Sample Housing Economics Research Paper. Browse other research paper examples and check the list of research paper topics for more inspiration. If you need a research paper written according to all the academic standards, you can always turn to our experienced writers for help. This is how your paper can get an A! Feel free to contact our custom research paper writing service for professional assistance. We offer high-quality assignments for reasonable rates.

Housing has a set of characteristics which together make it different from all other commodities.

Academic Writing, Editing, Proofreading, And Problem Solving Services

Get 10% OFF with 24START discount code

(a) Necessity: Housing satisfies a basic human need, shelter.

(b) Importance: Most households spend more on housing than on any other class of commodity.

(c) Spatial fixity: Most housing units are rooted to a particular location. Living in a particular housing unit, a household therefore consumes not only the characteristics of the housing unit per se, but also the characteristics of its location—its neighbors and neighborhood, its accessibility to other locations, its taxes and public services, and its locational amenities and disamenities.

(d) Durability: Housing is the most durable of major commodities. If built soundly and maintained well, a housing unit will last virtually indefinitely.

(e) Heterogeneity and complexity: To describe a housing unit reasonably accurately requires enumerating very many characteristics (complexity). Also, housing units exhibit considerable heterogeneity in characteristics, and households considerable heterogeneity in tastes.

(f ) Housing as an asset: Because housing is durable and the expenditure share on housing high, the housing stock constitutes a substantial proportion of a nation’s wealth and of most households’ portfolios. The demand for housing therefore combines consumption and asset motives.

(g) Housing and the macroeconomy: Since housing is durable, modest fluctuations in housing demand translate into large fluctuations in housing investment. Due to the importance and volatility of housing investment and the magnitude of the wealth effects generated by movements in housing values, the performance of the housing market has a major impact on the macroeconomy.

The interactions of these characteristics cause the economics of housing to be significantly different from the economics of other commodities. Section 2 will examine the supply of housing and Sect. 3 the demand. Section 4 will discuss how supply and demand interact to determine equilibrium in the housing market. Section 5 will look at the housing market from the perspective of real estate economics. Section 6 will consider the role of government with respect to housing.

1. Housing Supply

Before discussing how housing is supplied, a quantifiable definition of ‘housing’ is needed. The appropriate definition depends on context. In some contexts, highly aggregated definitions that ignore housing heterogeneity—the number of units or total floor area—are most useful. In other contexts, each housing unit is usefully viewed as a bundle of many characteristics. In yet other contexts, intermediate levels of aggregation are most helpful. The definition employed strongly influences the way the market is conceptualized and housing supply and demand described.

Most housing economics is conducted at a high level of aggregation. A nation’s monetary authority is interested in the value of the nation’s housing stock and the level of housing investment, not in where housing units are located within cities or how many units have two bedrooms. Similarly, the government’s housing ministry is principally concerned with housing affordability, crowding, sanitary facilities, and structural soundness, and not in how many units have fireplaces.

At the highest level of aggregation, a housing unit is described simply by the flow of housing services it provides, which can be measured by its rent. Holding its characteristics fixed, an increase in the unit’s rent corresponds to a rise in the price of housing services. A housing supply curve may then be defined relating the units of housing services supplied to the price of housing services. Because housing is durable, the elasticity of the housing services supply curve depends on the time horizon. Within, say, a month, the housing supply curve is almost vertical; little can be done beyond maintenance to increase the quantity of housing services supplied. As the time horizon increases, the housing services supply curve becomes increasingly elastic; within six months, a rise in the price of housing services will induce some rehabilitation; within a year, some new housing will be constructed; etc.

In many situations, the analyst is concerned with the interaction between particular housing submarkets. For example, the government might be interested in the effects of a subsidy on owner-occupied housing. To analyze this policy, the housing market would be divided into owner-occupied and rental submarkets. The two submarkets would interact on both the supply (the subsidy would encourage the conversion of housing from rental to owner occupancy) and demand (the subsidy-induced fall in the consumer price of owner-occupied housing services would cause a decrease in rental housing demand) sides. Other divisions of the housing market into submarkets are appropriate in other contexts. If the government is concerned with the living standards of the poor, the housing market is usefully divided into quality submarkets; if it is concerned with downtown revitalization, a division into downtown and suburban submarkets is suitable; etc.

