Sample Energy Economics Research Paper. Browse other research paper examples and check the list of research paper topics for more inspiration. If you need a research paper written according to all the academic standards, you can always turn to our experienced writers for help. This is how your paper can get an A! Also, chech our custom research proposal writing service for professional assistance. We offer high-quality assignments for reasonable rates.

Energy economics is the field that studies human utilization of energy resources and energy commodities, and the consequences of that utilization. In physical science terminology, ‘energy’ is the capacity for doing work, for example, lifting, accelerating, or heating material. In economic terminology, ‘energy’ includes all energy commodities and energy resources, commodities or resources that embody significant amounts of physical energy and thus offer the ability to perform work. Energy commodities—for example, gasoline, diesel fuel, natural gas, propane, coal, or electricity—can be used to provide energy services for human activities, such as lighting, space heating, water heating, cooking, motive power, or electronic activity. Energy resources—for example, crude oil, natural gas, coal, biomass, hydro, uranium, wind, sunlight, or geothermal deposits—can be harvested to produce energy commodities.

Academic Writing, Editing, Proofreading, And Problem Solving Services

Get 10% OFF with 24START discount code

Energy economics studies forces that lead economic agents—firms, individuals, governments—to supply energy resources, to convert those resources into other useful energy forms, to transport them to the users, to use them, and to dispose of the residuals. It studies roles of alternative market and regulatory structures on these activities, economic distributional impacts, and environmental consequences. It studies economically efficient provision and use of energy commodities, and resources and factors that lead away from economic efficiency.

1. Properties Of Energy Resources And Energy Commodities

Other than all embodying significant amounts of physical energy, energy resources or commodities vary greatly. They may embody chemical energy (e.g., oil, natural gas, coal, biomass), mechanical energy (e.g., wind, falling water), thermal energy (geothermal deposits), radiation (sunlight, infrared radiation), electrical energy (electricity), or the potential to create energy through nuclear reactions (uranium, plutonium.) They have differing physical forms. Crude oil, most refined petroleum products, and water are liquids. Water includes available energy only through its motion. Coal, most biomass, and uranium are solids. Natural gas and wind are gases, with wind including available energy based only on its movement. Geothermal energy is available through hot liquids (normally water) or solids (subterranean rock formations). Solar radiation is a pure form of energy. Electricity consists of electrons moving under an electrical potential.

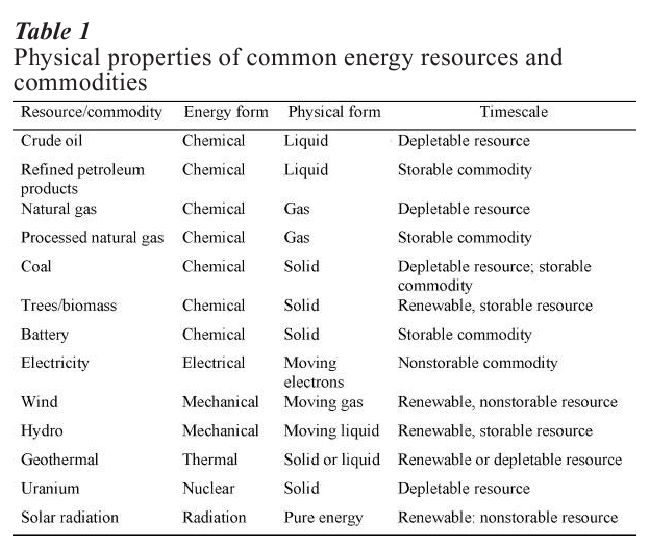

Resources can be viewed as renewable or depletable. Some renewable resources can be stored; others are not storable. These issues will be discussed more fully in a subsequent section. Table 1 summarizes the energy form, physical form, renewable depletable distinction for several common energy resources and commodities.

2. Energy Conversion Processes

A fundamental property of energy is expressed by the first law of thermodynamics: energy can be neither created nor destroyed (except through nuclear reactions transforming matter to energy.) Energy can be converted between forms, and human use of energy typically involves such conversions for human ends.

Energy conversion processes are basic to human experience. Fire, providing heat and light, is a process by which chemical energy stored in the fuel (say, wood) is converted to thermal energy and radiant energy. Chemical energy stored in wood is the result of photosynthesis, whereby plants convert energy in sunlight to chemical energy, stored in the plant material. Carbohydrates in food are converted within the human body to thermal energy and mechanical energy, providing body warmth and movement.

