View sample Organizational Crisis Management Research Paper. Browse research paper examples for more inspiration. If you need a management research paper written according to all the academic standards, you can always turn to our experienced writers for help. This is how your paper can get an A! Feel free to contact our writing service for professional assistance. We offer high-quality assignments for reasonable rates.

The financial scandals of the new millennium, as well as stories of how businesses suffered in the devastating aftermaths of the September 11, 2001, terrorist attacks and the Gulf Coast hurricanes, have created a renewed interest in organizational crises and their management. Images of the crooked “E” sign being removed from Enron’s headquarters in Houston, Jimmy Dunne’s determined face on CNBC when he announced that Sandler O’Neill and Partners would remain in business despite the World Trade Center attacks, and the flooded businesses in the French Quarter of New Orleans have become poignant reminders that powerful events can overwhelm the resources of today’s organizations. They can cause loss of life, loss of physical assets, loss of employment, loss of revenues, and loss of shareholder equity.

Academic Writing, Editing, Proofreading, And Problem Solving Services

Get 10% OFF with 24START discount code

In a survey of 114 Fortune 1,000 companies, Ian Mitroff, Terry Pauchant, and Paul Shrivastava (1989) estimated that large U.S. corporations face 10 crises a year. The frequency of crises is increasing because organizations operating in domestic and international markets have become interconnected so that negative events affecting one company can have a domino effect on its suppliers, creditors, and distributors; business environments are becoming more and more turbulent; and complex, high-risk technologies that can be potentially harmful, are being used. The capabilities of organizations to effectively handle a crisis, unfortunately, have not kept up with the new realities. In a longitudinal study by the Center for Crisis Management at the University of Southern California, Ian Mitroff and Murat Alpaslan (2003) revealed that three out of four Fortune 500 corporations are prepared to handle only the types of calamities that they have encountered in the past.

The purpose of this research-paper is to survey the literature on organizational crisis and crisis management. It offers a definition of organizational crisis, reviews conceptual models of organizational crisis, and describes different types of crises affecting businesses. It summarizes several approaches to crisis management and suggests that managers in the future may be best served by new strategies which require broad, abstract thinking as well as specialized, technical knowledge; continual assessment of external threats and internal vulnerabilities; the creation of a crisis center; mobilization of experts with multiple and diverse perspectives from inside and outside the organization; and joint problem solving with community leaders and government officials.

A Definition Of Organizational Crisis

Organizational crisis is a difficult concept to define. Consensus among researchers on a definition has been illusive for a number of reasons. First, contributions to crisis theory have been made by researchers coming from multiple disciplines. In psychology, for example, a crisis is defined as “an acute disruption of psychological homeostasis in which one’s usual coping mechanisms fail and there exists evidence of distress and functional impairment” (Yeager & Roberts, 2003, p. 6). In political science, a crisis consists of a “breakpoint along the peace/war continuum of a state’s relations with any other international actor” (Brecher & Wilkenfeld, 1982, pp. 382-383). In health care, a crisis is conceived of as a “transition for better or worse in the course of a disease, usually indicated by a marked change in the intensity of signs and symptoms” (Anderson, Anderson, & Glanze, 1998, p. 2371). Each researcher approaches the topic with his or her own units of analysis, lenses, tools, and biases.

Examples of Recent Organizational Crises

Organization: Tulane University

Precipitating Event: Hurricane Katrina hit the New Orleans area on August 27, 2005. The hurricane killed 1,323 individuals and displaced over 400,000 people. It shut down 71,000 businesses, with some of them never to reopen. Property damages reached $25 billion.

Impact: Tulane University incurred structural damage of $250 million and operating losses of $100 million. Two thirds of its campus was flooded. It cancelled its Fall 2005 semester and deployed its students to 595 different campuses across the country. Moody’s Investors Services predicted that the university could run out of cash by April 2006, if students did not return.

Predisaster preparations: Tulane had an emergency plan that had been tested several times. It called for a campus wide evacuation in the event of a category 3, 4, or 5 storm. The plan did not, however, consider the possibility of catastrophic dam-age or the shutting down of facilities for an extended period of time. The plan called for several senior administrators to stay on campus to ride out the storm. This turned out to be a mistake. Administrators were stranded for four days without food, utilities, or means of communication. immediate crisis

Responses: Students, who had just arrived on campus to start a new semester, were evacuated ahead of time by buses and cars to a gym at Jackson State University in Mississippi. When power failed at the gym, they traveled to airports in Dallas and Atlanta. A recovery team of administrators was soon assembled in Houston. The team set up an emergency Web site to communicate with students and faculty. David Pilo, an alumnus and cofounder of Yahoo, donated manpower and Web-hosting resources. With the help of police officers, employees retrieved IT files from a downtown New Orleans building. Other universities agreed to accept Tulane students for one semester. Tulane kept their first semester tuition. A $150 million loan was obtained to hire a firm to repair the damaged campus.

Intermediate crisis responses: Fund-raising activities began with the goal of $25 million by June 2006. A cruise ship was rented for use as a dormitory. $1.5 million was spent to charter a local school for the children of Tulane faculty. 243 full-time staff members were laid off.

