View sample economics research paper on government budgets, debt and deficits. Browse economics research paper topics for more inspiration. If you need a thorough research paper written according to all the academic standards, you can always turn to our experienced writers for help. This is how your paper can get an A! Feel free to contact our writing service for professional assistance. We offer high-quality assignments for reasonable rates.

This research paper describes the economics of government budgets, with particular attention to government borrowing in the United States at the federal, state, and local levels. The next section provides definitions and describes some principles of federal, state, and local budgeting. The third section focuses on major issues pertaining to federal government borrowing. The final section is a summary.

Academic Writing, Editing, Proofreading, And Problem Solving Services

Get 10% OFF with 24START discount code

Definitions and Principles of Government Budgeting

Preliminaries

Equity and efficiency are crucial concepts in economics, so it is useful to begin by defining these terms. Two principles guide evaluations of the effect economic policies have on equity. The benefit principle is the viewpoint that it is equitable for citizens who benefit from government services to pay for them. The ability-to-pay principle is the viewpoint that it is equitable for a citizen’s tax liabilities to be correlated with the citizen’s economic resources. It follows that taxpayers with equal abilities to pay should be taxed equally (horizontal equity) and that tax liability should increase as ability to pay increases (vertical equity). Resources are allocated efficiently if and only if they are used where they have the highest social value.

Operating and Capital Budgets

State and local governments report operating budgets and capital budgets. In general terms, an operating budget is an enumeration of (a) expenditures on current operations and (b) the revenue inflows required to finance those operations (current operations take place each period). Typical expenditures on current operations include purchases of services and of tangible items. Services are commodities that cannot be stored, for example, state employee salaries and interest payments on government debt. Tangibles are items that are used up each period, for example, stationery and gasoline. Revenue inflows collected in 2009 include tax and fee collections that are used to pay for 2009 operating expenditures.

Capital budgets enumerate (a) planned spending on purchases and repairs of capital assets and (b) the means of financing capital assets. In contrast to current operations, capital assets are used for many periods (examples are roads, school buildings, and water treatment plants). Because capital purchased in the current period produces services in the future, capital, like houses, often is financed with borrowed funds. Governments borrow by selling bonds, which are repaid over many periods, when the services produced by capital are enjoyed. A legal obligation requiring future expenditures is a financial liability. Thus, a capital budget is an enumeration of expenditures on capital assets and newly incurred liabilities in a given period. In contrast to most state and local governments, the federal government does not report a capital budget.

A fiscal year is a 12-month period covered by an operating budget. The U.S. federal government’s fiscal year begins on October 1 of each calendar year and ends on September 30 of the following calendar year. Before the beginning of a fiscal year, governments formulate planned operating budgets, which show planned expenditures and expected tax and fee revenues. However, some operating expenditures are difficult to plan for (e.g., disaster assistance), and tax and fee revenues are difficult to predict (e.g., sales tax revenue). Thus, within any fiscal year, actual expenditures may differ from plans, and actual tax and fee revenue may fall short of predictions. In all cases except Vermont, U.S. state governments are constitutionally required to adjust their operating budgets so that by the end of each fiscal year, actual expenditures do not exceed tax and fee revenue. Economists call this restriction the government’s current budget constraint. Note that if expenditures equal tax and fee revenue, the state budget is said to be balanced.

Although the national government also must satisfy a current budget constraint, the restriction is much less severe than that faced by subnational governments. This is true because national governments, generally, are not required to balance their operating budgets. Thus, national governments can borrow to finance operating expenditures. The national current budget constraint states simply that in a fiscal year, government expenditures cannot exceed the sum of borrowed funds plus tax and fee revenue. Additionally, many national governments can issue money, which can be used to finance expenditures. Of course, there is a limit to money finance because money creation tends to cause inflation. U.S. law precludes the federal government from directly issuing money to finance expenditures. However, if the U.S. Federal Reserve Bank (the Fed) buys U.S. Treasury bonds, the money stock increases. This is a form of indirect money finance. However, U.S. law precludes the federal government from compelling the Fed to buy Treasury bonds. For most of its history the Fed appears not to have engaged in indirect money finance.

Governments’ current budget constraints restrict expenditure and revenue choices within a fiscal year. Governments, like individual consumers and businesses, also face a constraint that extends into future periods, namely, the intertemporal budget constraint (IBC). IBC dictates that the sum of current and all future expenditures plus currently outstanding debt cannot exceed current plus all future tax and fee revenue (outstanding debt is debt that has not yet been paid off). Here, future expenditures/ revenues are measured in “present value terms.” (Note that the present value of a dollar to be received in a future period is the dollar adjusted downward by the opportunity cost incurred by not having the dollar for a period. The opportunity cost is the rate of return that could have been earned if the dollar were invested during the period.)

There seems to be a great deal of public confusion about IBC, so it is important to be clear about what restrictions it does and does not impose. In general, the IBC imposes the condition that any increase in expenditure implies an increase in current taxes or future tax liabilities equal in present value to the expenditure. By way of a false analogy, IBC sometimes is taken to mean that governments must repay principal on their debts. This is incorrect. To see why, first note the economic incentives that motivate creditors to lend. Creditors are willing to forgo consuming their wealth for some period of time if they are compensated with a market rate of return on the loans. Second, because individual consumers, sadly, live only finite periods of time, they must repay debt principal before they or their estates expire. Creditors will demand that the principal is repaid. For if creditors were not repaid the principal, they would suffer a large opportunity cost, namely, the opportunity to continue to earn the market rate of return.

However, the same cannot be said for governments and successful business firms because their “lifespans” effectively extend into the indefinite future: They are not finite. As a result, if a government reliably pays the market rate of return on its outstanding debt, and creditors believe the government will continue to do so, the government can satisfy its creditors by servicing its debts forever; it is not required to repay the principal on the debt.