The discussion thus far has treated the supply for housing services—a flow. Lurking in the background is the supply of housing stock. The two are related through the user cost of capital, which is the ratio of the annualized cost of employing a unit of capital to its supply price, and equals the interest rate plus the rate of depreciation plus the maintenance cost rate plus the effective tax rate on capital less the rate of capital gain.

In the short run, rent adjusts to clear the market for housing services. This translates, via the user cost of capital, into the equilibrium asset price or market value of housing. If this exceeds construction cost, new construction is triggered, which increases the supply of housing stock and of housing services, causing rent to fall. This process continues until a long-run equilibrium is attained where the market-clearing rent equals construction cost times the user cost of capital. The above conceptualization of the housing market is especially well-suited for aggregate analysis. The remainder of the section reviews several alternative conceptualizations, each of which has its particular domain of application.

The focus of the Mills–Muth model (see Mills (1972) and Muth (1961, 1969), and Brueckner (1986) for an integrative treatment) is on urban spatial structure— how housing density (the ratio of floor to land area), housing rent, and land rent vary with location. Ignore the spatial fixity and durability of structures, so that static analysis can be applied. A landowner adds capital to his land until marginal cost equals marginal revenue. Under competition land rent equals the corresponding producer’s surplus. This analysis relates land rent and housing density to housing rent at a particular location. Now turn to the market. Housing rents adjust so that in equilibrium at each location the quantity of housing supplied equals the quantity demanded, with more attractive and accessible locations commanding higher rents. Then from the relationship between housing rent and housing density, the equilibrium urban spatial structure is obtained.

The Mills–Muth model ignores the durability of structures. A related class of models, reviewed in Brueckner (2000), examines the spatial structure of a growing city, accounting for durability. A developer who owns vacant land then faces the decision of when to build as well as at what density. The relationship between predevelopment land value and post-development housing value and density can be straightforwardly derived. Normally vacant land is developed from the center outwards. Subsequently, there are successive waves of redevelopment. Each wave entails construction at higher density with the time between waves depending on the city’s growth rate. This process is evident in some cities but in others has been curtailed by redevelopment restrictions.

The Mills–Muth model and dynamic durable housing models treat location, housing density, and unit size. Housing units also differ in quality. If two housing units of the same size at the same location command different rents, the higher-rent unit is presumably of higher quality. Since the poor typically live in low-quality housing, quality differentiation is particularly important to consider when evaluating policies aimed at improving low-income housing. Models of housing quality differentiation examine the filtering process (Grigsby (1963)). An urban location goes through a life cycle. Housing is of high quality when constructed but depreciates with age, and as it does so is occupied by successively poorer households. Eventually, rehabilitation renovation or redevelopment of the site at higher density becomes profitable, and the cycle repeats. Since the typical neighborhood was initially developed in a short time span, the filtering process gives rise to neighborhood cycles too.

More recent filtering models (Sweeney (1974), Arnott et al. (1983), and Rothenberg et al. (1991)) view the housing market as a hierarchy or continuum of quality-differentiated submarkets. At any instant, the housing market is described by the housing stock at the various qualities. Rent as a function of quality adjusts to clear the market. Construction occurs at those qualities where housing value equals or exceeds construction costs. Maintenance is carried to the point where the last dollar spent increases housing value by one dollar, and a housing unit’s price is the present discounted value of rent less maintenance expenditures. These models can be enriched to treat land, as well as housing differentiation by unit size, location, and density (Anas and Arnott (1991).

Filtering models provide a strong conceptual basis for policy analysis and are intuitively appealing, accommodating all the standard housing conversion processes—construction, maintenance, rehabilitation, upward and downward conversion (combining and subdividing housing units), abandonment, and demolition and reconstruction. Despite their popularity among academic housing economists, filtering models have not yet been widely adopted by the housing policy community.

