View sample Economics of Welfare Programs Research Paper. Browse other research paper examples and check the list of research paper topics for more inspiration. If you need a religion research paper written according to all the academic standards, you can always turn to our experienced writers for help. This is how your paper can get an A! Feel free to contact our custom writing service for professional assistance. We offer high-quality assignments for reasonable rates.

All more developed nations have created some set of means-tested public assistance or welfare programs, designed to protect vulnerable groups from economic destitution. Among the groups that are often targeted by such programs are elderly, poor children, disabled persons, and low-income families, especially single mother families. In many cases, these programs are designed to provide an income supplement to those who cannot work or earn income. Other public assistance programs may be designed to support low-wage workers and help make it economically viable for them to continue in employment. As we shall see, there is often a conflict between the goal of subsidizing income versus encouraging work, which often spills over into controversy about the design and operation of welfare programs. In part because of this controversy, welfare programs have been the focus of ongoing public and political discussion in many nations. This has provided an incentive for extensive research among social scientists about the effects of such programs.

Academic Writing, Editing, Proofreading, And Problem Solving Services

Get 10% OFF with 24START discount code

1. Traditional Welfare-Program Design

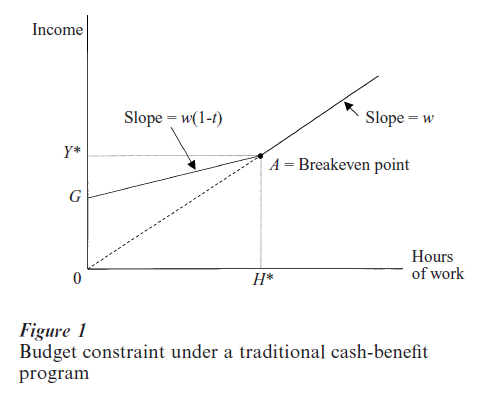

The design of a traditional cash-benefit program can be seen in Fig. 1, which shows the budget constraint under a typical cash-benefit program. This welfare program pays a benefit (G), often called the guarantee level, to those at the lowest levels of income. In Fig. 1 we show G paid to those who work zero hours, and assume that those who do not work have little other income. Of course, some families might have other income that would make them ineligible for welfare benefits, even if they were not working. As hours of work increase and earnings rise (at a given wage, w), the welfare benefit declines at a rate t, the benefit reduction rate or benefit tax rate, until at some income level (Y* in Fig. 1, at H* hours of work) benefits disappear entirely. This is point A in Fig. 1 and is often referred to as the break-even point.

Several aspects of the design of this welfare program are important. Note first that the maximum benefit payment occurs at the lowest hours of work. On the one hand, this assures that the poorest families receive the most aid. On the other hand, this creates disincentives to work, by increasing the income available to nonworkers from 0 to G. Note second that the rate at which income increases for families below the breakeven point is lower than the rate at which earnings rise. For every hour worked between 0 and H*, earnings increase by the hourly wage (w), but income increases only by w(1 – t). This is because public benefits are reduced at a rate t for every hour worked. This is equivalent to a reduction in the hourly wage; for every hour worked, these families earn only w(1 – t) rather than w. Standard analysis of income and substitution effects suggests that wage changes have theoretically ambiguous effects on work incentives, but the empirical literature indicates that wages are positively correlated with labor supply among low-wage workers. This means that a lower wage will lower labor supply.

The enactment of a welfare program similar to that described in Fig. 1 is expected to reduce labor supply, by increasing the number of persons who choose the zero hours point, as well as by reducing hours of work among those who would have worked somewhere between 0 and H* hours in the absence of a welfare program. In addition, because of the ‘kink’ in the budget constraint at point A, some people whose hours would be greater than H* in the absence of the welfare program will find it preferable to drop to a point below H*.