IBC may seem to be a weak restriction on government choices. Nonetheless, IBC does place an important restriction on government debt policy: The government cannot sustain a policy that would cause debt to grow faster than the economy in the long run. If the debt did grow faster, it would outrun the economy’s ability to generate the revenue that must be collected to pay the market rate of interest on the debt. In this case, creditors eventually would stop making loans to the government, and the policy must terminate. Is recent U.S. debt policy sustainable?

Why Report Budgets?

The U.S. government reports a budget each fiscal year in accord with Section 9, Article 1, of the U.S. Constitution, which states that “a regular statement of accounting of receipts and expenditures of all public money shall be published from time to time.” The states have stringent constitutional provisions, requiring construction of budgets, and states impose similar requirements on their local governments.

But what is the value added of a government budget? Government budgets have two major purposes. First, budgets provide information the public needs to evaluate the costs and benefits of public goods and services. This information is fundamental in democracies. Underlying the relations between a democratic government and its citizens is an assumption that government activities are sanctioned by a social contract in which citizens relinquish some freedom in return for public goods and services. Without a budget, this evaluation would be more difficult than it is.

Second, budgets indicate whether governments’ expenditure and revenue decisions are financially responsible. Without a budget, it is harder to know if fiscal policy satisfies the government’s budget constraints, and it would be difficult, if not impossible, for the public and the government itself to know whether spending, revenue, and borrowing policies are financially sound.

Why Report Capital Budgets?

State and local governments separate operating from capital expenditures, and report a separate capital budget. For example, spending on public capital infrastructure (government buildings, highways and bridges, etc.) is included in state capital budgets, whereas spending on teacher and administrative salaries is included in operating budgets. Many foreign national governments publish capital, as well as operating, budgets. Capital budgeting requires time and resources.

Do capital budgets have economic benefits that offset these costs? Public capital goods generate returns and impose risks, just as private capital does. Governments issue bonds, so there is risk of government bond default. Governments also maintain portfolios in trust for the public (largely in the form of pensions). There is a risk to taxpayers that pension assets will lose value. Government capital budgets allow taxpayers and investors to more easily evaluate the risk and returns of funds held in trust by the government.

State and local governments are required to balance their budgets. If there were no separation of capital expenditures from current expenditures, the balanced budget requirements would prevent state and local governments from borrowing to finance capital assets. In this case, states would need to finance capital expenditures by collecting taxes in the period the purchases were made: In no period could capital purchases exceed tax revenue collected in that period. This would be inefficient and inequitable.

To see why it would be inefficient, note that financing capital purchases from current tax collections would require outsized tax increases in periods when purchases are made, because capital, by nature, is very costly relative to a single period’s income. Tax finance of capital would lead to large variations in tax revenue requirements because purchases of capital tend to be “lumpy.” For example, once a new school or courthouse is built, government does not need to build another for a while. As explained next, tax variability is economically inefficient (Barro, 1979). As well, the expenditure could require a single-period increase in tax revenue too large to be politically tenable, which could lead to a less than efficient level of investment in public capital.

Financing capital purchases from current tax collections would also be inequitable. First, it would violate the benefit principle because future generations could consume government capital services they have not paid for. Borrowing today and repaying part of the debt with future tax dollars allows the cost to be shared with the future beneficiaries of capital services. Second, it would violate horizontal equity because households with equal abilities to pay, and who receive equal government services but are born to different generations, would face different tax burdens.

Should the U.S. Government Report a Capital Budget?

The U.S. federal government does not publish a capital budget. Some economists argue that publication of a federal capital budget would be beneficial. Others argue that a federal capital budget would be difficult to implement.

A federal capital budget would make it easier for taxpayers and investors to evaluate the risk and returns of federal government investments. Marco Bassetto and Thomas Sargent (2006) argue that the absence of a federal capital budget may tempt some policy makers to make choices inconsistent with Generally Accepted Accounting Principles. For example, it is sometimes argued that the government should sell some of its physical assets to reduce the federal government’s debt. In general, this is not an economically meaningful way of satisfying the government’s budget constraint; instead, it merely replaces a physical asset for cash, and has no effect on social net wealth. The exchange would be economically meaningful only if the private sector pays more for the asset than its true social value. This seems unlikely in most cases. If the federal government published a capital budget, the economic futility of such an exchange would be easier to understand and avoid.

It has been argued that it would be hard to implement a federal capital budget because it is difficult to categorize some public expenditures. Examples are highway spending, public education, and spending on public safety. State governments address this issue by including the cost of school building in capital budgets and teacher salaries in operating budgets. It is unclear why the federal government could not or should not take the same approach.

Weaknesses in Government Budgeting

Budgets should be designed to aid policymaking and provide the public with information about fiscal policy. In this way, budgets provide rough guides to the social costs and benefits of government. However, these goals can be subverted in a number of ways.

First, the government can impose costs and provide benefits in ways that are not captured in budgets. For example, the U.S. federal government has imposed unfunded mandates on subnational governments (e.g., requirements for school achievement), but the costs of such programs do not appear in the federal budget.

Second, many government-imposed costs and benefits are intangible and hard to measure. For example, it may be impossible to measure the social benefits of public education. Even if possible, the cost of conducting the measurements could be prohibitive. In the case of government guarantees of private loans, an implicit social cost is created because taxes may have to be increased if the loans go into default; however, the social cost is not reported in budgets. As well, governments can rule some expenditures “off budget.” In this case, although measurements are available, the government does not report them in its operating budget. At the federal level, Social Security is an example of an off-budget program.