Long-Term Strategic changes: Tulane’s president, Scott Cowen, assembled a planning board which included the president of John Hopkins University and consultants from PriceWaterhouseCoopers. The medical school was downsized (clinical work was discontinued; faculty and staff were cut by 40%). A decision was made to focus on undergraduate education (PhD programs in English, Law, Economics, and Social Work were eliminated). Several undergraduate Engineering majors (including civil and environmental engineering) were dropped. Eight of 16 athletic programs (including men’s track, women’s swimming, and men’s cross-country) were cut.

Sources: Cowen (2006) and Reingold (2006).”

Organization: Sandler O’Neill & Partners

Precipitating event: The September 11 terrorist attacks on the twin towers of the World Trade Center resulted in the death of 2,749 people; the destruction of the offices of over 430 businesses from 26 countries; and the demolition of 75 stores, restaurants, and service outlets in the underground mall. Total losses were expected to reach as much as $90 billion.

Impact: Sandler O’Neill’s headquarters were located on the 104th floor of the South Tower of the World Trade Center. It lost 66 out of its 171 employees including its cofounder and senior managing partner, Herman Sandler and investmentbanking head, Chris Quackenbush. All of the firm’s bond traders were killed (buying and selling bonds generated 40% of total revenues). Twenty out of 24 employees who worked on the equity desk were killed. The two employees who ran the syndicate desk were killed.

At the time of the attack, most employees felt that they would be safer remaining inside the building than trying to leave. They learned from a prior experience. Those who fled after the 1993 basement bombing of the World Trade Center were either engulfed in smoke in the staircases or stranded on the roof in the cold for hours.

Immediate crisis responses: Recovery efforts became the responsibility of James Dunne, the firm’s sole surviving senior partner, who had been playing golf the day of the attacks. His first concern was with the families of the victims. He made sure that at least one of Sandler’s 22 partners would attend each of the 66 funerals. He sent every family a check to cover the rest of the year’s salary of the deceased employee. He set up a charity fund, hired grief counselors and extended the health care benefits for the families for five years. He arranged for year end bonuses to be paid to the victims’ relatives.

Dunne created a new executive team through reappointments. The head of the bond desk became a managing partner responsible for day-to-day operations and the co-head of research became the new chief operating officer. He formed an outside advisory committee comprised of golfing friends who were also high-level investment bankers. Employees moved into temporary midtown office space donated by Bank of America. Although all records were destroyed, employees were able to get in touch with their clients because one staff member had all their telephone numbers memorized. Employees continued to close deals. Competitors offered their help. They provided employees with daily market information, taught them how to run a syndicate desk, and gave them commissions for joining them in deals.

Intermediate crisis responses: The firm began to hire new employees, adding 77 by September 2002. It was able to attract highly qualified individuals that other Wall Street firms had laid off. It rebuilt its information technology infrastructure. It moved into its own office space on a low floor at 919 Third Avenue in midtown Manhattan. In 2002, Sandler O’Neill rose to 8th place from 16th place in 2001 in a ranking of financial institutions.

Long-Term Strategic changes: Sandler O’Neill continued to grow. It moved into new areas of research (foreign banking and the broker-dealer sector). It created a Community Reinvestment Act advisory division. It became more active in merger and acquisition advising.

Sources: Brooker (2002) and Etzel (2002).

Organization: Enron Corporation

Precipitating Events: Enron was a Houston-based natural gas and electricity company which was admired for its innovative use of the Internet to trade energy contracts. In 2000, it reported revenues of $100 billion and it ranked number 7 in Fortune Magazine’s Fortune 500. It was later revealed that for a period of at least five years, high-ranking Enron executives engaged in unethical accounting practices and the mismanagement of the firm’s investments in water, telecommunications, and other utilities. Its accounting (in which it booked revenue upfront from long-term deals instead of spreading them over several years) and its off-balance sheet partnerships (in which it created special purpose entities which bought out partner stakes in joint ventures so that it could keep debt off its books) caused its profits to be overstated and its debts understated. On August 14, 2001, Jeffrey Skilling, CEO, resigned for personal reasons. Kenneth Lay, chairman, replaced Skilling as CEO. On October 16, 2001, Enron announced a quarterly loss of $638 million. Andrew Fastow, CFO, was fired. On November 8, 2001, Enron restated its financial results for the past four years (earnings declined by $591 million; debt for 2000 increased by $658 million). Its stock fell below $1 per share. On December 2, 2001, Enron filed for bankruptcy.

Impact: In the aftermath of Enron’s collapse, 2,400 other related business entities had to be closed; its workforce of 32,000 employees was dispersed; and $1 billion in retirement funds held in Enron stock was lost. Arthur Anderson, a respected accounting and consulting firm, went out of business because of the role its accountants played in the shredding of Enron documents. Banks, including Citibank and JP Morgan Chase, paid fines and settled lawsuits for their role in helping Enron finance deals. Lay, Skilling, Fastow, and other executives were convicted of fraud.