One way to view the trade-offs inherent in this type of welfare program is to realize that this program essentially contains two policy parameters—the maximum level of benefits, G, and the benefit reduction rate, t. But there are often at least three goals for these programs: to provide adequate income support to those who are not expected to work, to provide work incentives for those who can work, and to keep government spending at a reasonable level. If there is an increase in the benefit level G, this improves income support, but reduces work incentives and increases government spending. If the benefit reduction rate t is lowered, this moves the break-even point up the income distribution, to higher levels of income and higher hours of work. The result is an increase in work incentives for those at zero or low hours of work, but this will also induce more welfare participation among those near the new (higher) break-even point. It will also increase government expenditures, by expanding eligibility to more families.

A wide variety of empirical studies have attempted to estimate the impact of benefit levels and benefit reduction rates on labor supply. In fact, in the 1970s, the US government funded a series of randomized experiments known as the negative income tax experiments, which compared the impact of different levels of G and t (Robins 1985, Munnell 1987). (A cashassistance program as outlined in Fig. 1 that is run through the tax system is known as a negative income tax; in this case one receives a payment if income is below a certain level, and pays taxes if income is above a certain level.) Other researchers have used variation in benefit levels and effective tax rates across states in the USA to look at the impact of these parameters. Moffitt (1992) summarizes this literature. His conclusions are that the primary cash support program in the USA for low-income families (Aid to Families with Dependent Children or AFDC) created nontrivial work disincentives. (AFDC was replaced with a block grant known as Temporary Assistance to Needy Families or TANF in 1996.) A midpoint estimate of the impact of AFDC is that it reduced work by about 5.4 hours per week, a 30 percent reduction in work effort.

There are circumstances under which these tradeoffs between income support and work incentives may be less problematic. For instance, for a population from whom little or no work is possible or expected, it may be easy to set a high G (allowing greater income support), along with a high t (creating a break-even point at a low level of hours). The limited work incentives in this design are unimportant if there is no desire to encourage work among the eligible population. An alternative way to avoid these problems is to institute a mandatory work program for welfare participants who are judged to be able to work. For example, a wide variety of states in the USA have experimented with what are typically called ‘workfare’ programs, which mandate that work-eligible recipients must work a certain number of hours in publicly created jobs in order to maintain eligibility for their benefits. These and other work-incentive programs are discussed below.

Researchers have also noted that these tradeoffs between work and cash support may be less problematic in a situation where there is ‘stigma’ associated with being on welfare. Moffitt (1983) has modeled this situation, showing that if persons believe there is a cost to being on welfare (such as the stigma of being looked down on by one’s neighbors), this will make persons less likely to use it, and will shift welfare participation only to the neediest cases. If stigma is greater among those who are more able-bodied and work-ready, and less among needier and less work-able persons, this will reduce the work disincentives of the program, while protecting its income-support aspects. Of course, if stigma is also high among needy persons who are not able to work, this could make the program less effective as a social safety net. It may be difficult to target efforts to increase participation among the neediest without also reducing stigma and increasing participation among the less needy as well.

Stigma is only one reason why participation rates (often called take-up rates) among those eligible for a program are often far below 100 percent. There may be costs associated with participating, related to the regular reporting and certification process. There may also be a lack of information about the program among eligibles. It is not unusual to find that close to half of those eligible for a particular public-assistance program do not participate in it (Blank and Ruggles 1996).

While much of the research literature has focused on the labor supply effects of traditional welfare programs, other concerns have also been raised about such programs. For instance, welfare programs which provide support for mothers with children may in- crease the incidence of divorce or out-of-wedlock childbearing. The literature on these effects is much more controversial, and also more limited in terms of empirical sophistication. In general, there is little evidence of strong benefit effects on family fertility or female headship, but there are also methodological problems with much of the literature on this topic. (Moffitt 1992 also discusses these issues. A more recent review occurs in Robins and Fronstin 1996.) Dis- agreement over the impact of the negative income tax experiments on divorce and separation has also resulted in more recent estimates suggesting the impacts were relatively small (Cain and Wissocker 1990).

2. In-Kind Benefits

So far, the discussion has presumed that welfare programs pay out cash benefits, which are theoretically indistinguishable from other sources of income. Many welfare programs provide in-kind benefits, however, which are available only for particular types of consumption. For instance, in the USA, the food-stamp program provides special coupons which recipients can use in lieu of cash at the grocery store. Similarly, housing assistance programs typically subsidize rent, or child-care assistance programs subsidize child-care costs. (For a description of the research relating to food stamps, see Ohls and Beebout 1993; for a similar survey of the literature on housing subsidies in the USA, see Newman and Schnare 1992.)