Third, government budgets may be constructed using substandard accounting. For example, most governments use cash flow accounting. Under cash flow accounting, revenues are included in the budget in the period when received: Expenditures are included in the period when they are paid. In contrast, Generally Accepted Accounting Principles, which are established by the Financial Accounting Standards Board and must be followed by all publicly traded corporations, require private firms to use accrual accounting. In accrual accounting, revenues are included in the budget in the period earned, and costs are included when incurred. Cash accounting is easier (than accrual accounting) to manipulate in ways that produce a misleading representation of the government’s true fiscal position. For example, if a state’s operating budget is out of balance, the state may postpone payment for goods and services until the following fiscal year, or may order tax liabilities due in the following year be prepaid, making the budget to appear to be in balance. Cash flow accounting manipulation may delay the appearance of budget problems but does not solve them. In the interim the government’s fiscal position can worsen.

In the United States, delay and erosion in the federal government’s fiscal position appear to be most severe in the Social Security and Medicare programs. Social Security uses “pay-as-you-go” finance—that is, currently employed workers pay Social Security (payroll) taxes, and the government uses the tax collections to make benefit payments to current beneficiaries (mostly retirees). However, pay-as-you-go Social Security satisfies the government’s intertemporal budget constraint only if there are sufficient young taxpaying workers to finance benefits. Assuming the system initially is in balance, if the number of young workers subsequently declines relative to the number of beneficiaries, the system will no longer be sustainable: To satisfy the constraint, benefits must be reduced, taxes must be increased, or both. In the past 35 years, the average U.S. fertility rate has declined, diminishing the number of young workers per retiree, and the mortality rate of retirees has decreased, increasing the number of retirees per young worker. As currently structured, the U.S. Social Security system appears unsustainable, but this is not reflected in the budget.

In any year, the lion’s share of U.S. federal and state budgets consist of previously established programs. The majority of budgeted programs are not subjected to systematic review of their costs and benefits. Programs that outlive their original motivation and usefulness can become a net burden on society, subverting a basic reason for budgeting. Some observers advocate zero-based budgeting. In this case, the government would reevaluate each program at the beginning of each budget year. Such close monitoring of government programs has a potential to reduce unproductive government spending. However, close monitoring imposes administrative costs. Zero-based budgeting would be an improvement if the cost of unproductive programs exceeds the administrative costs of monitoring programs.

State and Local Government Budget Shortfalls: Rainy Day Funds

From time to time, actual expenditures expand faster than tax and fee revenue, or revenue may actually decline, causing a budget shortfall. Budget shortfalls often occur during economic contractions. Shortfalls are created as the decline of household and business income reduces income tax revenue, consumer spending, and sales tax revenue. Occasionally, property values also decline, reducing property tax revenue. Making matters worse, during contractions, demand for government expenditures on social programs tend to increase (e.g., unemployment insurance and social welfare spending increase in recessions).

Can budget shortfalls be avoided by eliminating the instigating factor, economic contraction? The National Bureau of Economic Research defines the business cycle as the recurring and persistent contractions and expansions in economic activity. The term recurring is emphasized because past experience offers convincing evidence that economic contractions are indicative of developed economies and will recur from time to time. The correlated budget shortfalls create enormous fiscal stress, because states must balance their operating budgets. The question here is, how can state and local governments respond to periodically recurring budget shortfalls?

One response is to increase taxes and reduce expenditures. This approach can be counterproductive and tends to be politically difficult. It can be counterproductive because reducing demand for goods and services can worsen the shortfall. It is difficult to increase taxes in contractions because income declines as workers lose jobs and firms go out of business. However, there is a sound alternative to tax increases and expenditure cuts during contractions. Because recurring contractions are almost a certainty, sound fiscal planning would have state and local governments act before economic disaster strikes by establishing budget stabilization funds, also known as rainy day funds (RDFs). In the ideal case, during economic expansions, RDFs would accumulate tax revenue in trust funds. During subsequent contractions, the trust funds would be used to support expenditures, reducing the need to raise taxes and cut expenditures.

The Advisory Council on Intergovernmental Relations, a group of tax administrators and state government officials, recommends that RDFs be established at a target level of 5% of a state’s annual expenditures. However, the 5% target has proven to be very inadequate. For example, in recessions in 1981 and 1982, 1990 and 1991, and 2001, North Carolina budget shortfalls averaged 19% of a typical year’s expenditure. There is evidence that absent or insufficient RDFs contribute to fiscal stress, imposing substantial yet avoidable costs on society. How?

First, without a sufficient RDF, policy makers and administrators spend substantial time and energy reworking policies in response to budget shortfalls, rather than on the formulation of social policy and the ordinary business of running the government. Ignoring the ordinary business of government causes government services to deteriorate.

Second, without a sufficient RDF, state and local governments risk lower credit ratings from bond rating agencies. Lower credit ratings cause interest rates on state and local borrowing to increase, which leads to avoidable increases in future tax liabilities.

Third, without a sufficient RDF, there is a risk to private investment and planning because taxes would otherwise need to be increased, or expenditures cut, or both, during economic contractions. Stop-and-go fiscal policy increases uncertainty, which discourages private investment and tends to retard economic growth.

Fourth, without a sufficient RDF, taxes tend to be more variable than otherwise. More tax variability implies a larger excess burden of taxation. The excess burden of a tax is the social burden of the tax in excess of the amount of tax revenue collected. Excess burden occurs because people substitute lower valued untaxed commodities for higher valued taxed commodities, reducing economic welfare by more than the tax payment remitted to the government. Without RDFs, policy makers tend to respond to budget shortfalls by increasing tax rates. An appropriately sized RDF can reduce excess burden by reducing the need to increase tax revenue during budget shortfalls.

National Debt and Deficits

What Is the “National Debt”?

National government financial debt is created when the expenditures in a fiscal year exceed tax and fee revenue. The national government finances the excess of expenditure over revenue by borrowing. For example, the U.S. government auctions off U.S. Treasury bills, notes, and bonds (U.S. bonds, hereafter). The U.S. Treasury defines the Gross Debt to be the value of all national government bonds outstanding. However, the media and the public often refer to this same concept as the National Debt. Gross Debt and National Debt are synonyms. The remainder of this research paper uses the former term.