Attempts to Save the Company: The day after Skilling resigned as CEO, Sherron Watkins, an accountant and vice president, wrote a memo to Lay expressing her concerns that the company was about to implode because of its accounting practices. She advised him to hire independent legal and accounting experts to review the partnerships. Lay hired attorneys from Vinson & Elkins who had prepared the legal documents for the partnerships. Lay instructed them not to look too closely into the accounting. The lawyers concluded that the accounting was aggressive but not inappropriate. Negotiations began with Enron’s competitor, Dynergy, who initially agreed to acquire Enron for $8.9 billion. Dynergy backed out of the deal after its executives reviewed Enron’s financial statements. Lay and other executives called high-ranking government officials, including Treasury secretary, Paul O’Neill, to see if they could convince banks to extend credit to them. They refused. Thousands of Enron employees were laid off. Enron sold its trading business to UBS Warburg.

Divestiture of Enron Businesses: In January 2002, Lay resigned as CEO under pressure from creditors. Enron hired Stephen Cooper, a turnaround specialist, as interim CEO. By looking at Enron’s organization, businesses, customer base, and liquidity, Cooper felt it was a good restructuring candidate. Almost all of Enron’s businesses were sold, including Mariner Energy Incorporated, Portland General Electric Company, its North American pipeline, and Prisma Energy, until a staff of 300 employees remained. Enron would become a shell company to handle litigation until it dissolved.

Sources: Fox (2003), Healy & Palepu (2003), and Lawrence (2003).

Second, researchers are divided on whether a crisis is an objective or subjective phenomenon. Some argue that crises have objective properties. It is possible to identify the onslaught and start of a crisis; the chaotic midway phase in which employees suffer from shock, denial, and panic; and the resolution period when the crisis subsides and the organization recovers. A crisis also involves a tangible threat (e.g., a major food poisoning outbreak in a hotel chain; a steep drop in world coffee prices and its impact on small coffee-bean growers; a powerful hurricane which destroys the headquarters of a specialty insurance company). Other researchers argue that crises exist predominantly in the minds of key decision makers. Leaders may create crises when they are nonexistent in order to further their own political agendas. When employees in an organization become complacent, managers try to create a sense or urgency by pointing to a threatening move of a competitor or by publicizing the results of an unfavorable customer-satisfaction survey. The underlying motive is to stimulate creative thinking and action. Managers may sometimes call a crisis a “minor blip” resulting from a “slight miscalculation” in order to avoid blame and to stay in power for as long as possible. Dawn Stover (2004), for example, reported that the National Aeronautics and Space Administration (NASA) labeled the breakup of the Space Shuttle Columbia a “mishap” because the term is blame-neutral, suggesting bad luck rather than human error.

Third, a few researchers have argued that the search for a common definition of organizational crisis is not only futile but also wrong. Ian Mitroff, Murat Alpaslan, and Sandy Green (2004) contended that crises are ill-structured problems and that any attempt to develop common terms violates the ambiguous and complex nature of such problems. Crises,

in other words, defy definition. The best managers can do is to use a systems model of scientific inquiry which involves threat sensing, crisis assessment, crisis capabilities, and damage containment. Once these activities have been completed, managers return to the threat sensing step to determine if the danger has passed. If not, the cycle is repeated.

Progress on a definition of crisis in the management literature was made in 1998. Christine Pearson and Judith Clair (1998) proposed that “an organizational crisis is a low-probability, high-impact event that threatens the viability of the organization and is characterized by ambiguity of cause, effect, and means of resolution, as well as by a belief that decisions must be made swiftly” (p. 59). It is a traumatic event which creates stress for members of the organization. Employees become defensive, deny the severity of the situation, and begin to question deeply held beliefs. Their ability to make sound decisions is impaired by cognitive biases. The crisis also leads to a breakdown of cultural norms and a lack of faith in leadership. The potential for a crisis is increased if an organization employs “high-risk” technologies (e.g., nuclear power). If one or two of the components fail, they interact in unexpected ways and cause the entire system to collapse. The result is a large-scale organizational disaster accompanied by the loss of life (e.g., Union Carbide’s chemical leak in Bhopal, India).

The advantage of Pearson and Clair’s (1998) work is that three of the most important perspectives on organizational crisis—the psychological approach, the sociopolitical approach, and the technological-structural approach—are integrated into one definition. A crisis has both an objective reality (i.e., it is a low-probability, high-impact event) and perceptual qualities (leaders must recognize that a crisis exists if they are to make any effort to respond). Many crises are preceded by warning signals that are ignored, minimized, or misread by decision makers. The lack of an appropriate response from senior managers only makes the impact of the crisis worse. The business will continue to lose customers and its financial performance will deteriorate even further.

