Sample Economics Of Innovation Research Paper. Browse other research paper examples and check the list of research paper topics for more inspiration. If you need a research paper written according to all the academic standards, you can always turn to our experienced writers for help. This is how your paper can get an A! Feel free to contact our custom research paper writing service for professional assistance. We offer high-quality assignments for reasonable rates.

Technological innovation is the function through which new technologies are introduced into the economic system. It entails recognizing new technological possibilities, organizing the human and financial resources needed to transform ideas into useful products or processes, and carrying out the requisite activities (typically called ‘research and development’). It is important because technological advances have played a paramount role in facilitating the radically improved standards of living experienced by the inhabitants of progressive nations over the past several centuries. Innovation is responsive to economic forces and the lure of profit, but their influence is complicated by uncertainty and the difficulty innovators encounter in capturing a sufficient share of the economic benefits resulting from their contributions.

Academic Writing, Editing, Proofreading, And Problem Solving Services

Get 10% OFF with 24START discount code

1. Acceleration And Systematization

New technologies have been introduced into production and consumption throughout recorded history. During the eighteenth century, however, there were discernible shifts in the pace and organization of technological change through what is now called the first Industrial Revolution. Landes (1969) and Mokyr (1990). New machines reduced dramatically the amount of labor required to accomplish productive tasks, steam engines provided less costly and more reliable means to drive the machines, the machines themselves were perfected through improvements in machine-building technology, and innovations in agriculture freed workers to produce a widening array of traditional and new manufactured products. One impact of these changes was an increase in the quantity of goods and services that could be produced by the average worker, i.e., an increase in labor productivity. Higher productivity in turn meant enhanced real income or purchasing power, sometimes at first only for some segments of the population but ultimately for virtually all consumers. Landes (1969) estimates that the growth of real income per capita in western Europe increased from a rate of roughly 0.16 percent per annum between AD 1000 and 1700 to 0.4 percent between 1700 and 1750. It then soared into a range of 1.2–1.5 percent per year during the next century, i.e., doubling every 46 to 58 years.

It was always recognized that the acceleration of per capita income growth beginning with the first Industrial Revolution was coupled closely to the implementation of new technologies. Debate continues over the exact contribution of new technology as compared to increases in the amount of capital goods with which work is accomplished, efficiencies associated with increases in the scale of productive operations (‘economies of scale’), and the enhancement of ‘human capital,’ i.e., the education and training of workers. Full resolution of the debate is impossible, because those contributors to economic growth are intrinsically complementary. Much new technology is embodied in capital goods and implemented only when new investments are made. Similarly, technological advances and investment typically are needed to realize economies of scale. And neither technological advances per se nor their implementation on an industrial scale would be possible without well-educated and well-trained workers. What is clear is that advances in technology play a very important role in driving productivity improvements and hence improvements in real income per capita (Griliches 1995).

The economist Schumpeter (1912, 1934) was the first to stress a systematic functional role for innovation, or the carrying out of new combinations by an entrepreneur, in achieving economically meaningful technological advances. He wrote (1934):

Economic leadership in particular must be distinguished from ‘invention.’ As long as they are not carried into practice, inventions are economically irrelevant. And to carry any improvement into effect is a task entirely different from the inventing of it, and a task, moreover, requiring entirely different kinds of aptitudes.

The differentiation of activities directed toward carrying technological innovations into practice was already evident during the late eighteenth century in the famous Boulton & Watt steam engine partnership, which included a group of workers specialized in performing what today would be called research and development (Scherer 1965). In Schumpeter’s schema, the ‘innovator’ recognized the commercial potential of new technologies, raised the capital for and accepted the primary risks faced in implementing them, and organized the effort needed to perfect them and introduce them into the market (today, research, development, and marketing). The spread of this systematized approach to technological innovation was at first gradual, but by 1994, industrial enterprises in 25 nations surveyed by the Organization for Economic Development and Cooperation (1997) spent a combined total of roughly $ 237 billion (measured at 1990 price levels) on formally organized research and development activities.

2. Endogenous Innovation

Most of the mainstream economic writings up to the middle of the twentieth century viewed technological innovation as a function regulated by forces distinct from and independent of the supply and demand conditions through which markets for well-established goods and services reached an equilibrium. Innovation was said to be an ‘exogenous’ activity, not systematically influenced by economic variables (i.e., ‘endogenous’). Innovations came from the efforts of ‘hero’ inventors who, though not immune to economic motivations, were driven at least as much by the urge to tinker and improve; or as a fortuitous by-product from the advance of scientific knowledge sought for its own sake or in the seventeenth century, ad majorem Gloriam Dei.