A government’s ability to sell bonds depends on creditors’ faith that the bonds will be repaid and on the creditors’ financial capacity to buy the bonds. Creditors’ faith depends on the economy’s ability to generate future tax revenue, which depends on the economic growth rate. Creditors’ financial capacity depends on their incomes and saving. Because saving cannot grow faster than the economy in the long run, creditors’ financial capacity to buy bonds is limited by the economy’s long-run growth rate. Therefore, if Gross Debt grows faster than the economy in the long run, the economy’s ability to generate tax revenue to service debt, and creditor’s capacity to buy new debt, falls short of the government’s liabilities. If the public understands that the Gross Debt continually grows faster than the economy, creditors will demand abnormally high interest rates to compensate for the risk of not being repaid. Or creditors may simply refuse to purchase additional government debt. In this case, the government faces a “debt crisis,” and the government’s choices become severely constrained: (a) taxes must increase or expenditure must be cut, or both, or (b) government must default on its liabilities and convince creditors to reschedule debt payments. If these options are not available, the only recourse is for the government to repudiate the debt. In this case, government simply declares its intention to not repay the debt.

Interest rates tend to increase greatly in debt crises, and living standards tend to decline. If the government responds to a debt crisis by raising taxes and reducing spending, this exacerbates the decline. Fortunately for the United States, its national government has never experienced a debt crisis. Nevertheless, some public finance economists (Blocker, Kotlikoff, & Ross, 2008; Gokhale, Page, Potter, & Sturrock, 2000; Kotlikoff, 1992) worry that in the decades ahead U.S. Medicare and Social Security obligations could generate fiscal imbalances that could approximate a debt crisis. They argue that U.S. tax rates must increase substantially or benefits must be cut by painful amounts.

Countries that default on debt often have attempted to maintain financial viability by rescheduling debt payments. In this case, the government usually ends up paying much higher interest rates to compensate for the increase in risk perceived by creditors. Even though interest rates increase, the exchange value of the country’s currency tends to decline greatly, as creditors shift funds to safer environments. A large decline in the currency reduces the standard of living because imports become more expensive.

Debt Repudiation

Debt repudiation is the most drastic response to a fiscal crisis. One form of debt repudiation occurs when a government renounces its debt obligations. In 1917, Russia announced that it would not repay debt incurred by the Czars. In the 1930s, the Peronists renounced Argentina’s government debt. A second form of debt repudiation occurs when a government prints money to repay outstanding debt. This form of repudiation often leads to inflation that reduces the real value of debt. After World War I, the Allies imposed war reparation payments on Germany. The German government created a hyperinflation that effectively made the reparation payments worthless.

An advantage of debt repudiation is that it eliminates the burden on taxpayers of repaying previously issued debt. A disadvantage is that repudiation usually decimates the value of a country’s currency, its ability to trade, and the standard of living. For a long time after repudiation, a country may not be able to borrow at all, making it difficult to maintain government services.

How Large Is the U.S. Gross Debt?

The U.S. Gross Debt was about $10 trillion at the end of the federal government’s 2008 fiscal year. As of early 2009, the U.S. Congressional Budget Office estimated that fiscal 2009 borrowing would increase the Gross Debt by about $1.2 trillion.

However, this figure could provide a misleading measure of the effects the debt has on the U.S. standard of living. There are a number of reasons for this.

First, the government’s ability to service its debt, as well as the extent of the debt’s effect on interest rates and the standard of living, depend on the size of the economy. For example, a debt of $10 trillion would overwhelm a small country such as Costa Rica, whose 2007 gross domestic product (GDP) is estimated to be about $48 billion (CIA World Factbook, 2008). If Costa Rica’s debt were this large, interest rates would rise to extreme levels, and the value of its currency probably would decline precipitously along with its standard of living. The $10 trillion U.S. Gross Debt does not cause these dire results because U.S. GDP, at a little less than $14 trillion in 2008, is 287 times larger than Costa Rica’s. Thus, the U.S. debt is a much smaller fraction of its credit markets, so the debt is much easier to service and sustain. As a result, the absolute amount of debt in countries cannot usefully be compared unless each country’s debt is adjusted for the scale of the economy. In fact, a single country’s debt in different periods cannot be usefully compared because the scale of the economy increases over time.

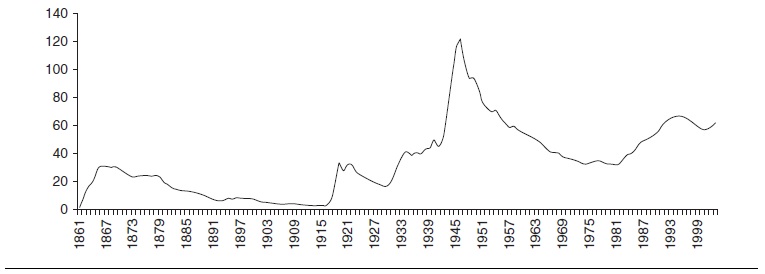

Because economic scale differs across countries and over time, a more accurate assessment of the economic impact of debt is made by adjusting the absolute amount of debt for scale. A common way to do this is to divide the absolute amount of a country’s national debt by its GDP. When the U.S. Gross Debt was $10 trillion, the debt/GDP ratio was about 71% ($10 trillion/$14 trillion). In historical comparison, the U.S. debt/GDP ratio was 120% at the end of World War II (WWII) and did not decline to 73% until the mid 1950s. During the Clinton administration, the ratio declined to about 60% (see Figure 1). The 2007, debt/GDP ratios in seven large capitalist-oriented economies were 64.2% in Canada, 104% in Italy, 170% in Japan, 63.9% in France, 64.9% in Germany, and 43.6 % in the United Kingdom. The arithmetic average is 85.1%.

