View sample crime research paper on tax offenses. Browse other research paper examples for more inspiration. If you need a thorough research paper written according to all the academic standards, you can always turn to our experienced writers for help. This is how your paper can get an A! Feel free to contact our writing service for professional assistance. We offer high-quality assignments for reasonable rates.

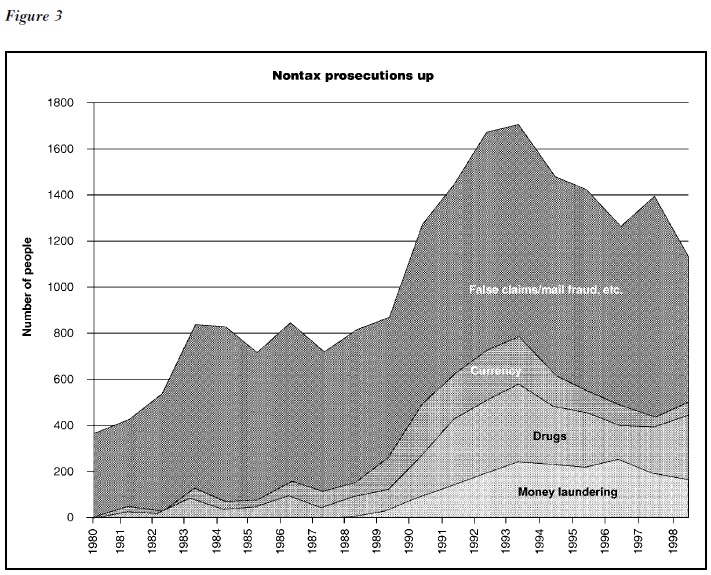

A traditional view holds that criminal tax offenses exist to combat tax evasion. Tax evasion is indeed a widespread, serious, and persistent problem in the United States and elsewhere. In the last part of the twentieth century, however, the United States government broadened its criminal enforcement focus from the suppression of classical tax evasion to a more general attack on crime, including drug dealing and financial crimes. The federal government still prosecutes tax cheats, but at the turn of the century ‘‘criminal tax enforcement’’ more accurately represents a particular style of investigation than a single-minded effort to secure the federal fisc.

Academic Writing, Editing, Proofreading, And Problem Solving Services

Get 10% OFF with 24START discount code

Tax Noncompliance

Tax compliance typically relies on voluntary self-assessment, which requires taxpayers to calculate their own tax liability and voluntarily to pay the amount due. For income taxes, there are three kinds of noncompliance: failure to file tax returns; underreporting of taxable income (either through underreporting income or overstating deductions); and failure to pay established liabilities. Tax scholars often distinguish between tax minimization, tax avoidance, and tax evasion, but no precise lines divide this continuum of conduct.

Tax noncompliance is socially harmful. Most obviously, tax noncompliance reduces tax revenues, which is a bad thing if one believes that legitimately elected governments should be able to carry out their policies as they choose. Tax noncompliance also can distort labor markets, as when people select jobs to dodge taxes. Efforts to avoid taxes (like efforts to increase compliance) are deadweight losses to society. Tax evasion can create unfairness and can fuel perceptions of rampant cheating that undermine respect for government. Left unchecked over time, these perceptions would tend to snowball as more people conclude that cheating is common, normal, and inviting.

The tax noncompliance problem in the United States is large and growing. The tax gap (the difference between what taxpayers owe and pay) was an estimated $195 billion/year in 1998, or about $1600 per year for every tax return filed by compliant taxpayers (Rossotti). Estimates are that American taxpayers voluntarily pay 83 percent of the taxes they owe. The compliance rate in other countries is often much lower (IRS, Sept. 1997; Graetz and Wilde). The dollar cost of noncompliance has risen sharply since about 1980 even as the rate of tax noncompliance has remained fairly stable (IRS, Sept. 1997). Most academic focus has been on evasion of income taxes, but noncompliance problems also exist for other taxes (e.g., employment taxes, excise taxes, retail sales taxes, estate and gift taxes).

