks’ research departments. There may not be overwhelming consensus on the exact operational details of implementing IT in practice, but the general opposition to IT is rather slim. Given the international monetary trends in the past few decades, it seems reasonable to suggest that IT will continue to be the predominant paradigm for the conduct of monetary policy in the near future.

Bibliography:

- Ball, L., & Sheridan, N. (2005). Does inflation targeting matter? In B. Bernanke & M. Woodford (Eds.), The inflation-targeting debate (NBER Studies in Business Cycles No. 32, pp. 249-276). Chicago: University of Chicago Press.

- Bernanke, B. S. (2004, January 13). Remarks by Governor Ben S. Bernanke. Speech at the Meetings of the American Economic Association, San Diego, California. Available from https://www.federalreserve.gov/boarddocs/speeches/2004/200401032/default.htm

- Bernanke, B. S., Laubach, T., Mishkin, F. S., & Posen, A. S. (1999). Inflation targeting: Lessons from the international experience. Princeton, NJ: Princeton University Press.

- Bernanke, B. S., & Woodford, M. (Eds.). (2006). The inflation targeting debate (NBER Studies in Business Cycles No. 32). Chicago: University of Chicago Press.

- Board of Governors of the Federal Reserve System. (2008, December 15-16). Minutes of Federal Open Market Committee. Available from https://www.federalreserve.gov/monetarypolicy/fomcminutes20081216.htm

- Calvo, G. (1978). On the time consistency of optimal policy in a monetary economy. Econometrica, 46(6), 36-48.

- Calvo, G. (1983). Staggered prices in a utility maximizing framework. Journal of Monetary Economics, 12(3), 383-398.

- Clarida, R., Gali, J., & Gertler, M. (1999). The science of monetary policy: A New Keynesian perspective. Journal of Economic Literature, 37(4), 1661-1707.

- European Central Bank. (n.d.). Objective of monetary policy. Available from https://www.ecb.europa.eu/mopo/intro/objective/html/index.en.html

- Friedman, B. (2004). Why the Federal Reserve should not adopt inflation targeting. International Finance, 7(1), 129-136.

- Friedman, M. (1968). The role of monetary policy. American Economic Review, 58(1), 1-17.

- Greenspan, A. (2004). Risk and uncertainty in monetary policy. American Economic Review Papers and Proceedings, 94(2), 33-40.

- Johnson, D. (2002). The effect of inflation targeting on the behavior of expected inflation: Evidence from an 11 country panel. Journal of Monetary Economics, 49(8), 1521-1538.

- Klaeffling, M., & Lopez Perez, V (2003). Inflation targets and the liquidity trap (European Central Bank Working Paper No. 272). Frankfurt, Germany: European Central Bank.

- Kydland, F., & Prescott, E. (1977). Rules rather than discretion: The inconsistency of optimal plans. Journal of Political Economy, 8(49), 473-493.

- Merrill, D. R., v. Federal Open Market Committee of the Federal Reserve System. (1981, February). Defendant’s supplemental memorandum of points and authorities (United States District Court for the District of Columbia, Civil Action No. 75-0736).

- Mishkin, F. S., & Schmidt-Hebbel, K. (2007). Does inflation targeting make a difference (NBER Working Paper No. 12876). Cambridge, MA: National Bureau of Economic Research.

- Roger, S., & Stone, M. (2005). On target? The international experience with achieving inflation targets (IMF Working Paper WP/05/163). Washington, DC: International Monetary Fund.

- Rogoff, K. (1985). The optimal degree of commitment to an intermediate monetary target. Quarterly Journal of Economics, 100(4), 1169-1189.

- Stark, J. (2007, January 19). Objectives and challenges of monetary policy: A view from the ECB. Speech at a conference on inflation targeting, Magyar Nemzeti Bank, Budapest, Hungary.

- Stevenson, R. W. (2002, August 4). The Fed’s evolving comfort zone. The New York Times, p. B4.

- Svensson, L. (1998, Winter). Monetary policy and inflation targeting. NBER Reporter, pp. 5-8.

- Svensson, L. (2002). Inflation targeting: Should it be modeled as an instrument rule or a targeting rule? European Economic Review, 46(4-5), 771-780.

- Svensson, L. (2003). What is wrong with Taylor rules? Using judgment in monetary policy through targeting rules. Journal of Economic Literature, 41(2), 426-177.

- Svensson, L. (2008). What have economists learned about monetary policy over the past 50 years? (Sveriges Riksbank Press Release No. 39). Stockholm: Sveriges Riksbank.

- Taylor, J. B. (1993). Discretion versus policy rules in practice. Carnegie-Rochester Conference Series on Public Policy, 39(1), 195-214.

- Thiessen, G. (1999, March 11). Then and now: The change in views on the role of monetary policy since the Porter Commission. Speech at the C. D. Howe Institute, Toronto, Ontario, Canada.

- Vega, M., & Winkelried, D. (2005). Inflation targeting and inflation behavior: A successful story? International Journal of Central Banking, 1(3), 153-175.

- Woodford, M. (2003). Interest and prices: Foundations of a theory of monetary policy. Princeton, NJ: Princeton University Press.

- World Bank. (2008). National accounts and prices statistics. In World development indicators 2007. Available from https://openknowledge.worldbank.org/handle/10986/8150