In most cases, the same issues that arise in traditional cash-benefit programs also arise in in-kind programs. These in-kind programs provide subsidies, which are then reduced in some manner as incomes rise. This raises the same questions about income support, work incentives, and incentives for family formation.

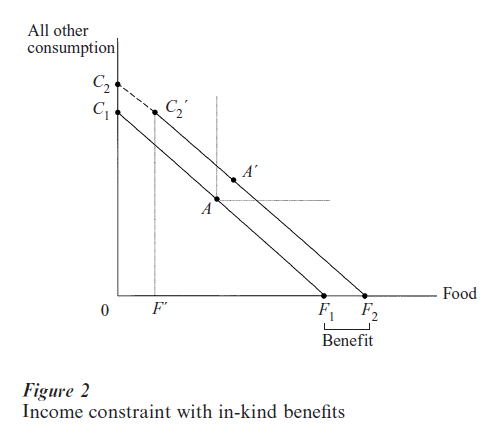

In-kind benefits are a more constrained form of a subsidy than cash benefits, however. Figure 2 shows the income constraint that emerges in the presence of a food subsidy. On the X-axis is food consumption and on the Y-axis is all other consumption. The food- stamp program shifts the income constraint from

F1 –C1 to F2 –C2` . Note that the line segment C2` –C2 is not part of the new budget constraint. The additional resources expand food purchases only, and cannot be used to expand other forms of consumption.

If these in-kind subsidies are relatively modest, they should cause little distortionary behavior. Individuals who were choosing point A on the income constraint F1 –C1 , now move to point A` on the income constraint F2 –C2` , somewhere within the northeastern quadrant to the right and top of point A. Note that at A` , a family consumes both more food and more other goods, that is, they substitute some of their earlier (cash) spending away from food to other goods. If, however, the food subsidy is relatively large or the family spends little cash on food, there is some possibility that the family would prefer to be on the C2` –C2 segment of the budget constraint, rather than on the F2 –C2` segment. In this case, the in-kind program constrains expenditures and forces families to choose the consumption point C2` , where they consume more food than they would if they had received a cash benefit rather than an in-kind benefit. Indeed, research in the USA, which compares food stamps to a program that provides an equivalent subsidy in cash, concludes that families who receive cash reduced their food expenditures by between 20 cents to 25 cents per dollar of food-stamp benefits, suggesting that the in-kind form of the benefit forced families to purchase a higher quantity of food than they would with an equivalent amount of cash (Fraker et al. 1995). In contrast, for elderly or disabled food-stamp recipients, there was little difference in their consumption when given food stamps vs. an equivalent amount of cash.

Economists have traditionally believed that in-kind programs are inefficient, since a cash transfer of an equivalent amount could make a family at least as well off, and might make them better off if they want to allocate more of their spending to another category of consumption. Those who support in-kind benefits tend to make two arguments in response. First, there is often more widespread support for in-kind programs than for cash programs. That is, the median taxpayer might be more willing to provide food stamps than general cash assistance. This raises the question of whose preferences are being maximized in poor support programs. While lower-income people might prefer less constrained subsidies, taxpayers might prefer to provide constrained assistance, in order to limit the extent to which public dollars are used to subsidize behavior that taxpayers believe is inappropriate. If welfare programs are meant to be responsive to taxpayer concerns, in-kind programs might be a reasonable way of providing support. Second, many have noted that in-kind programs often come attached to their own ‘lobby.’ For instance, food stamps are heavily supported by agricultural interests, while public health insurance is heavily supported by the health industry. This may provide a level of political support and protection for these more targeted in-kind programs—support that general cash-assistance programs often lack. In the midst of regular waves of budget-cutting fervor at both the state and national levels, public assistance programs are often vulnerable. A series of targeted, smaller, in-kind programs may be more politically viable and enduring in the long run than a single, large cash-assistance program (such as a negative income tax).