The industrial revolution was characterized by a change from the use of hand tools, using human mechanical energy, to machine and power tools. Machine tools allowed the conversion of energy in falling water to mechanical energy (water wheels), or the conversion of chemical energy in wood or coal to mechanical energy (steam engines) for industrial processes.

Humans now routinely harness complex sequences of energy conversion processes to provide desired services. Crude oil is separated into refined products such as gasoline, diesel oil, jet fuel, and heavy distillates, that embody chemical energy. Gasoline or diesel oil are burned explosively in internal combustion engines, converting chemical energy into thermal energy. Heated gases push engine pistons, converting thermal energy into mechanical energy. Some is lost as heated gases or as radiant energy. The mechanical energy moves the automobile and, in the process, is converted to thermal energy through friction within the automobile or between the automobile and the road or air. Some mechanical energy is converted to electrical energy by a generator in the automobile, to power electrical equipment. Some electrical energy is converted into chemical energy in the automobile battery. To start the car, chemical energy in the battery is converted to electrical energy which is then converted to mechanical energy to turn the engine.

Similarly, coal combustion converts chemical energy into thermal energy to create steam, which powers a turbine in an electric generating plant, converting the thermal energy into mechanical energy, and then into electrical energy. Electricity can power a motor (converting to mechanical energy), heat a room (to thermal energy), or light a bulb (to thermal energy, then to light). This energy is later converted to thermal energy, which ultimately is radiated into space.

Energy economics recognizes the fundamental physical realities that (a) no energy is created or destroyed, but that energy can be converted among its various forms, and (b) energy comes from the physical environment and ultimately is released back into it. Thus, energy economics is the study of human activities using energy resources from naturally available forms, through often complex conversion processes, to forms providing energy services. Several issues of the demand for energy will be examined next.

3. Demand For Energy As A Derived Demand

Demand for energy is derived from wishes to use energy to obtain desired services. It is not derived from preferences for the energy commodity itself. Energy demand depends primarily on demand for desired services, availability and properties of energy conversion technologies, and costs of energy and technologies used for conversion.

For example, consumers use gasoline to fuel an automobile or other motorized vehicle, converting gasoline to mechanical energy for motive power. The amount of gasoline used is proportional to the miles the auto is driven, and inversely proportional to the efficiency by which gasoline is converted to useful mechanical energy, measured as miles per gallon (mpg) of gasoline used by the automobile. Demand for gasoline is thus derived from choices about distances vehicles are driven, and their energy conversion efficiencies.

Similarly, electricity is purchased by consumers only to perform functions using electricity. Typical electricity uses include lighting, refrigeration, space heating, air conditioning, clothes washing, drying, dish washing, water heating, and operating electronic equipment such as computers or televisions. Electrical energy is converted to mechanical energy (motors in refrigerators, air-conditioning units, vacuum cleaners), thermal energy (space heating, clothes dryers, water heating), or radiation (lighting, television, computer monitors.) Electricity demand is derived from demand for the underlying services—comfortable space, refrigeration, cleaning, entertainment, information processing.

In each case, efficiency of energy conversion equipment also determines energy demand. Typically, energy conversion equipment is long-lived—automobiles, air-conditioning units, refrigerators, televisions, computer systems, furnaces. Consumers or firms can usually choose among alternatives with various conversion efficiencies; such choices influence energy demand significantly. To the extent that consumers and firms purchase these units with an understanding of their conversion efficiencies, expectations of future energy prices can influence choices of particular equipment. For example, high natural gas prices can motivate consumers to invest in home insulation.

In general, increased energy prices reduce demand by reducing use of energy services and motivating selection of higher conversion efficiency equipment. For example, gasoline prices influence demand through vehicle miles and fuel efficiency of vehicles. Vehicle miles are influenced by cost per mile of driving, including per-mile gasoline costs, equal to the ratio pg/mpg (where pg is the gasoline price), and other costs. Increased gasoline prices lead consumers to purchase more fuel-efficient cars. Both factors imply that increased gasoline prices reduce gasoline demand, with the vehicle miles adjusting relatively quickly, and vehicular fuel efficiency adjusting slowly as vehicles enter the fleet. Except for firms selling energy resources or energy commodities, similar issues are important for industrial and commercial use of energy.

