Sample International Business Research Paper. Browse other research paper examples and check the list of research paper topics for more inspiration. If you need a research paper written according to all the academic standards, you can always turn to our experienced writers for help. This is how your paper can get an A! Feel free to contact our custom research paper writing service for professional assistance. We offer high-quality assignments for reasonable rates.

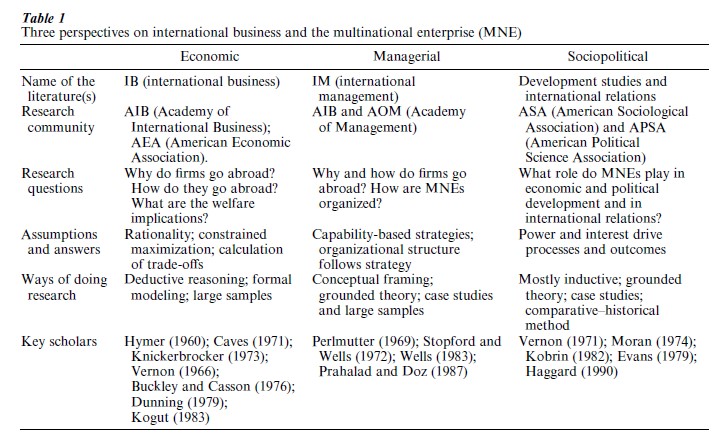

The term ‘international business’ refers to economic activities that take place across the boundaries of nation–states. The most important of these are trade and foreign investment. Merchandise trade has grown 12-fold since the end of World War II, and trade in services has increased even faster since the early 1980s. Foreign direct investment (as opposed to portfolio investment not seeking the managerial control of the foreign asset) has grown at a rate twice as fast as that of trade. Foreign direct investment gives rise to multinational enterprises, i.e., firms with operations in more than one country. There are some 54,000 of these enterprises in the world today which collectively control about 450,000 affiliates. They account for one third of world merchandise trade and for the vast majority of trade in technology. While theories of international trade were first put forward during the sixteenth century and largely have remained the province of economics, the study of foreign direct investment and the multinational enterprise started only after World War II and has been approached from a variety of social and behavioral perspectives. The three most important ones—economic, managerial, and sociopolitical—are covered here (see Table 1).

Academic Writing, Editing, Proofreading, And Problem Solving Services

Get 10% OFF with 24START discount code

1. The Economic Approach

Modern economic thinking about foreign direct investment and the multinational enterprise properly starts with Hymer’s (1976) thesis, posthumously published in 1976. The key insight was to see foreign direct investment not as a capital movement but as the decision of a firm to produce some good or service in a foreign location. Hymer noted that foreign direct investors did not seem to go abroad in search for higher interest rates—as the theory of investment would predict. Rather, he argued that ‘control of the foreign enterprise is desired in order to remove competition between that foreign enterprise and enterprises in other countries’ (Hymer 1976). Thus, Hymer was the first to observe the monopolistic behavior of the firm that engages in foreign direct investment. In other words, the multinational was seen as an anomaly that could only be explained by reference to imperfections in the markets for production factors and goods, economies of scale, and/or government intervention. The most complete rendering of the oligopolistic thesis is that of Knickerbocker (1973). He observed that firms in a loose-knit oligopoly in the home country match each other’s investments in foreign locations following a pattern of action–reaction or move–countermove out of fear that not keeping up with rivals might erode their profitability and competitive position or endanger their sources of supply.

Hymer was also the first scholar to note that ‘the control (of a foreign enterprise) is desired in order to appropriate fully the returns on certain skills and abilities’ (1976), especially those having to do with product and process innovation. Vernon (1979) further argued that patterns of trade and foreign investment had to do with the so-called ‘product cycle’ and not so much with comparative advantage. Vernon saw entrepreneurs and managers as relatively myopic, i.e., most knowledgeable about, and responsive to, conditions in the home market. The features of new products reflected characteristics of the home market and affected the pattern of foreign expansion of the firm. Vernon proposed that firms would only pursue foreign market opportunities after the home market became saturated. Foreign markets relatively similar to the home market in terms of purchasing power and tastes would be entered first, and exports would probably be the preferred mode of entry. Licensing or foreign production would come later in response to host country protectionism and/or rising production costs in the home country.