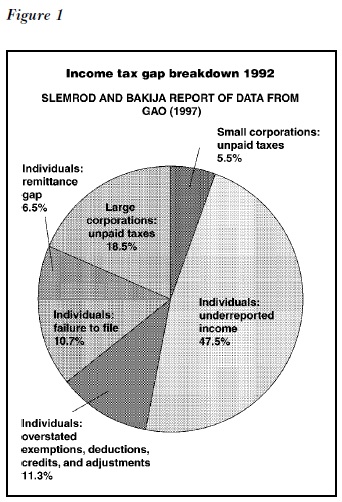

Who is not paying? Three-quarters of the problem has been the fault of individuals rather than corporations, according to data that Slemrod and Bakija report. The bulk of noncompliance seems to come from the underreporting of personal income, which accounted for 47.5 percent of the tax gap in 1992. Corporations, however, may be closing the gap. In the late twentieth century there has been a dramatic increase in the number of corporate tax shelters that corporate taxpayers use to reduce tax liability by entering into transactions that purportedly lack economic substance apart from tax benefits. Bankman estimates that the lost corporate tax revenues may amount to billions of dollars. It is difficult to generalize about the types of transactions deemed corporate tax shelters. They do share some common elements: (i) they seek to obtain a tax benefit not clearly contemplated by the applicable tax provision; (ii) they lack economic substance, in that the reasonable expected pre-tax economic profit is insignificant relative to the reasonably expected net tax benefits; (iii) they result in inconsistent financial accounting and tax treatment; and (iv) they use taxindifferent parties (generally foreign and taxexempt entities) to absorb or deflect taxable income (Department of Treasury 1999, 2000).

Compliance also varies greatly by types of income. For example, the compliance rates for wages and salaries (99.5%), pensions and annuities (98.4%), interest and dividends (94.6%), and income from capital gains (88.3%) are relatively high, while the compliance rates for partnerships and S corporations (42.1%) and self-employment income (41.4%) are quite low (in all cases estimated for reported net income as a percentage true net income for filers only) (Slemrod and Bakija).

To spur tax compliance, two techniques are coercive incentives and structural components. Coercive incentives seek to induce tax compliance, primarily through a program of audits, civil penalties, and, rarely, criminal prosecutions. Structural components aim to get the owed money (or the information that leads to the money) before taxpayers can hide it, mainly by means of increased withholding and information reporting. The IRS has changed its enforcement approach by relying more on structural components and less on coercive incentives. This shift has changed the types of noncompliance detected and prosecuted, and may have reduced the deterrent effect that tax cheats face. The shift also has reduced reliance on the ultimate deterrent: criminal prosecution of traditional tax crimes.

The coercive incentive approach begins with auditing, and the decline in IRS auditing has been marked. In the mid-1960s, the audit rate was about 6 percent for individuals (Dubin, Graetz, and Wilde), but this rate fell to less than one half of one percent by the century’s end. Audits of individual taxpayers thus were twelve times less common in the late 1990s than in the mid 1960s.

The rate of corporate auditing likewise fell at the end of the twentieth century. For the largest corporations (those with assets over $250 million) the audit probability fell from 54 percent to 37 percent from 1992 to 1998. Over the same time period, the audit rates for small corporations (those with less than $250,000 of assets) fell from 1.18 percent to .75 percent. In contrast, there has been a dramatic increase in the use of structural components in the last thirty-five years. The IRS has been quite successful in requiring information reporting on certain transaction and matching that information to income tax returns. In 1965, the IRS received about 340 million information documents; by the 1990s the annual number had increased to over 1 billion documents. The IRS estimates that over 75 percent of all income that should be reported on income tax returns is subject to information reporting requirements (Andreoni, Erard, and Feinstein).

Economics of Tax Evasion

Economists have made important strides in trying to understand tax evasion. Gary Becker’s classic article on the economics of crime used economic theory to tackle normative questions such as how many resources should be spent on law enforcement of laws and what penalties the government should impose. Becker’s theory about criminal behavior assumed that individuals evaluate the benefits and costs of various activities (including criminal activities like tax evasion) and choose those activities that provide the highest income (or expected utility), after taking into account the associated net costs.