4. Demand Substitution Among Energy Commodities

Some energy services can be provided by several different energy commodities. Homes can be heated using electricity, natural gas, oil, or wood, since each can be converted to thermal energy. Cooking can use electricity, natural gas, propane, wood, or charcoal. Thus, energy commodities typically are economic substitutes for one another: The demand for a particular energy commodity is an increasing function of prices of other energy commodities.

This substitutability of energy is made possible by, and is also limited by, the available set of energy conversion technologies. Typically, one conversion technology can be used only for a particular energy commodity. For home heating, a natural gas furnace cannot use oil, electricity, or wood. Because conversion equipment typically is very long lived, substitution among energy commodities occurs only slowly, and then only when new equipment is purchased. Short-run substitution can usually occur only if several energy conversion technologies are available simultaneously for use by particular consumers, for example, homes that have a central natural gas heating system plus portable electric space heating units. Thus, various energy commodities can usually be viewed as imperfect substitutes for one another, with much greater substitutability in the long run than in the short run.

The degree of substitutability can be altered sharply by the development of new conversion alternatives. For example, historically, automobiles were fueled only by gasoline or diesel fuel, but technologies currently being developed would allow them to be powered by electricity, natural gas, propane, hydrogen, or other energy commodities. Once such conversion technologies are commercialized successfully, gasoline and other energy commodities will become highly substitutable in transportation.

5. Is Energy An Essential Good?

In economics, an essential good is one for which the demand remains positive no matter how high its price becomes. At the theoretical limit, for prices unboundedly high, consumers would allocate all of their income to purchases of the essential good.

Energy is often described as an essential good because human activity would be impossible absent use of energy: living requires food embodying chemical energy. Although energy is essential to humans, neither particular energy commodities nor any commercial energy commodities are essential goods. Particular energy commodities are not essential because consumers can convert one form of energy into another. Even the aggregate of all commercial energy cannot be viewed as an essential good. Experience from low-energy research facilities shows that an extremely energy efficient home needs relatively little energy. Solar energy could generate electricity or heat water. Travel could be limited to walking or riding bicycles. Solar-generated electricity or wood fires could be used for cooking. For high enough prices of purchased energy, demand for purchased energy by consumers could be reduced to zero. Thus, commercial energy is not an essential good.

6. Optimality Of Consumer Choice

Debate is ongoing about the extent to which consumers understand conversion efficiencies of alternative technologies and act on this understanding, and the extent to which manufacturers of conversion equipment respond to consumer preferences. Labeling requirements have been one policy response to concerns that consumers otherwise would have insufficient information to enable them to choose among energy conversion equipment. New cars have stickers with estimates of mpg under different driving cycles. Refrigerator labels estimate annual electricity use and cost. The concern has led to the adoption of energy efficiency standards for household equipment, such as refrigerators, under the belief that labeling alone is not sufficient to motivate optimal consumer choices. Similarly, the imposition of corporate average fuel efficiency standards (CAFE) for automobiles is a legislative response to concern that, on their own, automobile manufacturers will make automobiles less fuel efficient than optimal. These behavioral issues and the appropriate policy responses have not been resolved fully in either the existing literature or the policy community.

7. Depletable, Storable Renewable, Nonstorable Renewable Resources

Based on the speed of natural processes, one can classify primary energy resources as depletable or renewable. Renewable resources can be further sub-divided into storable or nonstorable resources. Renewable resources are self-renewing within a timescale important for economic decision making. Storable renewable resources typically exist as a stock which can be used or can be stored. Biomass, hydro power, and some geothermal, fall in this category. The amount used at one time influences the amount available in subsequent times. Nonstorable renewable resources—wind, solar radiation, run-of-the-river hydro resources—can be used or not, but the quantity used at a given time has no direct influence on the quantity available subsequently. Most energy commodities are storable (refined petroleum products, processed natural gas, coal, batteries), but electricity is not storable as electricity. Depletable resources are those whose renewal speeds are so slow that it is appropriate to view them as made available once and only once by nature. Crude oil, natural gas, coal, and uranium all fall in this category.

Initially, all human energy use depended on renewable resources, in particular biomass resources used for food, heat, or light. In the United States, renewable energy—human, animal, water, wood, and wind power—dominated energy supply through the middle of the nineteenth century. Only during the second half of the nineteenth century did a depletable resource, coal, surpass renewable resource use. Crude oil and natural gas started supplying large quantities of energy only in the 1920s.