Working with detailed descriptions of housing units is normally distracting, but in measurement is essential. The minister of housing may be uninterested in whether the poor have fireplaces (as long as they receive heat), but will be interested in whether the average quality of low-income housing has increased. This requires obtaining a quality index, an aggregate of many housing characteristics—including fireplaces. Investors, housing policy analysts, and macroeconomists are all concerned with the time trend of housing prices, which requires developing price indices. And for property tax purposes, housing values need to be estimated accurately, which necessitates detailed description. Hedonic analysis utilizes such detailed description. The market values (or rents) of housing units are regressed against a long list of their characteristics (including public services, neighborhood and neighbor characteristics, accessibility measures, and environmental variables). The regression coefficients are interpreted as implicit market prices for characteristics (Rosen (1974)). Hedonic analysis has proved very useful not only in housing valuation and housing price and quality index construction, but also in inferring the market’s valuation of various neighborhood characteristics, public services, air quality, etc. But the implicit conceptualization it employs—separate markets for each of hundreds of housing characteristics—is unwieldy for most housing policy analysis.

Industry studies focus on market organization—industry concentration and the form of strategic interaction between firms. The conventional wisdom that the housing market is competitive or monopolistically competitive, while inadequately researched, appears sound.

2. Housing Demand

The previous section indicated that how housing supply is described depends on how housing is conceptualized. The same is true of housing demand. Most housing demand studies employ the housing services conceptualization. Accordingly, there is a vast empirical literature estimating the income and price elasticities of demand for housing services. Excellent reviews are provided in Goodman (1996) and Olsen (1986). Muth, whose classic Cities and Housing (1969) provides the foundation of modern housing analysis, has argued that since the housing expenditure share has shown remarkable stability over time and location—about 25 percent of after-tax income—the longrun price and income elasticities of housing must be close to unity. Most empirical studies, however, estimate significantly lower price and income elasticities. How can the results of these empirical studies be reconciled with Muth’s observation?

The literature has concentrated on four classes of explanations.

(a) With high moving costs (including psychic costs), a household does not instantaneously change its housing when its income or the price of housing changes; rather, housing decisions are long-term. This explains why experiments investigating how households alter their housing consumption under temporary rent subsidies have found a generally price-inelastic response. Relatedly, the demand for housing should depend more on permanent than on transitory income.

(b) That many moves are triggered by demographic change (e.g., marriage, births, retirement, and divorce) makes it more difficult to identify the economic determinants of housing choice.

(c) Tenure choice with borrowing constraints (e.g., Jones (1993), Ortalo-Magne and Rady (1999)). The typical household starts its lifecycle by renting, often under-consuming housing to save up for a down payment. Having saved up enough, it moves into a starter home, aiming to trade up when it can afford to. The timing of these moves depends on the realization of the household’s uncertain income prospects and demographic changes and on the evolution of housing prices, interest rates, and down-payment requirements.

(d) The asset or portfolio demand for housing. When deciding how expensive a home to buy, a household considers how much housing it would like to include in its wealth portfolio. A household’s demand for owner-occupied housing achieves a balance between its consumption and portfolio demands. Households adjust the discrepancy between these demands through tenure choice, customization and furnishing (Henderson and Ioannides (1983)). A household whose asset demand exceeds its consumption demand may purchase a large home but spend little on decoration, or may purchase additional housing units and rent them out. A household whose asset demand falls short of its consumption demand may choose either to own a cheaper house and decorate it nicely or to rent.

Estimating price and income elasticities accounting for all these complications, as well as the tax treatment of housing, is indeed a daunting task. Despite these difficulties, considerable progress has been made in the empirical analysis of housing demand, reflecting advances in data collection, computing power, applied econometrics, and housing economic theory, and the use of controlled experimentation. Regrettably, however, little work has been done on estimating filtering models (Rothenberg et al. (1991) is a notable exception), which has impeded their use in policy analysis.

3. Housing Allocation And Markets

Throughout history, most consumer goods have been allocated through markets. The twentieth century witnessed a sharp rise in the size and scope of government. The communist countries adopted central planning, which entailed government construction, operation, and direct allocation of housing. Elsewhere too, government intervention in the housing sector increased. The pendulum has started to swing in the opposite direction, but by historical standards government intervention in the housing sector remains high. Even in the United States, with the most free market of western economies, much low-income housing continues to be allocated outside the market, and the allocation of market housing to be deliberately influenced by a myriad of government policies.