Marx (1887) was the first to see innovation as a direct consequence of capitalists’ striving to enhance their profits, but his writing had little influence on mainstream economic views. Schumpeter’s insights (1912) were more influential, but only with a lag of a half-century. In Schumpeter’s schema, the innovator recognized opportunities to achieve supranormal profits by introducing superior alternatives to the products or processes embraced by the vast horde of competitive enterprises; thus, innovative activity was expressly profit-seeking. The profits realized by the innovator in turn sent a signal to other firms that their accepted technologies were becoming obsolete, but they could defend themselves and gain profits by imitating the innovator’s contribution. Thus, an original innovation was followed sooner or later by a ‘swarm’ of imitators whose competitive efforts drove prices down until only normal returns on investment could be sustained. Further innovation was necessary if supra-normal profits were again to be gained. Schumpeter (1942) called this incessantly repeated chain ‘the process of creative destruction,’ adding that the organization of innovative functions in modern research and development laboratories imparted a routinization that reduced the heroic role played by Schumpeter’s entrepreneur and perhaps (he wrongly feared) jeopardized the continuation of rapid technological progress.

Exactly why profit opportunities opened up for technological innovators was left unsettled by Schumpeter. Conventional wisdom held that the advance of science was the key agenda-setting influence: scientific breakthroughs or, less dramatically, the steady accretion of scientific knowledge, created an opportunity to make economically significant and profitable innovations. This view of the world was challenged by Schmookler (1966), whose qualitative and quantitative historical research pointed toward a crucial innovation-inducing role for demand-side influences. The greater the demand for a set of products, the more profitable improving upon those products was likely to be, and hence the larger was the flow of innovations aimed at satisfying consumers’ (or producers’) demands for those products (see also Usher 1954).

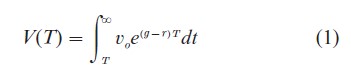

A formal model of how the economic forces of supply and demand endogenously affect the rate and direction of innovative activity can be synthesized from the contributions of Schmookler (1966), Scherer (1967), and Barzel (1969). Investing in innovation is viewed like other investment activities: a lump sum outlay is required for research, development, and introductory marketing. The innovator chooses to incur that outlay only if the investment is expected to be profitable, i.e., if the anticipated stream of quasi- rents or producer’s surplus (cost savings, or new product sales revenues minus production and routine marketing costs), discounted to present value, exceeds the expected lump-sum innovation outlay. Let the lump-sum innovation outlay be RD and the dis- counted present value of quasirents be V. How much must be spent to realize the innovation depends upon the state of scientific knowledge and related technology. As knowledge advances, what was impossible at one time (i.e., infinitely expensive) becomes less and less costly over time. Smooth and continuous advance in the knowledge base implies that if carrying out the innovation in year zero costs RDo, implementing it T years later costs RDo e –aT, where 100a is the percentage rate at which the cost of innovation declines per year as knowledge advances. On the payoff side, let (t) be the quasi-rent or producer’s surplus attainable in year tfrom an innovation. As demand grows, quasi-rents are likely to grow apace, so from an initial quasi-rent level of uo in year zero, quasirents will grow to uoe+gT in year T, where g is the annual rate of growth. Assuming for simplicity the innovation to have an infinite revenue-yielding life once implemented, the discounted present value of quasi-rents for an innovation introduced in year T is therefore

where r is the risk-adjusted discount rate. The innovator seeks to maximize its profits from innovation, so it will not plan to innovate if V(T) < RDoe-(a+r)T, with discount rate r added to the R&D cost term to reflect the fact that costs incurred in the future are valued less than costs incurred today. Assuming correct expectations about the future (an assumption to be examined critically later), the innovator will innovate at the earliest when those magnitudes come into equality, and perhaps (given recognition lags) not until V(T) > RDoe-(a+r)T.