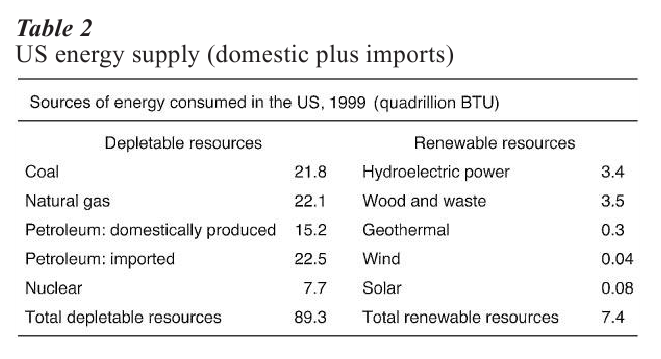

Now the dominant use of energy (other than as food) in developed nations is based on depletable resources, particularly fossil fuels. Table 2 shows that of the total sources of energy consumed in the United States in 1999, 92 percent was from a depletable resource and only 8 percent was from a renewable resource, of which almost all was hydroelectric and biomass (wood and waste).

But depletable resource use cannot dominate for ever. Once particular deposits have been used, they cannot be reused. Therefore, a future transition from depletable resources, particularly from fossil fuels, is inevitable. However, which renewable energy sources will dominate future consumption is not clear. And there is great uncertainty about the timing of a shift to renewable energy resources. Related is the unresolved question of future energy adequacy: will the renewable sources of energy be adequate to satisfy demands for energy, once the fossil fuel supplies move close to ultimate depletion? These issues will be examined further in the next section.

8. Depletable Resource Economics And The Transition To Renewable Resources

The study of depletable resource economics began with articles by Lewis Grey (1914) and Harold Hotelling (1931), which examined economically intertemporal optimal extraction from a perfectly known stock of the resource, with perfectly predictable future prices of the extracted commodity. Many, but not all, subsequent articles maintained the perfect knowledge assumptions.

The essential result is that under optimal extraction paths the resource owner recognizes (explicitly or implicitly) an opportunity cost, or rent, in addition to the marginal extraction costs. All information about the role of future prices and costs would be embodied in this opportunity cost. The competitive firm would extract at a rate such that the marginal extraction cost plus opportunity cost would equal the selling price for the extracted commodity. Price would thus exceed marginal cost, even if the firm were operating perfectly competitively. This opportunity cost would evolve smoothly over time. As the resource neared depletion, the opportunity cost and the marginal extraction cost even at very low extraction rates would together have increased until they equaled the commodity price, at which time extraction would cease.

In depletable resource theory, market prices would increase gradually to the cost of producing substitutes, reaching that cost only as the depletable resource were nearing depletion. Substitutes would be produced only in small quantities until near the time of depletion. Market forces would, automatically and optimally, guide commodity prices upward so that when the depletable resources were nearing depletion, commodity prices would have risen to a point at which the demands could be fully satisfied by the substitutes.

In reality, the economic cycle for depletable resources is far more complex and more prone to error and surprise. The cycle typically begins with innovations that allow the resource to be utilized. Technologies improve over time, partially guided by economic forces and public policy decisions, but often in somewhat unpredictable ways. Generally, the magnitude and location of the resource base remains unknown, and exploration is required to identify resource deposits. But exploration is costly. Therefore, typically it is optimal for companies to explore only until they find sufficient resources to satisfy their expectations of near-term extraction. These discovered resources—referred to as ‘reserves’—typically are only a fraction of the resource base and do not provide reliable estimates of the overall size of the resource stock. Firms may extract optimally from the proven reserves but cannot know with any certainty the quantity or extraction costs of the undiscovered resources. Opportunity cost would depend on the future prices of the extracted commodity, but future commodity prices will themselves depend on future demand and supply, which in turn depend on uncertain future discoveries, and which are therefore very unpredictable.

With this additional complexity and uncertainty, although the opportunity cost concept remains important, it seems appropriate to focus more attention on responses of markets to random changes in technologies, reserves, and other market information. And it seems appropriate to abandon the notion that markets will automatically and optimally guide the system to a smooth transition to renewable resources.