Allingham and Sandmo apply Becker’s general approach to issues of tax avoidance and evasion. Using similar assumptions about the rational maximizing behavior of individuals, Allingham and Sandmo posit a simple situation where individuals must decide whether to declare all of their income on a tax return or deliberately underreport the income to tax authorities. The rational individual evaluates the expected gains or losses associated with the decision and seeks to maximize the expected utility or income. The gain derived from underreporting is the expected value of the reduced taxes. The cost or loss associated with tax evasion is a function of the probability of detection and conviction and the penalties imposed.

This model of tax compliance is consistent with two intuitions. First, taxpayers will cheat if they think they can get away with it. Second, taxpayers voluntarily will improve their compliance when penalties increase or when the probability of getting caught goes up.

Allingham and Sandmo and others have attempted to estimate the impact of several factors on voluntary tax compliance. For example, commentators have examined the relationship of demographics and social factors to levels of noncompliance, the effectiveness of different penalty structures on increasing deterrence, and the deterrent effect of past audits on future compliance (Andreoni, Erard, and Feinstein).

Simple economic models cannot adequately capture the dynamics of tax evasion. Andreoni, Erard, and Feinstein offer three factors that may influence taxpayers’ compliance decisions. These factors also explain why the level of tax compliance, at least in the United States, is higher than the economic models would predict. First is the role of guilt and shame. It is difficult to model these factors, but it is clear that many taxpayers will feel guilt about evading taxes and shame upon apprehension. Second, taxpayers’ perception of fairness of their tax burden will influence compliance. There is substantial evidence that the existence, real or perceived, of an unfair tax system will allow taxpayers to rationalize cheating on their own tax returns. Finally, the degree of taxpayers’ satisfaction with the performance of government will influence tax compliance. Taxpayers are more willing to comply with tax laws if they believe that their tax money is being well spent. All these factor play an important role in the level of tax compliance in the United States. These factors also help explain the high level of tax evasion in countries in Eastern Europe and the former Soviet Union.

The Role of Criminal Sanctions

The most serious federal tax crime is willful tax evasion, which carries a five-year maximum prison sentence and a maximum fine of $250,000 ($500,000 in the case of a corporation) plus costs of prosecution (26 U.S.C. § 7201 18 U.S.C. § 3571). As decisions in Spies v. United States, 317 U.S. 492 (1943), and United States v. Carlson (2000) clarify, this felony requires the government to prove three elements: (1) the existence of a tax deficiency; (2) willfulness; and (3) an affirmative act of evasion or affirmative attempt to evade. The ‘‘affirmative act’’ or ‘‘affirmative attempt’’ requirement distinguishes felony tax evasion from the misdemeanor offenses proscribed by 26 U.S.C. § 7203. Conduct like keeping double books or destroying records satisfies this affirmative act requirement. ‘‘Willful but passive neglect of the statutory duty may constitute the lesser offense, but to combine with it a willful and positive attempt to evade tax in any manner or to defeat it by any means lifts the offense to the degree of felony’’ (Spies, p. 499).

Less severe tax felonies cover other misconduct: willfully making false statements under penalty of perjury, 26 U.S.C. § 7206(1) (maximum three-year imprisonment, same maximum fines); willfully aiding or assisting the preparation of false tax documents, 26 U.S.C. § 7206(2) (same); and interfering with or offering bribes to federal tax officials, 26 U.S.C. § 7212(a) (same). Willful tax evasion is a felony, but willful failure to file a tax return is a misdemeanor only, as is the willful delivery of false statements (See 26 U.S.C. §§ 7203 and 7207).

The provisions of 26 U.S.C. § 3571 raise the maximum fine for all of these crimes, including possibly to twice the ‘‘gross gain’’ to the defendant (or twice the ‘‘gross loss’’ to the government, whichever is greater). Why the criminal sanction? Tax noncompliance differs from conduct that more typically is the target of the criminal law. These differences raise questions about the appropriate role for criminal tax enforcement.