Second, the U.S. Federal Reserve holds a substantial fraction of the Gross Debt. Federal Reserve holdings of the debt do not impose the same tax burden as other pub-lically held debt because the Fed remits interest income it earns on U.S. bonds back to the Treasury. Prior to the 2008 financial crisis, the Federal Reserve held about $800 billion of the Gross Debt. Subtracting this amount from the Gross Debt reduces the debt/GDP ratio to about 65.7% ($9.2 trillion/$14 trillion).

Third, federal agencies, such as the Social Security Administration, have large holdings of federal government bonds. At the end of fiscal 2008, intra-agency debt was more than $4 trillion. Some public finance economists argue that this debt is not a true burden on taxpayers: Although it is a liability of one government agency, it is an asset to another agency. However, this point is controversial, because Social Security and Medicare suffer from large fiscal imbalances that imply large future tax liabilities (more on this point subsequently).

Figure 1 Ratio of U.S. Federal Gross Debt to U.S. GDP, 1861-2003

Fourth, state and local governments include bond finance of capital infrastructure expenditures in capital budgets. In contrast, the U.S. government does not report a capital budget. Instead, it includes debt finance of capital expenditure in the Gross Debt. However, to the extent that public capital is productive, it provides taxpayer benefits that tend to offset the liabilities. Productive public capital can increase national income, generating tax revenue that reduces future borrowing needs. The 2008 Economic Report of the President reports that federal government net investment was $38 billion in 2007.

Fifth, most outstanding U.S. debt held by the public has a fixed dollar value. However, inflation reduces the real value of this debt. This means that inflation reduces the real value of tax revenue that will be needed in the future to finance debt service. Thus, the current dollar value of the debt overstates its real economic effect. This should not be taken to imply that the national government has license to reduce its real debt by expansionary money policy that would create inflation. For, taxpayers learn to expect persistent inflation. Expected inflation causes nominal interest rates to increase, which causes the dollar value of the debt to rise. Everything else constant, over time, inflation loses its ability to decrease the real value of debt.

Sixth, Laurence Kotlikoff (1992) argues that proper accounting reveals that the true value of the U.S. government’s liabilities far exceeds the Gross Debt. In addition to the government’s explicit liabilities counted in the Gross Debt, there are large implicit liabilities created by the Medicare system and Social Security. Future revenues expected to be generated by these programs fall far short of the implicit liabilities. Estimates of the shortfalls vary between $25 trillion (Rosen & Gayer, 2008) and $40 trillion (Kotlikoff & Burns, 2004). However, in the future, the U.S. government could legislate lower benefits, whereas it almost certainly will not default on its bonds. Thus, the true size of the U.S. Gross Debt remains a matter of debate.

What Is a Budget “Deficit” and What Is Its Relation to the Debt?

A national government budget deficit occurs when expenditure exceeds tax and fee revenue in a single fiscal year. In this case, the government must borrow to make up the difference. Therefore, a deficit causes the Gross Debt to increase. For example, U.S. federal government expenditures exceeded its revenues by $363 billion in 2007. Thus, the Gross Debt increased from about $8.5 trillion at the end of 2006 to about $8.9 trillion at the end of 2007.

The official deficit reported by the U.S. Treasury in 2007 was $162 billion. Note that this is less than the $363 billion figure just cited. The smaller figure results from the fact that the official deficit includes the “surplus” in the Social Security program. The government spends Social Security surpluses each year. Because the surpluses are spent, when Social Security receipts eventually fall short of benefits paid (around 2017), the difference must be made up by public bond sales, or by increased taxes, or by decreased spending. Public finance economists argue, therefore, that a more accurate accounting of growth in the debt would exclude Social Security surpluses from the deficit. In this case, the $363 billion figure is a more precise measure of the increase in the debt than the official deficit reported by the Treasury.

Recall that the absolute dollar amount of the national debt does not convey its impact on the economy because the size of the economy grows over time. Economic scale also affects the economic impact of a country’s deficit. The preceding figure indicates that the Gross Debt/GDP ratio reached its highest recorded value at the end of WWII. At that time, the deficit/GDP ratio also reached its highest value, about 13%. In 1983, the ratio reached a postwar record of 4.9% (see Figure 1). In 2008 the deficit/GDP had fallen to about 2.8%. However, at this writing, the Congressional Budget Office has predicted that the recession that began at the end of 2007 could drive the ratio above 8% in fiscal 2009.

Do Budget Deficits Improve Economic Welfare?

Almost without exception, U.S. federal government deficits have been a fact of life since the early 1960s. Partly as a result of this record, a vigorous debate over the costs and benefits of deficits has arisen. Deficits have potential to both improve equity and diminish it. They can create efficiencies as well as inefficiencies. This section reviews the arguments pro and con.

It is useful to begin with what the debate is not about. Deficit expenditures on productive public capital investment can be efficient in cases where private markets underproduce such investment. For the most part, the deficit debate is not about debt finance of public capital infrastructure. Instead, the discussion in this section focuses on deficit finance of the national government’s operating expenditures.

The economics of budget deficits are somewhat different in wartime and peacetime. Consider wartime. Wars tend to absorb outsized amounts of an economy’s resources. Rather than relying solely on taxes to acquire resources, national governments often resort to borrowing (see Figure 1). The alternative is to increase taxes. Because the wartime generation sacrifices the use of resources, while future generations presumably benefit from the wartime effort, it has been argued that borrowing to finance wars is equitable. By the same token, it has been argued that debt finance of a war is an efficient investment if it makes citizens in current and future generations better off than they otherwise would be.

The economics of peacetime deficits are more complicated. First, the effects of deficits appear to depend on the specific types of expenditures the deficits support. Second, the effects of deficits appear to depend on the way household saving responds to deficits. Third, the impact deficits have depends on where the economy is located in the business cycle when the deficit is incurred.