Why have governments everywhere doubted the ability of markets to allocate housing? Textbooks in microeconomic theory give a standard list of (classic) market failures or inefficiencies—public goods, natural monopoly, and technological externalities. None is important in the context of housing. The primary motive for extensive government intervention vis-a-vis housing has rather been to improve equity. Some believe that the income distribution generated by the free market is just but most do not. How then is equity to be achieved within a generally market-oriented economy? There are two broad approaches. One is income redistribution, general egalitarianism; the other is effective redistribution through the taxation subsidization or nonmarket allocation of specific commodities, specific egalitarianism. Most economists favor general egalitarianism because it respects consumer sovereignty. But most governments evidently favor specific egalitarianism. They—and the person on the street—feel that the consumption of some goods (basic housing, clothing, food, education, and medical care) is more meritorious than others (alcohol, cigarettes, drugs, and luxuries). Many governments have favored the nonmarket allocation of housing over subsidization, because it permits more refined targeting and is administratively simpler. There has been remarkably little modern economic analysis of nonmarket housing allocation (Anas and Cho (1988) is a notable exception). The rest of the section will therefore consider market allocation under competition.

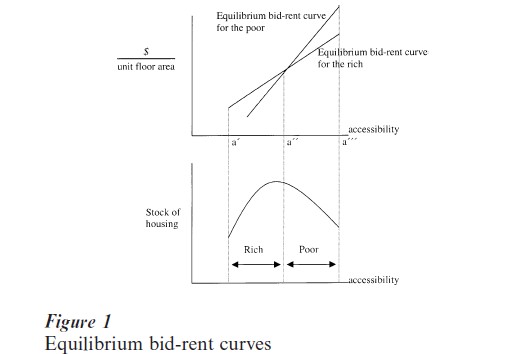

The relevant economic theory was developed by Alonso (1964). He asked: How does the market determine the pattern of household location within a city? Suppose that there are two household groups, rich and poor, that each household derives utility from only other goods and housing floor area, and that locations differ only in accessibility. In equilibrium, all rich households achieve the same utility level, R. Associated with this utility level is the equilibrium housing bid-rent curve for the rich, which indicates the housing rent (per unit floor area) payable by the rich at different locations consistent with this utility level. Similarly, in equilibrium, all poor households achieve the same utility level, P, associated with which is their equilibrium housing bid-rent curve.

Two basic principles apply: (a) A housing unit goes to whomever bids the most for it; and (b) rent equals the bid rent of whomever bids the most for it. The top panel of Fig. 1 plots the equilibrium bid-rent curves for the two groups as a function of accessibility, a. Applying the two principles implies that housing between accessibility levels a and a goes to the rich and that between a and a to the poor, and that housing rent as a function of accessibility is given by the ‘upper envelope’ of the equilibrium bid-rent curves. The lower panel of the figure shows the stock of housing available at different accessibility levels. The equilibrium utility levels are determined by the conditions that, for each group, the quantity of housing demanded equals the quantity of housing supplied. The slope of a group’s housing bid-rent curve is the premium that group is willing to pay for improved accessibility. As drawn, the poor outbid the rich at more accessible locations because they are willing to pay a higher premium per unit floor area for improved accessibility. This result has been used in explaining the post-World-War-II suburbanization of wealthier US households.

The accessibility-rent tradeoff is central in determining the pattern of household location. The above analysis can be extended to treat other factors, such as the relative value different groups attach to amenities, disamenities, public services, and neighborhood composition. Each group has an equilibrium bid-rent surface over all locations within the metropolitan area, and lives where it outbids all other groups. Groups may differ not only in income but also in demographic status, race, job location, etc. Extending the analysis to account for taste heterogeneity within groups yields the probabilities that a particular location is occupied by a household in a particular group. The same competitive allocation mechanism operates with respect to other housing attributes. A household group occupies housing of a particular quality, for example, if it outbids all other household groups.

The asset value of a housing unit is the discounted present value of expected future rents minus expected costs, adjusted for uncertainty. The volume of construction depends on profitability, as measured by asset price minus supply price; similarly, the volume of rehabilitation depends on the gain in asset price through rehabilitation minus the cost; and maintenance expenditure depends on how steeply housing value rises with quality.