This perspective on the innovation inducement process and important variants thereof is illustrated in Figs. 1–3. Figure 1 replicates geometrically the model of the preceding paragraph. The solid down- ward-sloping line labeled ‘R&D Cost’ shows RDo e-(a+r)T declining exponentially from its initially high value as the time of innovation is delayed from the earliest possible date, year zero. The upward sloping line labeled ‘Benefits’ shows the discounted quasi-rents from innovation V(T) rising steadily as the time of innovation is delayed and the innovator taps into revenue-earning possibilities augmented by the growth of demand. As discounted R&D costs fall and discounted quasi-rents rise, there comes a time (14 years from the initial vantage point) at which the innovation first becomes profitable. After year 14, the innovation becomes more and more profitable, so the lure of profit becomes increasingly irresistible, making it virtually inevitable that some entrepreneur will rise to the bait and carry out the innovation. Indeed, as time advances and discounted benefits rise relative to discounted R&D cost, increasing numbers of would-be innovators are likely to recognize the opportunity, precipitating more or less simultaneous innovation by two or even more firms—a phenomenon characterized earlier by the sociologist Ogburn (Ogburn and Thomas 1922) as a response to the ‘status of the material culture’ (see also Merton 1961).

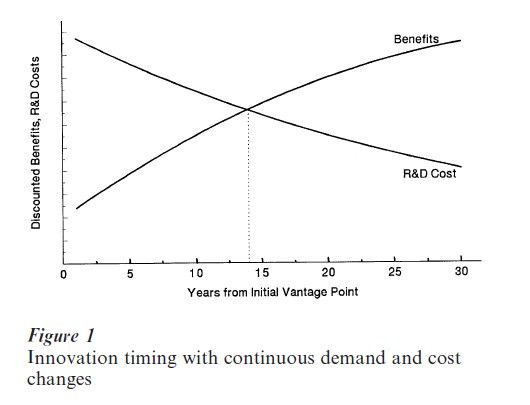

Nevertheless, the road to technological innovations is not always smooth, as portrayed in Fig. 1. Advances in science may occur discontinuously when there are scientific breakthroughs. This case is illustrated in Fig. 2. Up to year 9, the discounted R&D costs of innovating are well in excess of foreseeable discounted quasi-rents, so innovation is not profitable. But in year 9 a scientific breakthrough occurs, substantially reducing the cost of carrying out the developmental work needed to implement the innovation. Innovation is suddenly profitable in year 10 and becomes increasingly profitable as the knowledge base resumes its steady growth thereafter. An innovation induced in this way is called a ‘technologypush’ or ‘science-push’ innovation.

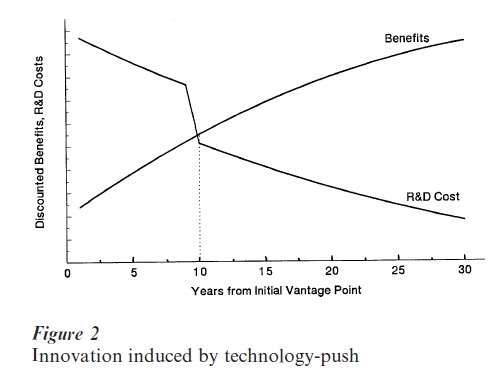

The other extreme case is portrayed in Fig. 3. Again, the innovation is clearly unprofitable up to year 9. But in that year demand takes an upward jump—e.g., because an energy shock has suddenly made energy-saving innovations attractive—and the innovation becomes profitable, the more so, the more demand continues to grow if the innovation is not undertaken immediately in year 10. Following Schmookler (1966), innovations induced in this way are called ‘demand-pull’ innovations.

Reality is some blend of these three polar cases. For Figs. 2 and 3, there is a clear one-sided inducement mechanism—either technology-push or demand-pull. More frequently, both demand-side stimuli and the knowledge base are changing, and it is difficult to tell which has the more powerful influence. Just as both blades of a scissors cut paper, both technology-side and demand-side changes contribute to making technological innovations profitable and thus induce (with some stochastic lag) their appearance on the market.