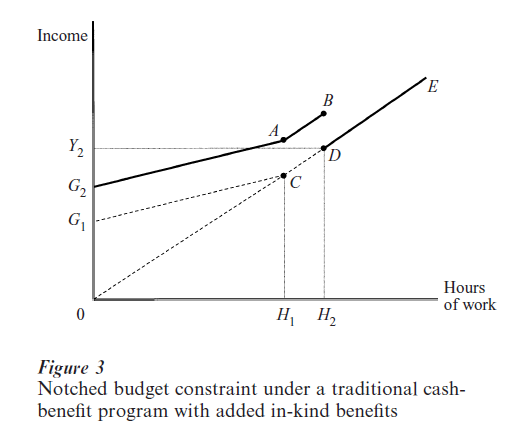

In-kind programs often raise another problem as well. Many of them are designed to phase out more abruptly than cash programs (although cash programs may be designed to phase out quickly as well). For instance, housing-subsidy programs often pay substantial benefits up to a particular income level and then cease, rather than slowly lowering benefits to a continuous break-even point. This creates a ‘notch’ in the budget constraint.

Figure 3 graphs a budget constraint in which a traditional cash-benefit program is supplemented by an in-kind benefit program for some specific good (this could be a program providing supplemental assistance to pay for food, housing, child care, or any other specified good.) In Fig. 3, the in-kind program provides a benefit of G2 –G1 , which is available to all families with incomes below Y2 and who work less than H2 hours at the specified wage w. Once income ses above Y2 , the in-kind benefit ceases. In this case, the cut-off point for in-kind benefits (D) is above the break-even point for receipt of cash benefits (C). The result is a very oddly shaped budget line, G2 –A–B–D–E, with a notch at B–D when the in-kind benefits cease. Standard economic analysis suggests that a number of families will choose point B and resist increasing their hours above H2 , since that means the end of their in-kind subsidy. This causes a ‘welfare trap,’ in which increases in work can actually produce a decline in income. Depending on the size of the notch, such a trap might be a real problem for policy makers who want to increase people’s employment and economic self-sufficiency.

Public-assistance systems with multiple-benefit programs layered on top of each other typically have some notches or welfare traps imbedded in them. In addition, high marginal tax rates can result when multiple programs have phase-out ranges in the same distribution of earnings, each acting as a separate tax on earnings. Blinder and Rosen (1985) discuss the pros and cons of ‘notched’ budget constraints. Under some circumstances, it may be preferable to create a notch rather than to reduce benefits more continuously, particularly if a slow benefit reduction would greatly increase potential eligibility for the program and a fast benefit reduction would create high marginal tax rates over a range of income.

3. Programs That Subsidize Work

Increased concern with the work disincentives imbedded in traditional welfare programs has led to a series of changes in the structure of public assistance programs in the USA, and similar changes are occurring in other countries. This concern is driven by a variety of factors. Increasing labor-force participation among women at all skill levels has made government support for mothers who stay at home less politically popular. In the USA growing public-assistance caseloads and a growing concern with the problems faced by low-income single-mother families have led to increasing concern about finding ways to help these families permanently to escape poverty and avoid welfare ‘dependency.’ (Blank 1997a discusses many of these issues.) In Europe, sustained high unemployment rates have also increased caseloads and increased public spending on welfare-related programs. The result has been a growing emphasis on work-oriented welfare reform. This has taken several forms.

3.1 Welfare-To-Work Employment And Training Programs

In the 1990s, major efforts were made to meld jobsearch and employment programs with traditional welfare programs. In some states, this took the form of mandatory welfare, or work for your benefits, as noted above. Other states in the 1980s began to experiment with serious job search and job placement programs aimed at welfare recipients. The result of these efforts has been a revolution in the way that public assistance offices operate and what services they deliver. In addition, a variety of very well-designed evaluations of these efforts reinforced the belief that such policies could increase work and earnings, and decrease public assistance spending. (The interaction between these experimental results and political decision making is reviewed in a set of articles in the 1991 Journal of Policy Analysis and Management 10.)