The above discussion indicates how a perfectly competitive housing market works. In actual housing markets, housing units and households exhibit multidimensional heterogeneity. To find a unit that suits its tastes, a household undertakes costly search over vacant units. The friction of search confers market power on landlords, who are consequently pricesetters rather than price-takers. With entry and exit close to free, actual housing markets are therefore more accurately described as monopolistically competitive, with excess capacity taking the form of vacant units. Furthermore, housing markets are matching markets, with market tightness (the ratio of searching households to vacant units) playing an important role in the market adjustment process (Anglin and Arnott (1999)). Down-payment requirements on mortgages and credit restrictions on developers also significantly affect the market’s operation.

Whether the gain in accuracy from treating the housing market as monopolistically rather than perfectly competitive justifies the increased analytical complexity is an empirical issue and depends on context. Normally little is sacrificed in using perfectly competitive models to analyze the positive effects of specific housing policies. But imperfectly competitive models should be used to provide microfoundations for housing macroeconomics since nonprice adjustment is important, and to evaluate welfare changes from housing policies.

In the frictionless world of perfect competition, and without taxes, a household would be indifferent between renting and owning. That tenure choice is in fact important indicates that it should be considered from the perspective of imperfect competition. Though often treated in the context of housing demand, tenure choice is an aspect of market equilibrium since it concerns the contractual form through which housing services are exchanged. Rental and single-family owner occupancy are the most common contractual forms; others include condominium ownership (under which common areas are jointly owned) and cooperative ownership (under which a resident is essentially a shareholder in the building).

4. Real Estate Economics

Real estate economics is superbly surveyed in DiPasquale and Wheaton (1996). How does residential real estate economics differ from traditional housing economics? Both are concerned with the housing sector, but real estate economics regards it from an investment perspective, housing economics from a policy perspective. At the beginning of the twenty-first century much of the best research on the economics of housing is being done under the rubric of real estate economics.

One important development has been the extension of real estate investment theory to treat uncertainty satisfactorily. Because real estate investment decisions are made under uncertainty and are largely irreversible, they are usefully viewed as the exercise of real options (Titman (1985), Capozza and Li (1994)), to which the theories of options valuation and irreversible investment can be applied.

Most housing economics is microeconomics applied to the housing sector. But housing macroeconomics is important too. Housing macroeconomics is concerned with the relationships between housing macroeconomic variables (stock, starts, completions, vacancy rates, average rents, etc.), and with how fluctuations in economy-wide variables affect the housing sector, and vice versa. Most large-scale macroeconomic forecasting models of the 1960s contained a housing module. After a period of inactivity, housing macroeconomics has reappeared on the research agenda—in real estate economics, as the study of residential real estate cycles. Current work (e.g. Stein (1995)), and DiPasquale and Wheaton (1996)) suggests that the amplitude of fluctuations in residential real estate values and investment is sensitive to the severity of borrowing constraints and the form of expectations.

Real estate economists have also explored the interlink ages between the real and financial sides of residential real estate markets, and the design of optimal contracts, considering incentive, selection, and risk-sharing effects, between banks and borrowers, developers and contractors, landlord and tenants, and between the sellers and buyers of houses and real estate agents.

5. Housing Policy

Housing policy debates tend to pit economists against planners. The divisions between the two groups are social philosophical. Since economists value individual freedom to choose, they hesitate more than planners in imposing their vision of the good life on others. Also, economists generally emphasize efficiency and believe it is best achieved via markets, with government enforcing property rights and intervening minimally to mitigate market failure, while planners tend to be suspicious of markets and to object to the inequities and apparent disorder they generate. For all these reasons, planners almost invariably favor more government intervention than do economists.

The planner’s view dominated housing policy in western Europe from the 1920s through to the 1980s, especially in the Scandinavian countries where housing markets were largely supplanted by government allocation. The objective of decent and affordable housing for all was largely achieved, but at the cost of considerable inefficiency. During the last decade, these countries have been dismantling the Byzantine allocative and regulatory structures which had evolved, and moving to increasingly free housing markets. Thus, the economist’s view is currently in the ascendancy.