3. The Appropriability Problem

An important complication entails what has come to be called the appropriability problem. Not all of an innovation’s incremental value accrues to the innovator as quasi-rents or producer’s surplus. Some of the value cannot be appropriated by the innovator, but accrues instead to consumers or other producers. This happens for three main reasons. First, even when the innovator commercializes a new product under monopoly conditions, it is difficult to devise a pricing scheme that does not confer new consumers’ surplus upon those who purchase the product. (Only in the implausible case of perfect price discrimination could the innovator appropriate all of the surplus from a product innovation.) Second, if multiple firms innovate more or less simultaneously or if imitation is swift, competition may drive the relevant product’s price below the monopoly profit-maximizing level, increasing the amount of surplus accruing to consumers and/or competitors and reducing the amount appropriated by innovators. Third, the very fact that a successful innovation has been achieved conveys, or ‘spills over,’ valuable information to other economic actors. They can study the innovator’s technical solutions and use the insights gleaned thereby to come up with their own innovations, which may either improve upon the original innovation’s characteristics or provide differentiated new features. Empirical studies (Griliches 1992) have documented extensive spill-overs whose value is not appropriated by innovators.

The most influential quantitative research on the appropriability problem was by Mansfield et al. (1977). For a sample of 17 commercialized innovations, they painstakingly estimated the quasi-rents realized by the original innovator (called the private return) and the surpluses spilling over to consumers, imitators, and subsequent technology users. Converting these estimates to rates of return on the innovator’s R&D investment, they found the median private return on R&D investment (i.e., the innovator’s return) to be 25 percent, while the median social return (counting in addition surpluses accruing to consumers, rivals, and others) was 56 percent.

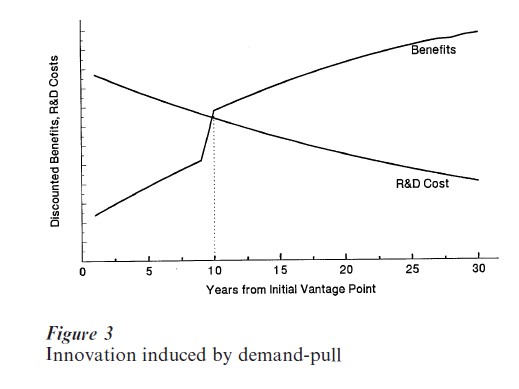

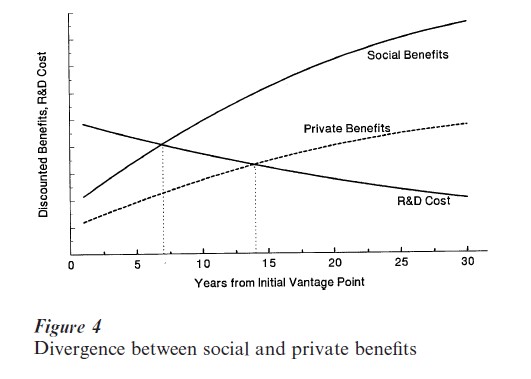

The implications of the appropriability problem are illustrated in Fig. 4. The innovator’s inability to appropriate all the surplus from their innovation in effect inserts a wedge between the stream of benefits appropriable by the innovator (the private benefits) and the total benefits realized by all actors in the economy (the social benefits). The private benefits function in Fig. 4 is the same as in Figs. 1 and 2; the social benefits function is shifted upward by 80 percent. Whereas the innovation first becomes profitable to a private firm 14 years from the initial vantage point, social benefits begin to exceed R&D cost after year 7. This does not mean that the innovation should be introduced in year 7. An all-knowing decision-maker seeking an ideal solution from the perspective of all participants in the economy would choose an introduction date that maximizes the discounted surplus of social benefits less R&D costs. That date will be the same as the private sector break-even date (14 years) when k = (a+r)/ r, where k is the ratio of social to private benefits (shown by Mansfield et al. (1977) to have a median value of approximately 2.25), a is the rate of R&D cost decline, as above, and the market growth rate g is assumed to be zero. For a proof, see Scherer (1980). If appropriability is so low that k>(a+r)/r, the private break-even date comes later than the socially optimal innovation date; if appropriability is sufficiently high that k<(a+r)/r, private break-even may precede the socially optimal innovation date.

Three main classes of remedies have been devised to lessen the innovation market failures believed to come from insufficient appropriability of innovation benefits by innovators.

A solution of particularly long standing, dating back to Venice in the Middle Ages, is the patent system. The first person to make an invention (or under some US interpretations, reduce it to practice) is granted by the government a temporary monopoly on the commercial exploitation of that invention. Patents delay the incursion of imitators and hence help innovators appropriate a larger share of the benefits from their innovations. Surveys of R&D decision-makers (Levin et al. 1987) reveal that the effectiveness of patents in achieving this result varies widely across industries. One reason for this variability is the fact that in some product lines, technological innovators enjoy substantial timing and reputation advantages over imitators even when no patent protection can be secured (Robinson et al. 1994).