Before discussing these issues, it is useful to address a general problem that may arise in the case of debt finance of most types of public expenditures. If current taxpayers believe that others, not they, must repay funds borrowed by the government, debt finance tends to be more politically palatable than taxes. In this case, the ability to finance debt may lead to larger government expenditures than taxpayers would choose if they believed, instead, that they themselves would be required to repay the debt. Therefore, the government’s ability to use deficit finance can lead to inefficiently large amounts of expenditure.

This inefficiency may be offset, to some degree, by the fact that debt finance can be used to reduce the variability of tax liabilities. Reduced tax variability is more efficient (Barro, 1979). To see how, note that variation in tax liabilities from period to period reduces taxpayer welfare, even if the overall tax liability is unchanged. This is true because variability in tax liability causes variability in disposable income, which, in turn, causes variability in household consumption. By the well-known economic law of diminishing returns, an increase in consumption adds less to welfare than a decline in consumption reduces welfare. Consider two ways a household can allocate a given level of income: In the first case, consumption is high at first, followed by low consumption; in the second case, the same level of income is consumed evenly over time. The second case provides more utility. It follows that a given level of tax liabilities reduces utility by less, if tax liabilities are constant over time. In the short run, government revenue requirements vary greatly because of short-run variation in demand for government services. Altering tax liabilities each period to equal the changing revenue requirements reduces welfare more than smooth tax liabilities. Debt finance can be efficient if it is used to smooth tax liabilities: The government can maintain constant tax liabilities by borrowing when revenue requirements are relatively high (e.g., in wartime or in economic crisis) and by repaying loans when requirements are relatively low.

Kotlikoff (1992) argues that the U.S. pay-as-you-go Social Security system incurs large implicit deficits. If the Social Security program is not reformed, current generations are receiving Social Security benefits that must be paid for by future generations, transferring wealth from future generations to current generations. In this case, implicit deficit finance is inefficient: Resources are not allocated where they have the highest social value in the sense that if all citizens, future and current, were fully informed about the system’s costs and benefits, they would chose a different allocation. The Social Security system also is inequitable because citizens who are born into different generations, but have equal abilities to pay, face different levels of taxation.

Further, deficit finance, implicit as well as explicit, has a potential to inefficiently reduce future production and a nation’s standard of living (Altig, Auerbach, Kotlikoff, Smetters, & Walliser, 2001; Auerbach & Kotlikoff, 1987; Feldstein, 1974). This point requires some explanation.

Deficits can reduce the future standard of living if they increase consumption and reduce national saving. To see this, note that national saving is the sum of private, business, and government saving. Also note that the economic effect of borrowing is equivalent to a decline in saving. For example, a household can finance a car by reducing its bank account by $25,000, reducing savings, or by retaining the bank account and borrowing $25,000: The economic effects are the same. Therefore, a deficit is a decline in government saving. If a deficit-induced decline in government saving is not accompanied by an equal increase in private saving, national saving will be lower than otherwise. Lower national saving tends to increase the interest rate: In this case, investment declines because the interest rate is a principal part of the cost of capital. The process by which increased deficits cause investment to decline is called crowding out.

If deficits crowd out private investment, and the government does not use the borrowed funds to purchase productive capital, national capital investment will be lower than it otherwise would be. In this way, crowding out can reduce the amount of capital inherited by future generations, thereby lowering future standards of living. Douglas Elmendorf and N. Gregory Mankiw (1999) estimate that deficits have reduced U.S. incomes by 3% to 6% annually. In this case, unless there is an offsetting economic rationale to run deficits, they are inefficient.

However, deficits may not have such dire effects and, Robert Barro (1974) argues, may not matter at all. Barro argues that deficits (implicit or explicit) do not affect national saving, capital investment, or the future standard of living. This will be true if private savers respond to the deficits by saving more, thereby offsetting the deficit’s negative effect on national saving. Private savers might increase saving if they foresee the negative effect the deficit otherwise could have on future living standards, and if they are determined to prevent deficits from undermining their children’s futures. In opposition to this idea, B. Douglas Bernheim (1987) argues that deficits reduce national saving if the amount that households can borrow is restricted by financial markets. In this case, deficit-financed tax cuts provide these households with funds they would like to borrow from markets, but cannot. These households treat deficit-financed tax cuts as they would borrowed funds, and spend them, reducing private saving and national saving.

Whether debt finance does or does not reduce national saving is an empirical issue and can be decided only on the basis of careful statistical analysis of savers’ behavior (Bernheim, 1987). Currently, there appears to be fairly widespread agreement among economists that deficit finance tends to reduce national saving. In particular, there appears to be a consensus that deficits increase aggregate demand. Economists who take this view argue that if deficit finance is used to increase government expenditures, aggregate demand increases directly. If deficit finance is used to reduce taxes, taxpayers spend at least part of the tax cut, increasing aggregate demand indirectly. The remainder of the discussion studies the effects of deficits in these cases.

Tax collections based on personal income, corporate income, and sales decline during contractions. At the same time, social spending by government tends to rise during contractions. Thus, if the federal government were prohibited from running deficits in contractions, it would be required to increase taxes or cut spending, or both. The federal government’s budget is a very large share of the U.S. economy (about 20% of GDP), so such tax increases or spending decreases would tend to exacerbate contractions, which would inefficiently increase the extent of unemployed resources. Thus, contraction-induced deficits are favored by many macroeconomists and policy makers.

Are contraction-induced deficits consistent with the government’s IBC? As explained before, the important economic implication of IBC is that government must reliably pay the market rate of return on its debt; thus, the debt cannot grow faster than the economy in the long run. If the government ran persistent deficits, the debt would outrun the economy’s ability to produce tax revenue required to service the debt, so persistent deficits are not sustainable. Thus, contractionary deficits satisfy IBC only if the government eventually runs surpluses. An efficient deficit policy would have the government repay recessionary deficits with expansionary surpluses. In this case, the government budget would be balanced across the business cycle: Resources absorbed by the government during recessionary deficits would be freed up during subsequent expansions.