Economists’ belief in the efficiency of markets is at least well-reasoned. Two central results in microeconomic theory are the First Theorem of Welfare Economics, which states that under perfect competition a market equilibrium is efficient, and the Second Theorem, which states that (under convexity conditions) any efficient allocation can be achieved as a competitive equilibrium with appropriate lump-sum redistribution. If, therefore, an economy satisfies the Theorems’ conditions, efficiency and equity can be simultaneously achieved if the government only enforces property rights and redistributes income appropriately, leaving everything else for markets to do, and almost all government intervention in the housing sector is harmful. Whether real world economies come close to satisfying the Theorems’ conditions is clearly crucial in determining the appropriate role of government in housing provision, and therefore needs to be considered very carefully.

In the 1960s most neoclassical economists believed that, since buyers and sellers are many and entry and exit free, housing markets are almost perfectly competitive. Most housing economists in the late twentieth century would disagree. Housing markets have many characteristics which violate the assumptions of perfect competition: housing is a heterogeneous good; transactions costs are important; asymmetric information is endemic; and insurance and futures markets in housing are highly incomplete. As well, because the government cannot observe an individual’s ‘need’ but must instead infer it from a signal (e.g., income) which she can manipulate, all redistributive policies are distortionary. Equity is then most efficiently achieved through a portfolio of policies, including perhaps housing assistance for the poor. Since the optimal portfolio is sensitive to details of the economic environment, housing economists nowadays tend to base their policy advice as much on the results of controlled experiments and empirical studies as on a priori reasoning. While consideration of market imperfections expands the scope of potentially ameliorative government intervention, the political economy literature warns that government, too, is highly imperfect.

Government withdrawal from the housing sector has been especially pronounced in direct housing provision. The current view is that low-income housing projects were a mistake. They led to the alienation and ghettoization of the poor, and were excessively costly (since it is efficient for the poor to live in filtereddown housing). Low-income housing policy in the United States today encourages household mixing by race, ethnicity, and income, through subsidizing the nonpoor to live in the projects and the poor to move into middle-income neighborhoods. Other countries are experimenting with selling project units for owner occupancy.

A classic debate in housing economic policy is whether intervention is more effective on the demand or supply side of the market. Generally speaking, housing demand policies can achieve better targeting, but may drive up rents in the short run until the lagged supply response kicks in.

Virtually all housing policies apply to either rental or owner-occupied housing but not both. Most policy makers encourage homeownership, believing it to foster social behavior, civic responsibility, and commitment to neighborhood. The empirical evidence is, however, weak since controlling for the effect that responsible and well-functioning households are more likely to choose homeownership is difficult. Homeownership is encouraged through subsidized and guaranteed mort- gages, mortgage interest deductibility under the income tax, tax inducements for first-time homeownership, and subsidies for home improvements.

There are several other elements common to the housing policy debate in most countries.

(a) Rent control: (reviewed in Arnott (1995)) Economists have been virtually unanimous in their opposition to traditional (now termed ‘first-generation’) rent controls, which impose ceilings on rents below market- clearing levels. Almost all jurisdictions which have had first-generation rent controls have either dismantled them or replaced them with second-generation pro-grams which stress tenant security rather than rent reduction.

(b) Tax policy: Most countries use tax policies to achieve housing policy goals.

(c) Eviction rights vs. security of tenure: The nature of the landlord-tenant relationship bears the seeds of conflict. Policy concerning eviction for nonpayment of rent entails a classic tradeoff between risk sharing and incentives. Predictably, relative to the United States, European jurisdictions favor the tenant.

(d) Zoning, building codes, and density and height restrictions: These significantly affect the spatial pattern of rents and hence household location by income-demographic group. In many cities, height and redevelopment restrictions have forced up downtown property values, driving many poor households previously resident there to surrounding locations. Also, affluent North American suburbs have used minimum lot size zoning and other regulations to exclude the poor.