These evaluations indicated that even rather minimal efforts at job-search assistance seem to produce employment and earnings gains among women on welfare (Gueron and Pauly 1991). The returns from these programs are usually greater than the costs to the government budget, making them cost-effective policies. The resulting earnings increases are not huge—at most around $1,000 per year—but they represent a large percentage increase in earnings among women, many of whom had little earned income to start with.

Since 1996, US states have had almost full discretion to design their own cash public-assistance programs. The result is a wide variety of experiments, many of which meld work and welfare together even more closely. For instance, many states have lowered their benefit reduction rates, increasing work incentives for those on welfare. Many states have also expanded their emergency-assistance programs (now often called ‘diversion activities’), which help welfare applicants deal with immediate problems, such as an ill family member or a housing eviction, without entering them permanently on the welfare rolls. All states are mandating that a growing share of their caseload participate in job-search and job-placement programs. Many states have also instituted serious sanctions, cutting benefits among families who do not respond to the mandate to enter a job-search program. (For a discussion of these changes, see Blank 1997b, Gais and Nathan 1998, or Gallagher et al. 1998.)

This movement to a more work-oriented welfare system has reduced caseloads and increased labor-force participation by single mothers. It has also raised a host of new policy-related questions, such as whether former welfare recipients will be able to maintain their jobs during an economic downturn, and whether women who initially enter very low-wage positions will be able to increase their earnings over time, becoming more economically stable and self-sufficient.

3.2 Wage Subsidies To Support Work

In the face of increasing demands that welfare recipients move into work as quickly as possible, the question has emerged, ‘How do we design a safety net that supports work?’ If one believes that work—even in unstable jobs and at low wages—is preferable to welfare, then providing the public support that enables steady workers to support their families becomes increasingly important.

A major innovation in the USA, which has been very important in increasing the returns to work and raising labor-force participation among adults in low-income families, is a wage-subsidy program called the Earned Income Tax Credit (EITC). The structure of the EITC is very different from traditional welfare programs. It provides a subsidy to low-wage workers in low-income families, based on family income but conditioned on work.

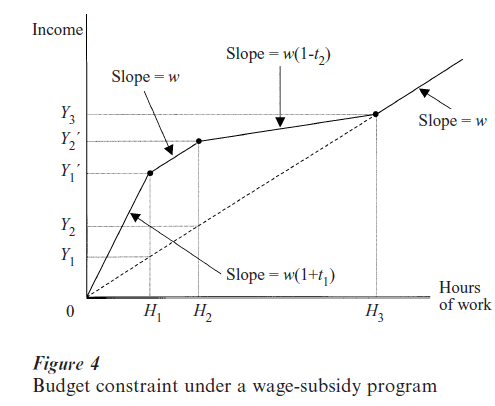

Figure 4 graphs the budget constraint produced by the EITC. In contrast to traditional welfare programs (where a nonworker receives the maximum level of benefits), a nonworker gets zero benefits from the EITC. As work hours increase, the EITC subsidizes the wage at a rate t1 . Hence, the effective wage rate faced by the worker rises from w to w(1 + t1 ). When earned income reaches Y1 (at H1 hours of work), the subsidy reaches its maximum level (Y1` –Y1 ). It stays at this level while earned income increases from Y1 to Y2 , providing a flat subsidy to the worker. As earned income rises past Y2 , the subsidy is phased out at a rate t2 , which lowers the wage rate to w(1 – t2 ). The subsidy ends entirely at the break-even point when income reaches Y3 .

Note several things about the design of the EITC. First, its maximum subsidy levels occurs at incomes between Y1 and Y3 (hours between H1 and H2 ). In order to reach the maximum subsidy, a person must work some (substantial) amount of time. Second, the work incentives imbedded in the EITC vary across different segments of the EITC budget constraint. For nonworkers or very low-hour workers the impact is positive, as the EITC raises wage rates. For workers with earnings greater than Y , the impact is likely to be more negative, particularly in the benefit reduction range when the effective wage rate is reduced.