Because resources are underutilized during recessions, many macroeconomists argue that the government can and should be more proactive than simply permitting recessionary deficits. They argue that the government should purposely increase deficits during economic contractions, and that doing so would increase aggregate demand, thereby reducing the severity of contractions. In this case, policy makers would resist cyclical contractions by legislating larger expenditures and lower taxes. This is called activist counter-cyclical fiscal policy. Such policy has a potential to be efficient, if it does not short-circuit the economy’s self-correcting mechanisms and if the government balances its budget over the business cycle.

How Are Government Debt and Foreign Debt Related?

The foreign debt is the accumulated amount that foreigners have lent to both private and government borrowers in the United States, minus the accumulated amount foreigners have borrowed from (primarily private) U.S. lenders. A substantial fraction of loans to U.S. governments are provided by foreigners. For example, before the 2008 financial crisis set in, about 32% of U.S. Gross Debt was owned by foreigners.

As explained earlier, budget deficits tend to increase interest rates, particularly if the economy is expanding. The increase in interest rates encourages foreign lending to the United States, which increases the U.S. foreign debt. Thus, U.S. government debt tends to be positively correlated with the U.S. foreign debt.

Does Foreign Ownership of U.S. Debt Affect the Standard of Living?

By themselves, deficits tend to increase interest rates. Foreign lending increases the supply of loanable funds, which tends to offset the positive pressure deficits exert on interest rates. More generally, foreign lending tends to reduce the cost of U.S. borrowing, which can support economic growth. However, foreign lending also tends to increase the foreign exchange value of the U.S. dollar because lenders must buy dollars in order to buy the U.S. debt. An increase in the exchange value of the dollar tends to reduce U.S. exports and increase U.S. imports, which tends to reduce economic growth. Therefore, the net effect that foreign lending has on the U.S. standard of living is an empirical question and cannot be determined by theory alone.

Many economists assume that foreign lending increases growth and the standard of living, at least in the short run. If so, the effect may be temporary: After all, interest on foreign debt must be paid, and foreigner lenders may someday choose not to refinance loans to the U.S. Does government borrowing from foreign investors increase the U.S. standard of living in the long run? There are a number of possibilities.

First, if U.S. governments use the borrowed funds for productive capital investment, the capital stock will be larger and future U.S. production will be larger. If the productivity of the public capital investments exceeds the interest on the loans, future U.S. living standards will tend to be higher than otherwise. However, if interest payments exceed the productivity of public capital, future U.S. living standards would tend to be lower than otherwise, even if U.S. production is larger. In this last case, even though the borrowed funds increase U.S. output, the income generated contributes to foreign living standards, not U.S. living standards.

Second, if U.S. governments use the borrowed funds for consumption, the foreign debt does not contribute to future production, and debt service would reduce future U.S. living standards because part of the unchanged level of production must be delivered to foreign lenders.

Third, a large and rapid shift away from foreign lending to the U.S. could cause the foreign exchange value of the dollar to decline precipitously. In this case, U.S. interest rates would rise, and the U.S. standard of living could decline sharply. Fortunately, events such as these have never occurred in the U.S. However, they are a real risk whose possibility should be taken seriously in fiscal policy makers’ deliberations.

A Balanced Budget Amendment?

The federal government is not required to balance its budget. Because deficits can be used to increase government expenditure above the amount fully informed taxpayers would choose, some public policy analysts advocate a strict Balanced Budget Amendment (BBA) to rule out federal deficits.

A disadvantage of a strict BBA is that it would prohibit deficit spending in recessions. This would require the government to increase taxes or cut spending during economic contractions, which would tend to exacerbate downturns and make taxes more variable, both of which are inefficient. Further, a strict BBA would prohibit countercyclical fiscal policies of the sort that observers of many political persuasions support during recessions.

Are U.S. Deficit (Debt) Policies Sustainable?

The crucial economic implication of the IBC is that government debt cannot persistently grow faster than the economy. If the debt growth persistently exceeds GDP growth, investors would eventually demand prohibitively high interest rates, or simply refuse to purchase additional government debt. The relative growth rates of debt and GDP are reflected in the debt/GDP ratio, which increases if the debt grows faster than the economy. In 1980, 1990, 2000, and 2008, the debt/GDP ratio was, respectively, 32.0%, 55.2%, 57.3%, and 73.0%. For 3 decades now, U.S. debt policy has been on an unsustainable path. The longer the U.S. continues on this trend, the more serious the economic repercussions will be.

Conclusion

Government budgets provide information the public needs to evaluate costs and benefits of government services and indicate whether the government is operating in a financially responsible manner. Capital budgets allow taxpayers and investors to evaluate the risk and returns of government investment more easily. State and local governments report capital budgets. The U.S. federal government does not. A federal capital budget would make it easier for taxpayers and investors to evaluate the risk and net returns of federal government programs.

State and local governments can reduce the adverse budget effects of economic contractions by properly structured and appropriately sized RDFs. RDFs can help reduce the need for ad hoc reductions in expenditures and increases in taxes that often accompany budget shortfalls. Thus, RDFs can reduce the risk of credit downgrades, uncertainty, and the excess burden of state and local taxes.

The National or Gross Debt is the value of all outstanding national government bonds. If government debt persistently grows faster than the economy, creditors will demand abnormally high interest rates or may refuse to purchase government debt. The economy can suffer severe damage. In a debt crisis, the government must raise taxes or cut government expenditure, default on its liabilities, or repudiate the debt.