One utilitarian perspective questions why, as a general matter, any criminal tax enforcement is appropriate. The focus here is on how best to achieve efficient deterrence. Tax noncompliance seems like the kind of conduct that appropriately severe civil penalties generally can deter. Tax evaders should respond to the prospect of harsh but purely financial penalties, because the point of tax noncompliance is financial gain, and because tax evaders at some point must have had enough financial resources to incur a tax problem in the first place. Tax evasion, moreover, is not the sort of impulsively sudden or passionate conduct that some skeptics doubt can be deterred. Under these conditions, some utilitarians advise government enforcers to use civil enforcement machinery, because the civil enforcement process and civil penalties both are cheaper to administer than are their criminal counterparts. The main conclusion here, which Kaplow and Shavell trace back to Bentham (p. 183), is that financial penalties should be imposed to the maximum extent feasible before turning to the criminal penalty of incarceration. (See also Polinsky and Shavell; Shavell, 1985, 1987.) This perspective is controversial, politically and otherwise, in its possible implication that the justice system should be more willing to imprison the poor than the wealthy. Calkins comments that ‘‘[a]ny suggestion that prison should be reserved for those who lack sufficient assets is a political non-starter that does not deserve serious discussion except as an interesting academic exercise’’ (p. 143, n.63). Utilitarians would agree that their analysis has limited relevance when federal law holds financial penalties to ineffectively low levels, as is true when fines cannot be set at more than double the actual gain from evasion and when the risk of prosecution is far less than 50 percent. In this situation—and especially when audits are uncommon—the threat of incarceration can be an important tax compliance incentive.

Retributivists begin with moral analysis rather than a utilitarian calculus, but here again the tax context has notable features. Social norms in support of paying taxes are weaker than the norms supporting many more traditional crimes. Tax sanctions compel nearly the entire adult population to undertake affirmative conduct that often is annoying, expensive, and popularly reviled. Conventional wisdom rates paying taxes with death. Even judges, the federal officials who ultimately enforce the tax code, sometime disparage the moral basis for tax obligations. The revered Judge Learned Hand, for instance, wrote in Newman v. Commissioner of Internal Revenue (159 F.2d 848 (2d Cir. 1947), cert. denied 331 U.S. 859 (1947)): ‘‘Over and over again courts have said that there is nothing sinister in so arranging one’s affairs as to keep taxes as low as possible. Everybody does so, rich or poor; and all do right, for nobody owes any public duty to pay more than the law demands: taxes are enforced exactions, not voluntary contributions. To demand more in the name of morals is mere cant’’ (pp. 850–851). In the nation that venerates the Boston Tea Party, criminalizing the failure to pay taxes creates offenses that must get their moral core, not from the accepted badness of the failure itself, but rather from a condemnation of deliberate cheating on rules that govern everyone. From this perspective, the conventional wisdom about death and taxes reveals that most people accept taxes as something inevitable— something that most people dislike, true, but something that most people plan to pay. Retributivists focus on this mutual obligation and would tend to limit criminal prosecutions to cases where people shirk it with a blameworthy sense of wrongdoing. As with any sort of cheating, cases of tax evasion that are flagrant and outrageous provoke strong retributive reactions.