One central result does remain, however. If there is only a limited stock of a resource—undiscovered plus discovered—then there will be only a limited number of years during which the resource can be extracted. Here, there is an important commonality between energy economics and ecological economics. The typical pattern includes an initial period in which the resource is not used, before technology for extracting and/or using the resource is developed. Extraction rates rise over time, perhaps rapidly, as the technology develops and demand increases. Commodity prices would fall with falling extraction and finding costs. However, at some time, rising costs due to depletion of the resource start overtaking the decreasing costs due to technology advances. The extraction rate declines until ultimately all of the economical resource stocks are depleted. At that point, the consumers of the depletable resource must substitute some other means of satisfying energy service demand.

If markets work well, the renewable resources will then be available in sufficient quantities and at reasonable costs. A transition to renewable energy resources will have been accomplished successfully, and there will always be an adequate energy supply to satisfy all demands at the prevailing market price.

However, given the complexity and the uncertainty, it is not obvious that the transition will work as automatically, as smoothly, or as optimally as is suggested above. It may be that fossil fuels saved for the future will ultimately never be needed because substitute forms of energy become available at a lower cost and at an earlier time than expected. Or it may be that fossil fuels are depleted rapidly, but that costs of renewable resources remain well above expected levels, or that quantities of renewable resources are more limited than expected. In either case, in retrospect everyone might wish to have made very different public policy decisions.

9. World Oil Prices

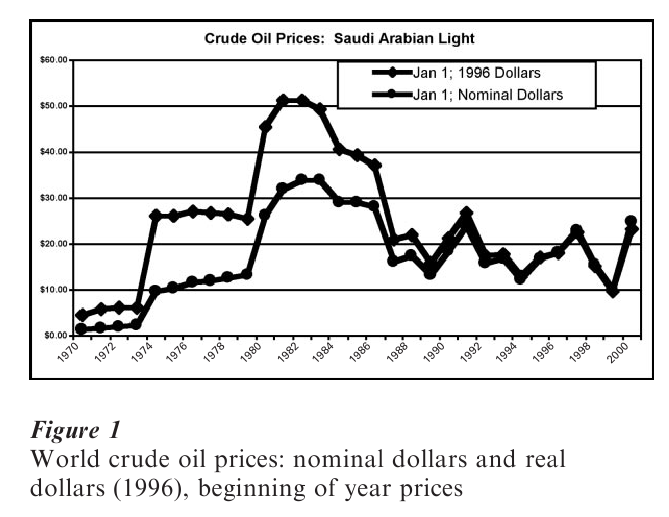

In 1973, energy markets were disrupted when war broke out between Israel and neighboring nations. Oil supply was reduced by some member nations of the Organization of Petroleum Exporting Countries (OPEC). At that time there was relatively little excess worldwide oil extraction capacity. Consumers and producers expected further disruptions. Therefore, the supply reductions led to disproportionately sharp increases in the world price of oil, increases that remained well after the war. Another price increase occurred in 1979. The price of Saudi Arabian light jumped from $2.10 per barrel ( bbl) at the beginning of year (boy) 1973 to $9.60 bbl at boy 1974. The boy 1979 price of $13.34 bbl was followed by a boy 1980 price of $26.00 per barrel. Not until 1986 did prices drop to levels consistent with the current levels. Prices are well above the pre-1973 levels, even when adjusted for inflation, and remain very volatile. Figure 1 shows these boy annual prices in nominal dollars and in 1996 dollars, adjusted using the US implicit GNP price deflator.

Many explanations have been offered for the persistence of the world price increases, including assertions that they simply reflected a realization that oil resources were being depleted, that they reflected only random movements, and that they reflect independent choices by various nations attempting to satisfy developmental goals. The most obvious explanation, that they reflect a collusive exercise of market power by OPEC members, is the best supported by economic data.

These sudden jumps in oil prices led directly to a wide range of economic impacts, and indirectly to impacts through governmental programs responding to the perceived crisis. Worldwide recessions followed both price jumps, partly caused by direct disruptions to industry, partly by reductions in real income of oil importing countries, and partly by tight monetary policies imposed to decrease oil-market-induced inflation. Price and allocation controls were placed on refined petroleum products in the USA, resulting in widespread shortages, manifested by long gasoline lines. And prices of other energy resources and commodities increased significantly in response to the oil price increases.