There is a long list of reasons why the reported value of national debt must be interpreted cautiously, if one is to understand its economic effects. First, the debt/GDP ratio adjusts the raw value of the debt for economic scale and provides a reasonable tool that can be used to compare debt policies in different countries, as well as the debt of a single country in different years. Second, central banks hold substantial fractions of national debt: This tends to diminish some of the adverse effects of government debt and should be taken into account in attempts to evaluate debt’s economic impact. Third, some fraction of debt finances public capital, which can contribute to economic growth and tax revenue needed to service the debt. Thus, government infrastructure investment also should be accounted for when evaluating the effects of debt. For this reason, many economists favor a federal government capital budget separate from the operating budget. Fourth, a substantial part of the debt has a fixed dollar value, which declines in real terms when inflation is positive. Thus, many economists agree that the real value of the debt influences interest rates, investment, and the standard of living. Fifth, the U.S. government has incurred large implicit liabilities that are not counted in the Gross Debt. Thus, the reported national debt understates the government’s true financial liabilities and provides a misleading estimate of future tax revenues necessary to sustain U.S. fiscal policy.

Debt issue can be used to reduce the variability of taxes, increasing efficiency. It can be used to spread out the costs of government to future generations, who benefit from current government expenditures, which most observers judge to be equitable. However, the ability to issue debt can lead to inefficiently large government expenditure if voters believe they will benefit from spending they will not pay for. Implicit government borrowing can also be used to transfer wealth from future to current generations, which can be inefficient and inequitable (Kotlikoff, 1992). Debt finance can reduce future production and a nation’s standard of living, if deficits crowd out private investment and government does not use the borrowed funds to purchase public capital.

Many macroeconomists argue that the government can and should use countercyclical deficit policy to reduce the severity of economic contractions. Countercyclical fiscal policy has a potential to be efficient, if it does not short-circuit the economy’s self-correcting mechanisms, and assuming the government balances the budget over the business cycle.

Deficit-induced increases in interest rates encourage foreign lending to the United States, which increases the foreign debt. Foreign lending tends to reduce borrowing costs and can contribute to economic growth. However, foreign lending also tends to increase the foreign exchange value of the U.S. dollar, which can reduce U.S. net exports, reducing growth somewhat. The net effect cannot be determined by theory. Funds borrowed from foreign investors and used for public investments can increase the standard of living in the long run, if the return on investment exceeds the interest cost. If the funds are used for consumption, foreign lending will tend to reduce future U.S. standards of living. Foreign debt runs a risk that foreigners may suddenly shift investments away from the United States, which can damage the U.S. economy severely.

Finally, government debt cannot grow faster than the economy in the long run. U.S. Gross Debt has grown faster than the economy for decades. U.S. fiscal policy surely is not sustainable.

Bibliography:

- Altig, D., Auerbach, A. J., Kotlikoff, L. J., Smetters, K. A., & Walliser, J. (2001). Simulating fundamental tax reform in the United States. American Economic Review, 91(3), 575-595.

- Auerbach, A. J., & Kotlikoff, L. J. (1987). Dynamic fiscal policy. Cambridge, UK: Cambridge University Press.

- Barro, R. J. (1974). Are government bonds net wealth? Journal of Political Economy, 82, 1095-1117.

- Barro, R. J. (1979). On the determination of the public debt. Journal of Political Economy, 87, 940-971.

- Bassetto, M., & Sargent, T. (2006). Politics and efficiency of separating capital and ordinary government budgets. Quarterly Journal of Economics, 121(4), 1167-1210.

- Bernheim, B. D. (1987). Ricardian equivalence: An evaluation of theory and evidence. NBER Macroeconomics Annual, 2, 263-304.

- Blocker, A. W., Kotlikoff, L. J., & Ross, S. A. (2008). The true cost of Social Security. Unpublished working paper, Boston University Economics Department.

- CIA World Factbook. (2008, January). Available from https://www.cia.gov/library/publications/the-world-factbook/index.html

- Economic report of the president. Transmitted to the Congress February 2008, together with the annual report of the Council of Economic Advisers. (2008). Washington, DC: Government Printing Office. Available from https://fraser.stlouisfed.org/files/docs/publications/ERP/2008/ERP_2008.pdf

- Elmendorf, D. W., & Mankiw, N. G. (1999). Government debt. In J. B. Taylor & M. Woodford (Eds.), Handbook of macroeconomics (pp. 1616-1669). Amsterdam: Elsevier North-Holland.

- Feldstein, M. (1974). Social Security, induced retirement, and aggregate capital accumulation. Journal of Political Economy, S2, 905-926.

- Fisher, R. C. (2007). State and local public finance. Mason, OH: Thomson South-Western.

- Fox, W. F. (1998). Can the state sales tax survive a future like its past? In D. Brunori (Ed.), The future of state taxation (pp. 33-48). Washington, DC: Urban Institute Press.

- Gokhale, J., Page, B., Potter, J., & Sturrock, J. (2000). Generational accounts for the U.S.: An update. American Economic Review, 90(2), 293-296.

- Kotlikoff, L. J. (1992). Generational accounting: Knowing who pays, and when, for what we spend. New York: Free Press.

- Kotlikoff, L. J., & Burns, S. (2004). The coming generational storm. Cambridge: MIT Press.

- Lindsey, B. L. (1987). Individual taxpayer response to tax cuts: 1982-84: With implications for the revenue maximizing tax rate. Journal of Public Economics, 33, 173-206.

- Mankiw, N. G. (2007). Government debt. In Macroeconomics (pp. 431-452). New York: Worth.

- Noll, F. (2008, August). The United States public debt, 1861 to 1975. In R. Whaples (Ed.), EH.Net encyclopedia. Available from https://eh.net/encyclopedia/the-united-states-public-debt-1861-to-1975/

- Rosen, H. S., & Gayer, T. (2008). Public finance. New York: McGraw-Hill Irwin.