Second, insufficient appropriability has been viewed as a rationale for government subsidies to support research and development investments. The relevant policy instruments range from corporate income tax credits for incremental funds spent on R&D (implemented first by Canada in 1962) to the conduct of R&D by government agencies or, more commonly, the issuance by government of contracts reimbursing more or less fully the R&D costs incurred by private firms. The contracts approach suffers from moral hazard problems and possible errors in the choice of innovators, but it is virtually unavoidable when large R&D outlays must be risked to develop high technology products such as guided missile systems for government use. The vast array of policies chosen by governments to foster innovation in their home markets has been studied by economists under the rubric, ‘national innovation systems’ (Nelson 1993).

Third, firms have sought to alleviate appropriability problems by entering into joint ventures to conduct R&D and perhaps also to market the innovations achieved thereby. The cooperative R&D approach offers an added advantage of minimizing what might otherwise be costly duplication of more or less identical R&D efforts. Concomitant disadvantages include the lessening of diversity among technical approaches, where diversity enhances the prospects of achieving a successful solution, and reducing the competitive pressures that compel firms to conduct their R&D programs aggressively (see, e.g., Klein 1977).

How much competition is desirable in the pursuit of innovations is a question on which much economic research has been done (see Reinganum 1989). There are conflicting tendencies. On the one hand, competition forces firms to be aggressive and imaginative in their R&D efforts, seizing innovation opportunities at the earliest feasible moment (e.g., at year 14 in Fig. 1). On the other hand, too much competition reduces appropriability and may lead to a market failure under which no firm can anticipate sufficient quasi-rents to make its R&D investments worthwhile. This tension has led to what is called the ‘inverted U’ hypothesis, holding that the polar extremes of no competition at all (e.g., a secure monopoly) and intense competition are less conducive to innovation than an intermediate degree of competition, e.g., under differentiated oligopoly (see, e.g., Baldwin and Scott 1987).

4. The Risks And Costs Of Innovation

Innovation is intrinsically an excursion into uncharted waters. The notion that costs and benefits can be predicted with precision, as assumed in the model underlying Figures 1–4, abstracts from the fog of real-world decision-making. Clearly, substantial uncertainty and risk are present. However, in early discussions concerning the economics of innovation, little was known about how much uncertainty actually pervaded innovation decisions. Mansfield made the most important clarifying contributions. In one of several such studies, Mansfield et al. (1977) obtained from the heads of 16 chemicals, pharmaceutical, electronics, and petroleum company R&D laboratories three probability estimates for the portfolio of R&D projects pursued by those laboratories: the probability that an average project would achieve its original technical goals, the probability that, conditional upon technical success, the resulting product or process would be introduced commercially, and the probability that, conditional upon commercialization, the project would yield a return on investment at least as high as the opportunity cost of the firm’s capital. For all 16 laboratories combined, the average conditional probabilities were as follows:

Technical success 0.57

Commercialization, given technical success 0.65

Financial success, given commercialization 0.74

Cumulating the three probabilities by multiplication, one finds that on average 27 percent, or roughly one in four, of the projects initially undertaken eventually led to financial success as defined by Mansfield et al. (1977). To make the innovative process broadly worth while, the financial rewards from that minority of successes had to repay not only their own investments but also those made on projects that died at pre-commercialization stages. More recent research (Scherer and Harhoff 1999) has revealed that even among commercialized innovations, the size distribution of rewards (measured in absolute, not rate of return, terms) is highly skew, conforming most closely to a log normal distribution law, and that failure to achieve at least normal returns on commercialized projects may be more common than the survey by Mansfield et al. (1977) implied. The greater uncertainties appear to lie in determining the reaction of consumers and competitors to new products than in the ability of scientists and engineers to achieve success in the laboratory. So skew is the distribution of rewards that it is difficult to make profits converge toward fairly stable averages by supporting feasibly large project portfolios.

The ability to pursue portfolio policies also depends upon the sizes of individual innovation projects. There too, evidence of considerable skew exists. The median case in a large sample of prize-winning technological innovations entailed R&D outlays on the order of $2 million (Scherer 1999). However, the project size distribution has a long thin tail, including hundredmillion-dollar outlays to achieve successful new pharmaceutical innovations in the United States and multibillion outlays for new airliners. In such extreme cases, ‘bet the company’ risks are difficult to avoid.