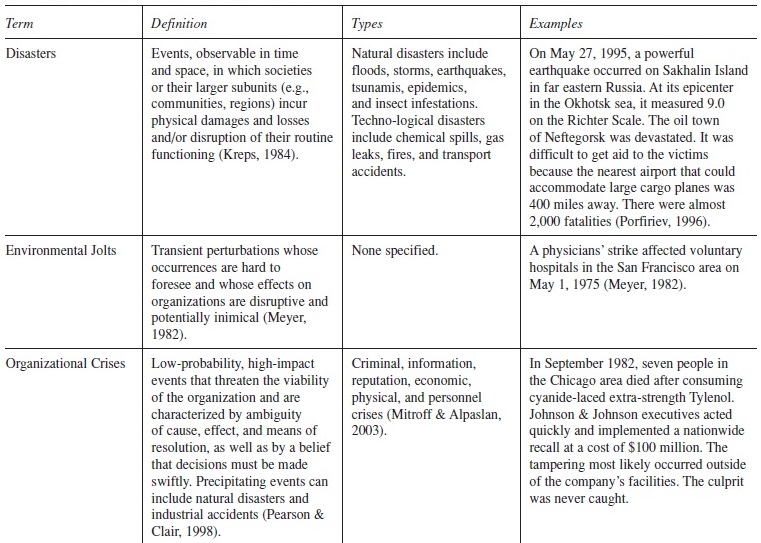

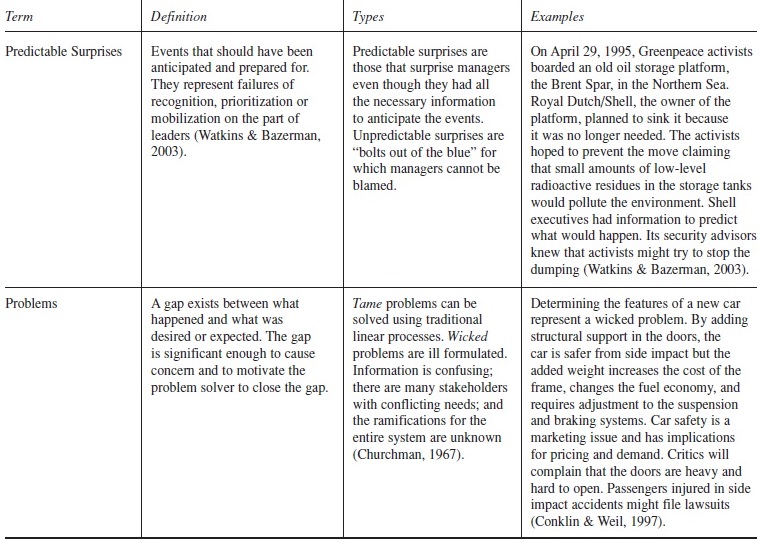

The disadvantages associated with Pearson and Clair’s (1998) definition is that crises are occurring more and more frequently in the new millennium; therefore, the notion that a crisis is a “low-probability” event may be heading toward obsolescence. It is also important to clearly define “high-impact.” The appearance of anthrax-tainted mail in the United States in 2001 and the sniper attacks in the Washington, DC area in 2002 fortunately did not result in the loss of thousands of lives. They did, however, cause widespread panic and the disruption of daily routines. Finally, Pearson and Clair’s definition does not acknowledge that some crises are favorable for an organization. The Chinese symbol for crisis means danger and opportunity. A crisis, therefore, represents a significant turning point in an organization’s history. Some organizations will emerge successfully from the crisis while others will fail. The events that lead up to crises can come from the organization’s internal environment (e.g., human error, lax security, equipment failures, unethical behaviors, power struggles) or from the organization’s external environment (e.g., natural disasters, stock market crashes, nationalization, terrorism). Table 1 shows the relationship between crisis and other similar terms.

Conceptual Models Of Organizational Crisis

Organizational crises have been studied from a life cycle perspective. Organizations, like individuals, pass through several developmental phases, in which movement from one phase to the next is triggered by a crisis and its successful resolution. Crises involving organizational growth and development are fairly predictable (and therefore manageable). Since organizations pass through well-known stages and face common issues, managers are advised to follow a set of specific strategies to help their businesses move forward. In “birth,” managers should create an organizational vision, acquire needed resources, and hire talented employees; in “growth,” managers need to maintain stakeholder confidence, acquire additional resources, and build commitment; in “maturity,” managers must pursue organizational change and revitalization; in “decline,” managers must cut costs and arrange for an orderly closing of the firm.

Larry Greiner (1972) developed a classic model of organizational crisis within the organizational life cycle literature. He argued that as an organization grows in size and age, it encounters several crises. A “crisis of leadership” emerges when an organization has grown too large and complex for the managing capabilities of its entrepreneurial founder. Professional managers must be hired to “pull the organization together” through formal communication, accounting policies, incentive programs, and quality-control systems. A “crisis of autonomy” develops as lower level managers seek greater freedom and responsibility while top managers are reluctant to give up power. Eventually, lower level managers and plant managers are allowed to make day-to-day operating decisions. Conflicts between plant managers who now want complete discretion in running their operations and top managers who attempt to centralize decision making erupt in “a crisis of control.” The firm can only move forward when plant managers are given the responsibility to run decentralized field units while a general headquarters is created so that top managers can plan, control, and review the performance of line managers. Finally, a “crisis of red tape” occurs when rigid bureaucratic structures inhibit problem solving and innovation. By creating cross-departmental teams, managers can encourage spontaneity and conflict resolution.