(e) Antidiscrimination: Housing audits have been used in the United States to identify discrimination. A pair of individuals, one of whom belongs to a potentially discriminated-against group, are paid to pose as prospective tenants or prospective homebuyers and are given the same resume; differences in their treatment are then attributed to discrimination. Also, recent empirical research has attempted to identify discrimination by banks in mortgage lending.

(f) Homelessness: In most western countries, homelessness is now a very visible housing problem. While many causes are sociological—the weakened bonds of family and community, higher mobility, deinstitutionalization of the mentally ill, and increased drug use—economic causes are important too (O’Flaherty (1996)). The withdrawal of governments from the housing sector has caused low-quality housing rents in many cities to rise so much that homelessness is a rational response for some very low-income individuals and households.

Bibliography:

- Alonso W 1964 Location and Land Use: Towards a General Theory of Rent. Harvard University Press, Cambridge, MA

- Anas A, Arnott R 1991 Dynamic housing market equilibrium with taste heterogeneity, idiosyncratic perfect foresight and stock conversions. Journal of Housing Economics 1: 2–32

- Anas A, Cho J R 1988 A dynamic, policy-oriented model of the regulated housing market: the Swedish proto-type. The Review of Economic Studies with Regional Science and Urban Economics 18: 201–231

- Anglin P, Arnott R 1999 Are brokers’ commission rates on home sales too high? A conceptual analysis. Regional Science and Urban Economics 27: 719–749

- Arnott R 1995 Time for revisionism on rent control? Journal of Economic Perspectives 9: 99–120

- Arnott R, Davidson R, Pines D 1982 Housing quality, maintenance, and rehabilitation. The Review of Economic Studies 50: 467–494

- Brueckner J K 1986 The structure of urban equilibria: A unified treatment of the Muth–Mills model. In: Mills E S (ed.) Handbook of Regional and Urban Economics, Vol. 2, Chapter 20. North-Holland, Amsterdam, The Netherlands

- Brueckner J K 2000 Urban growth models with durable housing: An overview. In: Huriot J M, Thisse J F (eds.) Economics of Cities: Theoretical Perspectives. Cambridge University Press, Cambridge

- Capozza D, Li Y 1994 The intensity and timing of investment: the case of land. American Economic Review 84: 889–940

- DiPasquale D, Wheaton W C 1996 Urban Economics and Real Estate Markets. Prentice Hall, Englewood Cliffs, NJ

- Goodman A C 1996 Topics in empirical urban housing research. In: Arnott R (ed.) Encyclopedia of Economics, Vol. 1, Harwood, Amsterdam, The Netherlands

- Grigsby W G 1963 Housing Markets and Public Policy. University of Pennsylvania Press, Philadelphia, PA

- Henderson J V, Ioannides Y 1983 A model of housing tenure choice. American Economic Review 73: 98–113

- Jones L 1993 The demand for home mortgage debt. Journal of Urban Economics 33: 10–28

- Mills E S 1972 Studies in the Structure of the Urban Economy. The Johns Hopkins University Press, Baltimore, MD

- Muth R 1961 Economic change and rural—urban land conversion. Econometrica 29: 1–23

- Muth R F 1969 Cities and Housing. University of Chicago Press, Chicago

- Oates W E 1972 Fiscal Federalism. Harcourt Brace Jovanovich, New York

- O’Flaherty B 1996 Making Room. Harvard University Press, Cambridge, MA

- Olsen E O 1986 The demand and supply of housing service: A critical survey of the empirical literature. Handbook of Regional and Urban Economics, Vol. 2, Chapter 25

- Ortalo-Magne F, Rady S 1999 Boom in, bust out: Young households and the housing price cycle. European Economic Review 43: 755–66

- Rosen S 1974 Hedonic prices and implicit markets. Journal of Political Economy 82: 35–55

- Rothenberg J, Galster G C, Butler R V, Pitkin J 1991 The Maze of Urban Housing Markets. University of Chicago Press, Chicago

- Stein J C 1995 Prices and trading volume in the housing market: a model with down-payment eff Quarterly Journal of Economics 110: 379–406

- Sweeney J L 1974 A commodity hierarchy model of the rental housing market. Journal of Urban Economics 1: 288–323

- Titman S 1985 Urban land prices under uncertainty. American Economic Review 75: 505–14