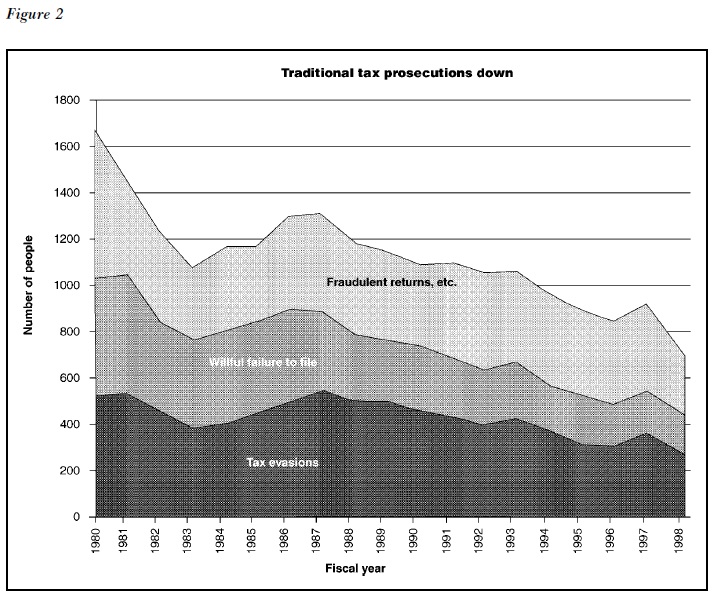

These utilitarian and retributive perspectives do fit with some aspects of U.S. criminal tax enforcement. Beginning with the utilitarian view, it is significant that U.S. criminal tax prosecutions are quite rare. During 1994–1998, for instance, the federal government prosecuted before district court judges on average only 846 people per year on tax law violations (DOJ, 1999, p. 24, Table A.3). (There seem to be many differing definitions of ‘‘tax law’’ and ‘‘prosecutions,’’ so statistics of this sort must be treated with care and are most safely used only for general points of illustration.) Officials resort to criminal actions so rarely in part because they have a wide array of powerful civil enforcement remedies, including fines, interest, and property seizures.

Turning to the retributive perspective, a second striking feature of federal criminal tax policy is its demand for an unusually high level of culpability. Most federal tax crimes require proof that a defendant acted ‘‘willfully,’’ which is a word of notorious ambiguity. (See generally Model Penal Code § 2.02 cmt. 10 n.47 (1985).) A recent Supreme Court attempt to define what ‘‘willfully’’ means in tax evasion cases is the decision in Cheek v. United States. Phrasing the matter in Model Penal Code terms (as the Cheek Court did not), the Cheek decision in essence held that ‘‘willfulness’’ requires knowledge by defendants that their actions violate the law. It is not enough to prove that these defendants acted recklessly in taking a risk that their actions might be illegal. Under Cheek’s knowledge standard, a jury must acquit defendants who convince that jury that their beliefs about the tax laws are sincere—no matter how nutty or risky those beliefs might be. For tax crimes requiring ‘‘willful’’ conduct, then, the Cheek case established that ignorance of the law indeed is an excuse—even when that ignorance is objectively unreasonable. This high requirement of knowing culpability does contrast with the lower and more usual criminal law requirement of reckless culpability. (See Model Penal Code § 2.02(3); Wiley.) By judicial interpretation, then, tax crimes require the government to prove an unusually high level of culpability—more culpability than retributivists generally require for criminal liability.

Criminal tax prosecutions have declined in number and shifted in focus. The decline began in 1987 (see Syracuse University) and has been marked as a percentage of filed tax returns. The shift in enforcement focus stems in part from the decisions in the past two decades to enlarge the jurisdiction of the Criminal Investigation Division (CI) of the IRS. The Criminal Investigation Division has moved from investigating mainly pure tax crimes to participating in investigating other criminal violations in which tax components are related conduct: for example, money laundering, currency reporting, narcotics trafficking, and various frauds (including frauds in bankruptcy, gaming, health care, insurance, and telemarketing) (IRS, CI FY1999 Annual Report; see also Abrams). The general decline in the number of federal tax prosecutions thus is even sharper for traditional tax crimes like tax evasion. In 1998, for example, there were only 771 tax fraud prosecutions in the U.S., half the number from 1981 (TRAC at http://trac.syr.edu/ tracirs/findings/aboutIRS/keyFindings.html).

A 1999 review of the Criminal Investigation Division by former judge and F.B.I. Director William H. Webster criticized this trend and recommended that the Criminal Investigation Division should focus its caseload more specifically on cases promoting voluntary compliance with the tax law—the historic and stated mission of the Criminal Investigation Division (Webster, 14). In the wake of the Webster Report’s criticism, the IRS has defended its policies in documents entitled ‘‘Why Is IRS Criminal Investigation Involved in Narcotics Investigations?’’ and ‘‘Why Is IRS Criminal Investigation Involved in Financial Crimes?’’ The latter document explained that:

IRS is involved because IRS CI special agents conduct full, in-depth financial investigations which are intensely revealing about life style, habits, business transactions and business associates. Such complex financial investigations often lead right to the door of the drug kingpin, the fraudulent telemarketer, or corrupt individuals such as health care executives, political leaders, return preparers or even the local grocery store operator. (p. 1)

This rationale suggests that the Criminal Investigation Division will continue its past policies. It likewise suggests that federal ‘‘tax prosecution’’ may denote more a set of investigative techniques than a particular kind of crime that the Treasury Department has targeted.