Gilbert Probst and Sebastian Raisch (2005) provide an example of the continued interest in organizational crises that occur as companies pass through different life cycle stages. In their study of 100 large organizational crises, they found that companies suffering from a premature aging syndrome (i.e., they grew old before their time) or from a burnout syndrome (i.e., they experienced permanent stress due to system exhaustion) collapsed at the height of their success. They either grew too rapidly or too slowly, pursued either constant change or tentative change, had either overly powerful or extremely weak managers, and fostered either very competitive or very cooperative cultures. Success hinged on a company’s ability to maintain, over the long term, an appropriate balance in growth rates, change processes, leadership styles, and cultures.

Table 1 Organizational Crises and Similar Terms

Crises often result from pressures emanating from an organization’s external environment. Carolyne Smart, Walter Thompson, and Ilan Vertinsky (1978) segmented the external environment into those elements that are controllable by the actions or attributes of an organization (e.g., managers can conduct market research to learn how well products are being received and make product enhancements based on customer feedback) and those elements which cannot be controlled or influenced by the organization (e.g., political, legal, and social factors as well as competitor moves). A crisis occurs when there is a dramatic shift in the level or structure of the uncontrollable elements in a firm’s external environment. The firm’s ability to cope successfully with the crisis depends on its profile of organizational attributes. The profile includes (a) executive characteristics such as motives, leadership styles, cognitive abilities, and the propensity for risk taking; and (b) organizational characteristics, such as slack resources, and degrees of diversification, centralization, formalization, and routinization. In a follow-up study, Carolyne Smart and Ilan Vertinsky (1984) found that managers tended to defend the status quo and use standard operating procedures in response to a crisis in a routine environment. Managers used retrenchment strategies in response to crises in complex and turbulent environments because they felt they were unable to exert control over events. Managers adopted entrepreneurial strategies when faced with a crisis in a simple environment.

Irving Janis (1982) coined the phrase “groupthink” to refer to decision-making situations in which high-level government officials make low-quality and hasty foreign policy recommendations. They feel pressured to conform to the will of the leader and to maintain a sense of amiability and esprit de corps within their inner circle. Janis hypothesized that groups that are highly cohesive and insulate themselves from outside criticism tend to concur with the judgments of the leader and to support his or her plans. This leads to such symptoms as feelings of invulnerability, stereotyped views of the enemy, beliefs in the group’s morality, and illusions of unanimity. When decision makers face a crisis or a provocative situational context characterized by high stress, external threat, and short decision time, they use poor judgment. The result is a fiasco. President Kennedy’s 1963 decision to send 1,400 Cuban exiles to Cuba in an attempt to overthrow the Castro government was flawed because his advisory team failed to criticize the plan and miscalculated the strength and size of Castro’s forces. Groupthink has been used to explain everything from the demise of Enron to the loss of the Challenger Space Shuttle to NBC’s mistake in hiring Jay Leno to host The Tonight Show.

In a retrospective examination of his work, Charles Per-row (2004) discussed his finding that increasingly complex technologies, such as those in nuclear power plants and chemical refineries, are risky because their components can interact with one another in unanticipated ways and cause large-scale disasters. In order to understand a specific event, such as the failure of an operator to close a valve, it is necessary to examine the context of the failure, such as the mindset of the operator, which in turn is determined by training, experience, and corporate ideology. Crises are inevitable because a small problem can escalate quickly; in retrospect, no one knew that if component x failed, then component y would fail and together the two failures would start a fire and silence the alarm system. Perrow was so worried about advanced technologies that he advocated for the abandonment of nuclear power and nuclear weapons.

Paul Shrivastava, Ian Mitroff, Danny Miller, and Anil Miglani (1988) take Perrow’s ideas a step further. They agree that complex technological systems are unreliable and that human error and inadequate resource allocations for safety can contribute to industrial crises. Regulatory failures, which allowed the hazardous technologies to enter communities which are ill equipped to handle them, are to blame as well. The infrastructure needed to successfully contain the damage and evacuate civilians is lacking. A crisis, therefore, is not just a problem for a single organization; it affects both private and public organizations and requires a coordinated strategy involving multiple stakeholders.

Strategic And Tactical Responses To Crisis

There are many “dos” and “don’ts” of effective crisis management. In the short term, managers are warned not to ignore the early signs of the onset of a crisis, not to deceive or lie to employees or the public about major threats, and not to find scapegoats for the company’s problems. In the long term, managers are told to develop contingency plans, to create crisis-management teams, and to implement training programs so that others can learn to recognize the beginnings of a crisis. Managers can easily become overwhelmed by the abundance of advice and the number of items on crisis-preparation checklists. Managers should realize that both the type of crisis facing the organization and the stage in the evolution of the crisis require different strategic and tactical responses. Strategies are comprehensive and have a long-term perspective; tactics consist of short-term, operational maneuvers. The more predictable crises can be handled by rescue specialists and technical experts while the less predictable crises should be managed by an organization’s top executives since they require significant system wide changes.

From a strategic point of view, managers are encouraged to adopt a general crisis orientation. They must be able to tolerate ambiguity, stay calm during difficult times, and fully mobilize an organization’s resources. Managers must acknowledge that they will never have a detailed plan for every crisis that might occur. Their goal is to be prepared for a crisis and, when the time comes, to exhibit flexibility (i.e., to quickly recognize how an existing plan can be modified to meet a new threat) and resiliency (i.e., to evaluate the crisis, recover from initial shock, and utilize the organization’s strengths and resources).