The economic approach to the multinational enterprise acquired a high degree of internal consistency after scholars started to draw from the insights of transaction cost economics, which has become the backbone of the widely-accepted view among economists that multinationals are an efficient governance response to certain market failures (Buckley and Casson 1976; Dunning 1979; Caves 1996). The multinational enterprise is expected to exist if two conditions are met. First, the necessary condition is that there be differences in the productivity and cost of production factors by location (in the case of vertical expansion by multinationals) or significant transportation costs, trade protectionism, adverse changes in exchange rates, and/or needs to customize products to local demand (in the case of horizontal expansion). Transaction cost theory, however, warns that a second, sufficient condition must be met in order to guarantee that foreign production will be controlled managerially by a multinational firm: market failure due to asset specificity or uncertainty (vertical expansion) or the possession of intangible assets such as patents, brands, and other proprietary skills that cannot be protected in a contractual, arm’s length fashion (horizontal expansion). A final, distinctive contribution to the economic approach was made by Kogut (1983), who proposed to see the multinational enterprise as a flexible network in which resources are arbitraged across borders, a view that revisited Vernon’s insight that multinationals approach foreign investment decisions as a sequential process. A significant body of empirical evidence exists corroborating the major tenets of the economic approach (Caves 1996).

2. The Managerial Approach

While the economic approach has focused on the questions of why and how firms go abroad, the managerial approach has contributed an understanding of how multinationals are organized and managed. This second approach relies on typological conceptual frameworks and inductive reasoning rather than formal modeling. In addition, theoretical development frequently results from case studies, although testing of the main propositions has also been undertaken with large samples, as in the economic approach. Perhaps the first noteworthy typology of the multinational enterprise in the managerial literature was proposed by Perlmutter (1969), who distinguished among three types of multinational ‘mindsets.’ Ethnocentric multinationals are the ones assumed by Vernon’s (1979) produce-cycle approach. They have simple but inflexible organizational structures. Polycentric multinationals, by contrast, adapt to local circumstances but have difficulty co-ordinating. Finally, geocentric multinationals are costly but very good at gathering and integrating information from various locations. Drawing on a rich data set on US multinationals assembled under the co-ordination of Vernon, Stopford, and Wells (1972) presented the first comprehensive treatment of the various factors at the firm, industry, and country levels affecting the choice of organizational structure and degree of ownership over the foreign subsidiaries of the multinational firm.

The early insights by Perlmutter and by Stopford and Wells were further developed in their respective dissertations by Prahalad and Doz as the ‘integrationresponsiveness’ framework (Prahalad and Doz 1987). Multinationals are seen as organizations responding to environmental pressures for global integration (so as to reduce costs through economies of scale and scope) and to pressures for local responsiveness (so as to adapt to local tastes, institutions, or regulations). Following the strategy–structure paradigm in organizational theory, they identify different organizational structures and managerial processes that allow multinationals to operate under different configurations of global integration and local responsiveness. Although still in its infancy, a neoinstitutional approach to the multinational enterprise as a firm exposed to isomorphic pulls from both the home and the host country is also emphasizing the organizational problems associated with multinationality.

3. The Sociopolitical Approach

A third perspective on international business has built on the insights of both the economic and managerial approaches to the study of the political and social context of multinational activity. Vernon (1971) was the first to explicitly argue that the spread of multinational corporations creates ‘destructive political tensions,’ and that there is a ‘need to re-establish balance’ between political and economic institutions.

Political scientists have looked at the impact of multinationals on international relations. They argue that changes in the international location of activities due to foreign direct investment have reinforced the importance of domestic policies, as countries engaged in regionalization, sectoral protectionism, and mercantilistic competition during the 1980s so as to cope with globalizing trends. They have also analyzed the relative bargaining positions of host governments and multinationals. In a classic book, Moran (1974) analyzes Chilean efforts to seize control over its vast copper industry, finding that nominal ownership and control does not guarantee success in a worldwide oligopoly. Sociologist Evans (1979) published his landmark book Dependent Development. He argues that foreign investment attracted by import– substitution industrialization policies results in a ‘triple alliance’ among local entrepreneurs, state bureaucrats, and foreign capital that perpetuates and even enhances patterns of dependence of the host country on foreign technology and capital. Haggard (1990) summarizes the bargaining power literature writing that the host government is relatively powerful vis-a-vis multinationals making huge fixed investments (e.g., in extractive industries), relatively weak when dealing with export-oriented firms looking for cheap labor, and weakest when multinationals are attracted by import-substitution policies that create a political base of support among local suppliers, distributors, employees, and joint-venture partners. Kobrin (1982) offers a different, yet complementary, approach to the politics of multinational activity by examining how multinationals evaluate political risk and try to protect themselves against it.