The advent of the Federal Sentencing Guidelines in 1987 had a dramatic impact on sentencing for all federal crimes, including tax crimes. The guidelines set out a mandatory approach that greatly reduced the judicial discretion that previously had characterized federal sentencing. Under the cookbook approach of the guidelines, the crucial factor driving sentencing is the size of ‘‘tax loss’’—the revenue loss that would have resulted had the offense been successfully completed, or the sum that the taxpayer owed but did not pay. (Tax payments after the crime has been committed do not reduce tax loss.) A graded table of tax losses sorts cases into twenty different categories. The most lenient category applies if the tax loss is less than $1700, for instance, in which case the guidelines dictate a prison sentence in the range of 0–6 months and permit probation instead of custody. In contrast, a tax loss of $80 million or more triggers the most severe treatment, which requires a mandatory prison sentence in the range of 63–78 months. The guidelines also adjust prison time for a range of related culpability factors. ‘‘Sophisticated concealment’’ or a previous criminal history, for instance, increase the prescribed sentencing ranges, while ‘‘acceptance of responsibility’’ leads to a shorter prison terms (U.S. Sentencing Guidelines Manual).

The U.S. Attorney’s Manual section 6–4.340 states that ‘‘the Tax Division prefers that government counsel request the imposition of a jail sentence’’ in tax cases, but there are provisions for exceptions in ‘‘unusual and exceptional circumstances.’’ In recent years, slightly more than half of those convicted of tax crimes actually do go to prison. At the same time, average federal tax crime penalties have remained roughly constant, at least at an aggregate level. The average jail sentence was twenty-two months in 1994 and 1995, twenty-six months in 1996 and 1997, and twenty-four months in 1998. The average fine was $8119 in 1994, $7140 in 1995, $9461 in 1996, $11,893 in 1997, and $7434 in 1998 (TRAC, at https://trac.syr.edu/tracirs/findings/98/index.html).

Conclusion

Theory and evidence mark tax evasion as a serious and persistent federal problem. Yet the government has responded with only a modest level of criminal prosecution. It is possible for a low level of criminal tax prosecution to be both just and efficient: this policy might appropriately reserve the criminal sanction for cases of exceptional culpability while promoting tax compliance through use of civil sanctions that are effective but more economical than the criminal process. The jury is out on whether current U.S. tax enforcement policy achieves these desirable goals. It is clear that federal criminal tax enforcers in recent years have broadened their criminal tax investigations to narcotics cases and financial crimes, so that ‘‘criminal tax enforcement’’ today may signify more a style of investigation than an effort to suppress a particular type of criminal conduct.

Bibliography:

- ABRAMS, NORMAN. ‘‘The New Ancillary Offenses.’’ Criminal Law Forum 1 (1989).

- ANDREONI, JAMES; ERARD, BRIAN; and FEINSTEIN, JONATHAN. ‘‘Tax Compliance.’’ Journal of Economic Literature 36 (1998): 818–860.

- ALLINGHAM, MICHAEL, and SANDMO, AGNIAN. ‘‘Income-Tax Evasion: A Theoretical Analysis.’’ Journal of Public Economics 1 (1972): 323– 338.

- BANKMAN, JOSEPH. ‘‘The New Market in Corporate Tax Shelters.’’ Tax Notes 83 (1999): 1775.

- BECKER, GARY ‘‘Crime and Punishment: An Economic Approach.’’ Journal of Political Economy 76 (1968): 169–217.

- BENTHAM, JEREMY. ‘‘An Introduction to the Principles of Morals and Legislation.’’ In The Utilitarians. Garden City, N.Y.: Anchor Books, 1973.

- CALKINS, STEPHEN. ‘‘Corporate Compliance and the Antitrust Agencies’ Bi-Modal Penalties.’’ Law and Contemporary Problems 60 (1997): 127– 167.