Bertrand Robert and Chris Lajtha (2002) developed a 10-point mental action plan for successful crisis management:

- Instead of viewing crises as negative or threatening events, managers should treat them as unusual opportunities for change in which a company’s core values and management policies are tested and improved. Developing the skills and talents of employees to better handle crises via training can enhance their everyday performance and serve as a springboard for innovation and risk taking.

- A company’s chief executive and top managers must be actively engaged in crisis management and agree to undergo crisis-management training themselves.

- Rigid operating procedures and lengthy policy manuals are useless during a crisis. Managers must regard crisis management as a continual process that requires frequent revisions and updating. It should be an integral part of a company’s strategic management processes.

- Managers should assess the feasibility of setting up a crisis-management team or crisis-management center. It is unlikely that one manager will possess all the necessary leadership skills to handle a crisis.

- It is just as important to prepare for crises in advance and to learn from crises that have been successfully resolved as it is to help the organization through the acute phase of a crisis. Managers, however, are often unwilling to devote the necessary resources to the precrisis and postcrisis stages.

- During the precrisis stage, it is important to use lateral thinking and to pay attention to early warning signs no matter how marginal or peripheral they may seem.

- Crisis-management teams should not be afraid to violate organizational taboos. They should not be reprimanded for speaking freely, crossing hierarchical lines, or disagreeing with a culture value.

- Managers should rebuild lost confidence among customers, shareholders, suppliers, creditors, and employees. By acting competently, they can gain the respect and trust of key stakeholders and increase the likelihood that new decisions will be accepted and implemented.

- Employees need training to deal with the unexpected. Detailed simulations which incorporate the element of surprise are especially helpful.

- Organizations should be more open with one another and share information with the academic community (even regarding their weaknesses and mistakes) so that “best practices” in crisis management can be developed.

From a process point of view, crises have been analyzed according to several phases which have become associated with different strategies. Summarizing the literature, Sheldene Simola (2005) outlined the basic strategies that reduce the occurrence of and damage from organizational crises. In the precrisis stage, managers try to get a sense of what is going to happen so that they can prepare for a crisis in advance. Managers conduct an organizational risk assessment to identify areas of potential vulnerability and to take steps to reduce the risk. They create crisis-management teams and a crisis-management center equipped with emergency communications systems. A backup location is established in case the primary facility incurs damage. Managers write crisis plans, protect company data, hold practice drills, and simulate emergencies.

In the acute stage, a crisis has hit and some damage has occurred. Managers must work hard to control as much of the crisis as possible. They activate the crisis-management team; assess the causes and likely consequences of the crisis; contain the crisis physically (e.g., in the case of a chemical spill); send a message to the media that the situation is under control; and ensure the safety and health of employees, customers, and the general public.

The chronic crisis stage refers to cleanup, recovery, and healing. The crisis-resolution stage means that the organization is healthy again. Organizations must engage in learning and adopt flexible roles, cross-functional teams, open communications, and joint problem solving. Arjen Boin, Paul t’Hart, Eric Stern, and Bengt Sundelius (2005) believe that three different types of learning must occur. Experience-based learning means that past events and actions are remembered and studied; they provide guidelines regarding what will and what will not work in the future. Explanation-based learning requires the rational and scientific search for the causes of a crisis and its consequences; an extensive and meticulous audit will provide recommendations for the future. Competence/skill-based learning suggests that new talents, skills, and technologies are needed to deal effectively with a crisis.

From a practical point of view, not all crises are the same. Their origins, intensity, duration, and consequences are different. Crises resulting from natural disasters, industrial mishaps, malicious acts of violence, and internal ethical breakdowns are fundamentally different in nature and are best handled by different strategies. Securities fraud, white-collar crime, and accounting irregularities are associated with unethical behaviors which can be most damaging to a corporation’s reputation. Such organizations face the daunting task of creating an ethical culture, putting into place safeguards to prevent future incidents, and restoring credibility with the public. Recommended remedies range from such commonplace practices as the operating of anonymous hotlines for whistleblowers to more drastic measures such as the hiring of chief risk officers to monitor the corporation as a whole and not just one department, and the expanding of democratic participation in corporate governance by inviting employees, community representatives, and other stakeholders to sit on boards of directors.

Defective products, environmental spills, and plant explosions also receive negative publicity and the scorn of members of society. They often indicate a disregard for safety and inadequate quality control procedures that resulted from a firm’s cost-cutting efforts. These crises have significant consequences that can occur long after the triggering event. Crisis responses are initially aimed at technical damage control and rescue and relief of the injured. Later, victims need to be compensated; technological and organizational improvements need to be made. There is an increased focus on creating “high-reliability organizations” that demonstrate a commitment to safety, a culture of continuous learning and improvement, and redundancy in safety measures and personnel.