The oil price increases and ensuing economic problems led to profound changes in energy policy and energy markets worldwide. For example, in the USA, President Nixon declared ‘Project Independence’ to reduce sharply US dependence on imported oil. Oil exploration and development increased extraction capacity throughout the non-OPEC nations, particularly in the North Sea (Norway and the UK), China, and Mexico. Energy ‘conservation’ programs were enacted to reduce energy demand, particularly for oil. For example, corporate average fuel efficiency (CAFE) standards were imposed on the US automobile industry. Public and private-sector investments in renewable energy R&D increased sharply, with emphasis on solar, wind, geothermal, and hydro power. New national and international organizations were created, for example, the International Energy Agency (IEA) in Paris, and the US Department of Energy. Programs were initiated to reduce economic impacts of oil disruptions: the US government purchased large quantities of crude oil for storage underground; oil-importing nations agreed to IAE monitored minimum levels of oil storage. Although some changes have been reversed—for example, investment in energy R&D has declined since 1986— oil policies, particularly for oil-importing nations, are still shaped by these profound changes in the world oil price.

10. Energy Conversion Industries

In addition, activities are associated with commercial conversion of energy from one form to another, particularly to electricity, from hydro power, coal, natural gas, oil, nuclear fission, wood and waste products, geothermal, wind, or solar radiation. Energy conversion industries, for economic success, must be able to sell their product at a price higher than the cost of energy commodities used as inputs plus per unit capital and operating costs of the facilities. Energy conversion is never perfectly efficient, and some input energy is lost into the environment. Therefore, the price per Btu of electricity must be substantially greater than the price of energy commodities used to generate electricity.

Technological advance can be very important. New technologies are becoming available that increase the conversion efficiency from natural gas or coal to electricity, and which can be expected to have lower operating and capital costs. Such technological advances can be expected to bring prices of these energy commodities closer together over time.

In addition to these technological changes, there are important ongoing changes in economic structure of the electricity production and distribution industry, throughout the world. In many countries, state-owned industries generate, transmit, and distribute electricity. In others, private electricity suppliers are subject to special economic regulation. The reason for governmental ownership or control seems to stem from two factors. Electricity is fundamental to economic activity, and many people have not trusted private industry. Second, production, transmission, and distribution of electricity have shown significant increasing returns to scale, and the industry has been viewed as a natural monopoly. Fearful that an unregulated monopoly would exercise market power and overprice electricity, most nations have chosen to own or to control tightly the industry.

Recently, however, smaller geographically distributed electricity generating plants that could reasonably compete with one another, have become attractive economically. Thus, the possibility for competition in electricity generation has been recognized. In addition, it is now realized that an electricity utility sells two classes of product: electricity delivery services (wires), and electricity. Although these two classes of product traditionally were bundled together into a price per kilowatt hour of electricity, in principle, the two could be unbundled and sold by separate companies. Electricity delivery service is characterized by increasing returns to scale, but electricity itself is not. Therefore, the possibility is open for a competitive market structure to sell electricity to consumers, separately from the electricity delivery services.

In some localities this movement toward privatization and deregulation seems to be very successful; in others, it has not been. At the time of writing, there is an intense and heated debate about whether deregulation of the electricity industry is appropriate, and if so, what is the appropriate form of deregulation.

11. Environmental Consequences Of Energy Use

Much important environmental damage stems from the production, conversion, and consumption of energy. Costs of this environmental damage generally are not incorporated into prices for energy commodities and resources; this omission leads to overuse of energy. Concern about this issue is common to energy economics, environmental economics, and ecological economics, with energy economics and environmental economics literature attempting to assign monetary valuation of the impacts, and ecological economics rejecting the idea that a monetary value could be placed on environmental impacts.

Environmental impacts currently receiving most attention are associated with the release of greenhouse gases into the atmosphere, primarily carbon dioxide, from combustion of fossil fuels. The three primary fossil fuels—coal, petroleum, and natural gas—each include carbon. During combustion, carbon combines with oxygen to produce carbon dioxide, the primary greenhouse gas. Carbon dioxide accumulates in the atmosphere and is expected to result in significant detrimental impacts on the world’s climate, including global warming, rises in the ocean levels, increased intensity of tropical storms, and losses in biodiversity. Fossil fuels account for 98 percent of the US carbon dioxide net releases into the atmosphere, and 82 percent of the releases of greenhouse gases, measured on a carbon equivalent basis.