Sociologists have also examined the effects of international business activity on economic growth and inequality in the world. One major controversy in the literature is whether foreign investment retards long-term economic growth and exacerbates income inequality in the host country or not. Capital dependency theorists have long argued in the affirmative using cross-national empirical evidence, while other sociologists have pointed out that the data do not support such claims (see Kentor 1998). This protracted debate—now three decades old—does not take into account the fact that the effect of foreign investment on host-country growth and income inequality is mediated by the economic development strategy of the host government. Countries allow more or less foreign investment depending on a number of ideological, political, and economic considerations, and the effects of multinational activity differ widely between importsubstitution and export-oriented contexts (Haggard 1990). While it is easy to point to examples of the harmful effects of multinationals, and even of their outright wrong-doing, the social science literature has been slow to recognize that they have played a largely constructive role in many countries, e.g., Singapore, Malaysia, Puerto Rico, Ireland, Portugal, Spain, in which even organized labor and the left have welcomed them.

Since the 1980s the expansion of international business activity has acquired a new, qualitatively different outlook. Globalization in the late twentieth century is different from the internationalization of the world economy during the nineteenth century through increasing cross-border flows of trade and investment. The ‘global’ economy is driven by the increasing scale of technology, the surge in cross-border collaboration between firms along the value-added chain, and the cross-border integration of information flows. While the conventional wisdom is that globalization undermines the nation–state and compels firms to converge towards ‘universal best practices,’ sociologists and political scientists document that governments exercise a great deal of choice in the global economy and firms continue to adopt organizational structures and patterns of behavior that are related to the institutional conditions in their home countries (Orru et al. 1997). Thus, globalization is far from being a monolithic, uniform, and inexorable trend. Rather, it is a fragmented, contradictory, and heterogeneous process of change (Guillen 2001). More empirical and theoretical research is needed to describe the causes of globalization—including those having to do with international business activity—and to understand its effects on political, economic, and social outcomes in various parts of the world.

Bibliography:

- Buckley P, Casson M 1976 The Theory of the Multinational Enterprise. MacMillan, London

- Caves R E 1996 Multinational Enterprise and Economic Analysis, 2nd edn. Cambridge University Press, New York

- Dunning J 1979 Explaining changing patterns of international production: In defence of the eclectic theory. Oxford Bulletin of Economics and Statistics 41: 269–95

- Evans P 1979 Dependent Development. Princeton University Press, Princeton, NJ

- Guillen M F 2001 Is globalization civilizing, destructive or feeble? A critique of five key debates in the social-science literature. Annual Review of Sociology 27: 235–60

- Haggard S 1990 Pathways from the Periphery: The Politics of Growth in the Newly Industrializing Countries. Cornell University Press, Ithaca, NY

- Hymer S 1976 The International Operations of National Firms: A Study of Direct Foreign Investment. MIT Press, Cambridge, MA

- Kentor J 1998 The long-term effects of foreign investment dependence on economic growth, 1940–1990. American Journal of Sociology 103: 1024–46

- Knickerbocker F T 1973 Oligopolistic Reaction and Multi- national Enterprise. Harvard Business School, Boston

- Kobrin S J 1982 Managing Political Risk Assessment: Strategic Response to Environmental Change. University of California Press, Berkeley, CA

- Kogut B 1983 Foreign direct investment as a sequential process. In: Kindleberger C P, Audretsch D (eds.) The Multinational Corporation in the 1980s. MIT Press, Cambridge, MA

- Martinelli A 1982 The political and social impact of transnational corporations. In: Maklen H, Martinelli A, Sinelser N J (eds.) The New International Economy. Sage, London, pp. 79–116

- Moran T H 1974 Multinational Corporations and the Politics of Dependence: Copper in Chile. Princeton University Press, Princeton, NJ

- Orru M, Biggart N W, Hamilton G G 1997 The Economic Organization of East Asian Capitalism. Sage, Thousand Oaks, CA

- Perlmutter H 1969 The tortuous evolution of the multinational corporation. Columbia Journal of World Business Jan–Feb: 9–18

- Prahalad C K, Doz Y L 1987 The Multinational Mission: Balancing Local Demands and Global Vision. Free Press, New York

- Stopford J M, Wells L T Jr 1972 Managing the Multinational Enterprise: Organization of the Firm and Ownership of the Subsidiaries. Basic Book, New York

- Vernon R 1971 Sovereignty at Bay: The Multinational Spread of US Enterprises. Basic Books, New York

- Vernon R 1979 The product cycle hypothesis in a new international environment. Oxford Bulletin of Economics and Statistics 41(4) (November): 255–67