Powerful earthquakes and hurricanes are acts of nature that are best handled by operating early warning systems, fortifying infrastructures, implementing orderly evacuations, and rebuilding affected areas. Their patterns are somewhat predictable. Hurricanes, for example, usually occur during the summer months in the southern regions of the United States, tornadoes develop in the Midwest and South, and earthquakes affect California. They cause the most significant damage at the time and place of occurrence and their adverse effects diminish over time. One reason Hurricane Katrina was so devastating was because the model hurricane used to design the network of levees, floodwalls, storm gates, and pumps in New Orleans was too simplistic. Had a better hurricane-protection system been in place, the results would have been different—causing, perhaps, a case of “wet ankles” at the most (Schwartz, 2006).

Terrorism is an act of violence committed by individuals who seek to cause as much damage and loss of life as possible. The attacks on the World Trade Center and Pentagon highlighted the importance of information flow and interorganizational coordination before, during, and after a crisis (see Comfort, 2002). Different agencies had key pieces of information which in isolation from each other appeared insignificant. An FBI agent in Phoenix, Arizona, for example, expressed concerns about suspicious individuals taking flying lessons. The British government knew that Zacarias Moussaui, under arrest in the United States for an immigration violation, had trained at an Al-Qaeda camp in Afghanistan. Communications between firemen and police officers on the scene broke down, resulting in a large number of fatalities among emergency and rescue personnel.

A major recommendation made by the architects of the 9/11 Commission Report was the need to share sensitive and time-critical information by creating trust between federal and nonfederal entities and by establishing secure communications mechanisms so that information did not fall into the wrong hands. Other tools are helpful in confronting terrorism. Sarah Murray (2004) discussed a matrix in which risks are assessed on the basis of the probability of an attack and an organization’s resilience, and Matt Crenson (2004) wrote about a branch of abstract mathematics that may be able to help intelligence officers determine the most efficient way to disable a terrorist network (work in both these areas is being conducted by professors at MIT). Dean Alexander (2004) reported that some companies are investing in telecommunications networks and virtual offices, operating duplicate facilities and managing multiple personnel, and even providing counterterrorism training for executives and bodyguards.

The Future

A new generation of crises may be on the way. Arjen Boin and Patrick Lagadec (2000) compiled a list of the characteristics of modern crises. They can affect large populations; produce high economic costs; endure for a long period; trigger a snowball effect on other individuals, groups, and institutions; involve a large number of actors and organizations who jump into action; create communication snafus; and cause extreme uncertainty. “Unthinkable” or “inconceivable” events have the potential to wreck havoc not just on today’s organizations but also on the social order in countries around the globe. Scenarios for radical weather changes, biological terrorism, and asteroid collisions have been developed by various agencies. Disaster checklists, evacuation policies, and media training are no longer sufficient. New forms of information sharing, problem solving, and cooperation among individuals, groups, organizations, and governments at all levels of society are warranted.

A Conference Board Report recently concluded that an avian flu pandemic would require global, holistic planning (Conference Board, 2006). Jeffrey Staples (2006) said that companies could experience absentee rates of between 15%-30% due to sickness, quarantines, travel restrictions, and fear of contagion. A good plan should focus on employee education, hygiene, evacuation, and minimization of supply chain disruptions. Scientists claim that an asteroid, 1950 DA, will travel dangerously close to the Earth and might crash into the Atlantic Ocean in the year 2880.

According to a report by Cynthia Wagner (2003), a simulation showed that it could cause a tsunami that might engulf the northeastern U.S. coast within two hours after impact. Improving the nation’s knowledge base and applying expertise acquired in other large-scale disasters might aid in the planning for such an event.

Only a few organizations have begun to prepare for such rare occurrences. The software company, SAS Institute Inc., for example, has set up a Pandemic Task Force, with executives from its travel, security, health care, and risk functions, to develop plans for human-to-human transmissions of avian flu. In case of an outbreak, employees would be encouraged to work at home; if the payroll system became inaccessible there would be an alternative so that employees could still get paid (Reingold, 2006). Sun Microsystems has built an information technology infrastructure that will give its employees and customers access to information on their own desktop computers no matter where they are. It plans to broadcast reports in different languages on the spread of an infectious disease on its intranet radio station (Caruso, 2006). As these examples illustrate, companies need good crisis management plans. In their article, “Preparing for Evil,” Ian Mitroff and Murat Alpaslan (2003) caution that it is no longer possible to fight “new wars with old strategies” (p. 109). The authors continue: “If they are to cope with abnormal crises, companies must see—as their enemies do—skyscrapers as vertical coffins and aircraft as flying bombs, ugly and horrifying though the prospect may be” (p. 11). It has become more important than ever to develop novel and comprehensive approaches to crisis management.

Bibliography:

- Alexander, D. C. (2004). Business confronts terrorism: Risks and responses. Madison: University of Wisconsin Press.

- Anderson, K. N., Anderson, L. E., & Glanze, W. D. (1998). Mosby’s medical, nursing, & allied health dictionary (5th ed.). St. Louis, MO: Mosby.

- Boin, A., & Lagadec, P. (2000). Preparing for the future: Critical challenges in crisis management. Journal of Contingencies and Crisis Management, 8(4), 185-191.

- Boin, A., t’Hart, P., Stern, E., & Sundelius, B. (2005). The politics of crisis management. New York: Cambridge University Press.

- Brecher, M., & Wilkenfeld, J. (1982). Crises in world politics. World Politics, 34(3), 380-417.