- Department of Treasury. General Explanations of the Administration’s Fiscal Year 2001: Revenue Proposals. Washington, D.C.: Government Printing Office, 2001.

- Department of Treasury. The Problem of Corporate Tax Shelters: Discussion, Analysis and Legislative Proposals. Washington, D.C.: Government Printing Office, 1999.

- DUBIN, JEFFREY; GRAETZ, MICHAEL J.; and WILDE, LOUIS L. ‘‘The Effect of Audit Rates on the Federal Individual Income Tax, 1977– 1986.’’ National Tax Journal 43 (1990): 395– 409.

- DUBIN, JEFFREY; GRAETZ, MICHAEL J.; and WILDE, LOUIS L. ‘‘Are We A Nation of Tax Cheaters? New Econometric Evidence on Tax Compliance.’’ American Economic Review (AEA Papers and Proceedings) 240 (May 1987).

- GRAETZ, MICHAEL, and WILDE, LOUIS L. ‘‘The Economics of Tax Compliance: Fact and Fantasy.’’ National Tax Journal 38, no. 3 (1985): 355–363.

- Internal Revenue Service. ‘‘1977 Data Book.’’ Publication 55B, Catalog 215671. Washington, D.C.: Government Printing Office, 1998.

- Internal Revenue Service. ‘‘News Release, The Individual Income Tax Gap and Accounts Receivable.’’ 1997 WL 585427 (I.R.S.) (September 1997). Washington, D.C.: Internal Revenue Service, 1997.

- KAPLOW, LOUIS, and SHAVELL, STEVEN ‘‘Economic Analysis of Law.’’ Olin Working Paper no. 251. Available at: http://www.law.harvard.edu/faculty/shavell/pdf/99_Economic_analysis_of_law.pdf

- POLINSKY, A. MITCHELL, and SHAVELL, STEVEN ‘‘The Optimal Use of Fines and Imprisonment.’’ Journal of Public Economics 24 (1984): 89–99.

- POSNER, HON. RICHARD Economic Analysis of Law, 5th ed. New York: Aspen Law and Business, 1998.

- ROSSOTTI, CHARLES Prepared Statement of Charles O. Rossotti, Commissioner, Internal Revenue Service, 1 May 1998. IRS Oversight: Hearings before the Senate Comm. on Finance, 105th Cong. 276, 276 (1998).

- SHAVELL, STEVEN ‘‘Criminal Law and the Optimal Use of Nonmonetary Sanctions as a Deterrent.’’ Columbia Law Review 85 (1985): 1232–1262.

- SHAVELL, STEVEN ‘‘The Optimal Use of Nonmonetary Sanctions as a Deterrent.’’ American Economic Review 77 (1987): 584–592.

- SLEMROD, JOEL, and BAKIJA, JON. Taxing Ourselves: A Citizen’s Guide to the Great Debate over Tax Reform, 2d ed. Cambridge, Mass.: MIT Press, 2000.

- Syracuse University, Transactional Records Access Clearinghouse (TRAC). https://trac.syr.edu/tracirs/

- U.S. Attorney’s Manual § 6–4.340 B and C (1999).

- United States Department of Justice, Office of Justice Programs, Bureau of Justice Statistics. ‘‘Federal Criminal Case Processing, 1998, With trends 1982–98, Federal Justice Statistics: Reconciled Data (August 1999, NCJ 169277).’’ https://www.ojp.gov/library/publications/federal-criminal-case-processing-1998-trends-1982-98-reconciled-data

- U.S. Sentencing Guidelines Manual §§ 2T1.1, 2T4.1 and 3E1.1 (2000).

- WEBSTER, WILLIAM HON. ‘‘Review of the Internal Revenue Service’s Criminal Investigation Division.’’ IRS Publication 3388 (4-1999) catalog number 27623P (April 1999) (Webster Report).

- WILEY, JOHN SHEPARD, JR. ‘‘Not Guilty by Reason of Blamelessness: Culpability in Federal Criminal Interpretation.’’ Virginia Law Review 85 (1999): 1021.