Energy use leads to additional environmental damages. Coal combustion, particularly high sulfur coal combustion, emits oxides of sulfur, which, through atmospheric chemical reactions, result in acid rain. Automobile gasoline combustion releases oxides of nitrogen and volatile organic compounds, which, in the presence of sunlight, result in smog. Electricity generating facilities often use large quantities of water for cooling and release the heated water into lakes or oceans, leading to local impacts on the ecosystem. Extraction of oil or mining of coal can lead to subsidence of the land overlying the extracted deposits.

Pervasive environmental impacts of energy use, absent governmental intervention, imply that significant costs of energy use are not included in the price energy users face. These so-called externalities lead to overuse of energy and provide strong motivation for interventions designed to reduce energy use.

Bibliography:

- Adelman M A 1993 The Economics of Petroleum Supply: Papers by M A Adelman 1962–1993. MIT Press, Cambridge, MA

- Barnett H, Morse C 1963 Scarcity and Growth: The Economics of Natural Resource Availability. Johns Hopkins University Press, Baltimore, MD

- Berndt E R, Wood D O 1975 Technology, prices, and the derived demand for energy. Review of Economics and Statistics 57: 259–68

- Bohi D R 1981 Analyzing Demand Behavior: A Study of Energy Elasticities. Johns Hopkins University Press, Baltimore, MD

- Bohi D R, Toman M A 1996 The Economics of Energy Security. Kluwer, Boston, MA

- Cato D M, Rodekohr M, Sweeney J 1976 The capital stock adjustment process and the demand for gasoline: A market share approach. In: Askin B, Kraft J (eds.) Econometric Dimensions of Energy Supply and Demand. D C Heath, Lexington, KY

- Cropper M L, Oates W E 1992 Environmental economics: A survey. Journal of Economic Literature 30: 675–740

- Dasgupta P S, Heal G 1979 Economic Theory and Exhaustible Resources. Cambridge University Press, Cambridge, UK

- Denny M, Fuss M, Waverman L 1981 The substitution possibilities for energy: Evidence from US and Canadian manufacturing industries. In: Berndt E R, Field B (eds.) Modeling and Measuring Natural Resource Substitution. MIT Press, Cambridge, MA

- Energy Information Administration 2001 Annual Energy Review 2000. US Department of Energy, Washington, DC

- Energy Modeling Forum 1982 World Oil. The Energy Modeling Forum, Stanford University, Stanford, CA

- Federal Energy Administration 1974 Project Independence Report. US Federal Energy Administration, Washington, DC

- Gately D 1984 A ten-year retrospective on OPEC and the world oil market. Journal of Economic Literature 22(3): 1100–14

- Grey L C 1914 Rent under the assumption of exhaustibility. Quarterly Journal of Economics 28: 466–89

- Griffin J M, Steele H B 1986 Energy Economics and Policy, 2nd edn. Academic Press, New York

- Heal G 1976 The relationship between price and extraction cost for a resource with a backstop technology. The Bell Journal of Economics 7(2): 371–8

- Hickman B G, Huntington H, Sweeney J (eds.) 1987 Macroeconomic Impacts of Energy Shocks. North-Holland, Amsterdam

- Hotelling H 1931 The economics of exhaustible resources. Journal of Political Economy 39: 137–75

- Hudson E A, Jorgenson D W 1974 US energy policy and economic growth: 1975–2000. The Bell Journal of Economics 5: 463–514

- Kneese A V, Sweeney J L 1993 (eds.) Handbook of Natural Resource and Energy Economics. Elsevier Science Publishers, Amsterdam, Vol. III

- Nordhaus W D 1994 Managing the Global Commons: The Economics of Climate Change. MIT Press, Cambridge, MA

- Slade M E 1982 Trends in natural resource commodity prices: An analysis of the time domain. Journal of Environmental Economics and Management 9: 122–37

- Solow R M 1974 The economics of resources or the resources of economics. Papers and Proceedings. Richard T Ely Lecture. American Economic Review

- Sweeney J L 1977 Economics of depletable resources: Market forces and intertemporal bias. Review of Economic Studies February: 125–41

- Sweeney J L 1984 The response of energy demand to higher prices: What have we learned? American Economic Review 74(2): 31–7

- Taylor L D 1975 The demand for electricity: A survey. The Bell Journal of Economics 6: 74–110

- Weyant J 1993 Costs of reducing global carbon emissions. Journal of Economic Perspectives 7(1): 27–46