- Brooker, K. (2002). Starting over. Fortune, 145(2), 50-64. Caruso, D. (2006). Staying connected. Harvard Business Review, 84(5), 38.

- Churchman, C. W. (1967). Wicked problems. Management Science, 14(4), B141.

- Conference Board. (2006, July 2). Report suggests companies need a more global, holistic preparation for potential avian flu epidemic. Lab Business Week, p. 274.

- Comfort, L. K. (2002). Managing intergovernmental responses to terrorism and other extreme events. Publius, 32(4), 29-49.

- Conklin, E. J., & Weil, W. (1997). Wicked problems: Naming the pain in organizations. 3M meeting network. Retrieved September 8, 2007, from http://www.leanconstruction.org/ pdf/wicked.pdf

- Cowen, S. S. (2006). Be prepared. The chronicle of higher education, 52(33), 12.

- Crenson, M. (2004, October 17). Fighting terrorism with abstract math; Hamas succession predicted by lab. The Washington Post, p. A4.

- Etzel, B. (2002). Up from ground zero, Investment Dealer’s Digest, 68(34): 7-9.

- Fox, L. (2003). Enron: The rise and fall. Hoboken, NJ: Wiley.

- Greiner, L. E. (1972). Evolution and revolution as organizations grow. Harvard Business Review, 50(4), 37-46.

- Healy, P. M., & Palepu, K. G. (2003). The fall of Enron. The Journal of Economic Perspectives, 17(2), 3-12.

- Janis, I. (1982). Groupthink. Boston: Houghton Mifflin.

- Kreps, G. A. (1984). Sociological inquiry and disaster research. Annual Review of Sociology, 10, 309-330.

- Lawrence, A. (2003). The Collapse of Enron. NY: McGraw-Hill/ Irwin.

- Meyer, A. D. (1982). Adapting to environmental jolts. Administrative Science Quarterly, 27(4), 516-537.

- Mitroff, I. I., & Alpaslan, M. C. (2003). Preparing for evil. Harvard Business Review, 81(4), 109-115.

- Mitroff, I. I., Alpaslan, M. C., & Green, S. E. (2004). Crises as ill-structured messes. International Studies Review, 6(1), 165-194.

- Mitroff, I. I., Pauchant, T. C., & Shrivastava, P. (1989). Crisis, disaster, catastrophe: Are you ready? Security Management. 33(2), 101-108.

- Murray, S. (2004, June 2). Gambling on the life of a business, terrorism: Sarah Murray explains why each company needs to take a different approach to the chances of being attacked. Financial Times, p. 2.

- Pearson, C. M., & Clair, J. A. (1998). Reframing crisis management. Academy of Management Review, 23(1), 59-76.

- Perrow, C. (2004). A personal note on normal accidents. Organization & Environment, 17(1), 9-14.

- Porfiriev, B. N. (1996). Social aftermath and organizational response to a major disaster: The case of the 1995 Sakhalin earthquake in Russia. Journal of Contingencies and Crisis Management, 4(4), 218-227.

- Probst, G., & Raisch, S. (2005). Organizational crisis: The logic of failure. Academy of Management Executive, 19(1), 90105.

- Reingold, J. (2006). The storm after the storm. Fast Company, 104, 88-94.

- Reingold, J. (2006, July/August). Mastering disaster. Fast Company, 107, 38-39.

- Robert, B., & Lajtha, C. (2002). A new approach to crisis management. Journal of Contingencies and Crisis Management, 10(4), 181-191.

- Schwartz, J. (2006, May 30). An autopsy of Katrina: Four storms, not just one. The New York Times, p. F1.

- Shrivastava, P., Mitroff, I. I., Miller, D., & Miglani, A. (1988). Understanding industrial crises. Journal of Management Studies, 25(4), 285-303.

- Simola, S. K. (2005). Organizational crisis management: Overview and opportunities. Consulting Psychology Journal: Practice and Research, 57(3), 180-192.

- Smart, C. F., Thompson, W. A., & Vertinsky, I. (1978). Diagnosing corporate effectiveness and susceptibility to crises. In C. F. Smart & W. T. Stanbury (Eds.), Studies on crisis management (pp. 57-95). Toronto, Ontario, Canada: Butterworth.

- Smart, C. & Vertinsky, I. (1984). Strategy and the environment: A study of corporate responses to crises. Strategic Management Journal, 5(3), 199-213.

- Staples, J. (2006). A new type of threat. Harvard Business Review. 84(5), 20-22.

- Stover, D. (2004). Anomaly = Disaster, and other handy NASA euphemisms. Popular Science, 264(2), 96.

- Wagner, C. G. (2003). Impact! Simulating an asteroid hit. Futurist, 37(5), 68.

- Watkins, M. D., & Bazerman, M. H. (2003). Predictable surprises: The disasters you should have seen coming. Harvard Business Review, 81(3), 72-85.

- Yeager, K. R., & Roberts, A. R. (2003). Differentiating among stress, acute stress disorder, crisis episodes, trauma and PTSD: Paradigm and treatment goals. Brief Treatment and Crisis Intervention, 3(1), 3-25.