How large business enterprises must be to undertake the risks of privately financed innovation has been a subject of continuing debate. Especially in Europe, the dominant belief for many decades following World War II was that large national champion enterprises were better positioned than smaller firms to sustain innovative activities. Evidence from the United States has tended to be inconsistent with this view, in part because there are thousands of companies sizeable enough to support portfolios containing numerous median-outlay innovation projects without risking financial failure. Also, beginning in the United States but spreading during the 1990s to many industrialized nations, there has been a proliferation of venture funds pooling money from wealthy investors who seek the occasional but spectacular returns that can be realized by backing an unusually successful high- technology startup firm.

Bibliography:

- Baldwin W L, Scott J T 1987 Market Structure and Technological Change. Harwood Academic Publishers, Chur, Switzerland

- Barzel Y 1968 Optimal timing of innovations. Review of Economics and Statistics 50: 348–55

- Griliches Z 1992 The search for research-and-development spillovers. Scandinavian Journal of Economics 94: 29–47

- Griliches Z 1995 R&D and productivity. In: Stoneman P (ed.), Handbook of the Economics of Innovations and Technological Change. Basil Blackwell, Oxford, UK

- Klein B H 1977 Dynamic Economics. Harvard University Press, Cambridge, MA

- Landes D S 1969 The Unbound Prometheus: Technology Change and Industrial Development in Western Europe from 1750 to the Present. Cambridge University Press, London

- Levin R C, Klevorick A, Nelson R R, Winter S G 1987 Appropriating the returns from industrial research and development. Brookings Papers on Economic Activity: Microeconomics 783–820

- Marx K 1887 Capital (English-language edition by Frederick Engels). Swan Sonnenschein, Lowry & Co., London

- Mansfield E, Rapoport J, Schnee J, Wagner S, Hamburger M 1971 Research and Innovation in the Modern Corporation, 1st edn. Norton, New York

- Mansfield E, Rapoport J, Romeo A, Wagner S, Beardsley G 1977 Social and private rates of return from industrial innovations. Quarterly Journal of Economics 91: 221–40

- Merton R K 1961 Singletons and multiples in scientific discovery. Proceedings of the American Philosophical Society 105: 370–86

- Mokyr J 1990 The Lever of Riches. Oxford University Press, New York

- Nelson R R (ed.) 1993 National Innovation Systems: A Comparative Analysis. Oxford University Press, Oxford, UK

- Ogburn W F, Thomas D S 1922 Are inventions inevitable? Political Science Quarterly 37: 83–98

- Organisation for Economic Cooperation and Development 1997 Basic Science and Technology Statistics. Paris

- Reinganum J F 1989 The timing of innovation: research, development, and diff In: Schmalensee R, Willig R D (eds.) Handbook of Industrial Organization, North-Holland, Amsterdam, Vol. 1, pp. 849–908

- Robinson W T, Kalyanaram G, Urban G L 1994 First-mover advantages from pioneering new markets. Review of Industrial Organization 9: 1–24

- Scherer F M 1965 Invention and innovation in the Watt– Boulton steam engine venture. Technological and Culture 6: 165–87

- Scherer F M 1967 R&D resource allocation under rivalry. Quarterly Journal of Economics 81: 359–94

- Scherer F M 1980 Industrial Market Structure and Economic Performance, 2nd edn. Rand McNally, Chicago

- Scherer F M 1999 New Perspectives on Economic Growth and Technological Innovation. Brookings Institution, Washington, DC

- Scherer F M, Harhoff D 2000 Technology policy for a world of skew-distributed outcomes. Research Policy 29: 559–66

- Schmookler J 1966 Invention and Economic Growth. Harvard University Press, Cambridge, MA

- Schumpeter J A 1912 Theorie der Wirtschaftlichen Entwicklung. Duncker & Humblot, Leipzig (trans. Opie R 1934 The Theory of Economic Development. Harvard University Press, Cambridge, MA)

- Schumpeter J A 1942 Capitalism, Socialism, and Democracy. Harper, New York

- Usher A P 1954 A History of Mechanical Inventions (rev. edn.). Harvard University Press, Cambridge, MA