These theoretical observations are consistent with the empirical research to date, which suggests that the EITC has had a strong positive effect on work effort among single mothers, who tend to be nonworkers or low-hour workers (Eissa and Leibman 1996), but has had a small negative effect on the work effort of wives, whose family income is more likely to be higher, putting them in the benefit reduction range (Eissa and Hoynes 1998). These labor-supply effects may be somewhat tempered by the complex design of the EITC. It is possible that few low-income workers fully understand its structure or can easily calculate how the EITC affects their own incentives.

It is also worth noting that the EITC and the minimum wage reinforce each other in useful ways. The minimum wage provides an income base to workers, which means that the EITC subsidy need not be as large. This is important, because the larger the maximum subsidy the more difficult it is to do the benefit reduction. At a high subsidy level, if a relatively low benefit reduction rate (t ) is chosen, the breakeven point for the EITC would occur far up into the earnings and income distribution, substantially increasing the number of persons who receive the subsidy and making it less targeted to low-income workers. On the other hand, if a high benefit reduction rate is chosen quickly to reduce the subsidy, then the work disincentives in that part of the budget constraint are greater. The minimum wage assures that low-income workers can reach a target level of earnings without the problem of how to ‘claw back’ a very large EITC subsidy. Similarly, the EITC reinforces the higher take-home pay provided by the minimum wage, and allows the level of the minimum wage to remain lower, while still increasing income among low-income workers. This presumably reduces the potential disemployment effects of the minimum wage.

The importance of recent increases in the USA in the EITC and the minimum wage together can be easily calculated. The earnings of a single mother with two children, working full-time at the minimum wage and receiving the EITC, would have risen from $9,856 in 1989 to $14,056 in 1998 (in 1998 dollars), a 40 percent increase due entirely to these policy changes. This is a substantial addition to earnings for low-income families. It is not surprising that these changes appear to be causally related to the increase in laborforce participation among single mothers (Meyer and Rosenbaum 1998).

3.3 Additional Work-Support Programs

While job-search assistance programs and wage-subsidy programs are often discussed as a primary way to encourage work, most countries also operate a variety of other programs that help or hinder the movement of less skilled persons into employment.

Particularly for many single mothers, the cost of childcare can substantially increase the expense of working (or, alternatively, reduce the take-home pay generated by employment). Public subsidies to offset child-care expenses among working low-income mothers can increase work incentives. If childcare is viewed as an hourly expense (call it c), the returns to work are (w – c). If a subsidy (s) is provided, then returns to work rise to (w – c(1 – s)). This is the same as an increase in the effective wage and should increase work effort. There is clear research evidence that childcare assistance can increase labor supply among low-income mothers (Anderson and Levine 1999).

The availability of health care is also an issue for working low-income families in the USA. Families that receive public assistance have historically been eligible for Medicaid, the publicly provided health-insurance plan. Leaving public assistance has usually meant losing Medicaid. Since few low-wage jobs offer health insurance, this often means going without insurance, and may lead a number of families to stay on welfare in order to continue receiving Medicaid. The evidence on the magnitude of this effect is mixed (Winkler 1991, Moffitt and Wolfe 1992), but recent welfare reforms have mandated that states offer ongoing Medicaid coverage to persons leaving welfare for at least some period of time. This is one area, however, where the USA lags behind many European nations. Their nationalized health-insurance systems make health-insurance coverage a nonissue in the choice between work and welfare.

Other types of programs may also be important in supporting income and work under particular circumstances. The regular collection of child support from noncustodial parents is one way to guarantee additional income among single mothers whose earnings may be low. Subsidized public transportation systems, with routes that run through low-income neighborhoods, may lessen travel costs and travel time for potential workers. Strong enforcement of antidiscrimination laws may also improve the availability of jobs for certain populations. In short, a wide variety of policies can be important in assisting low-income families into employment.

4. Conclusions

Given the multiple goals associated with welfare programs, it is not surprising that there has been constant controversy about the appropriate design of such programs. It is clear that there are a number of alternative policy choices which may be attractive for different groups among the poor population.

For groups that not expected to work and for whom income support is the primary consideration, such as the infirm and elderly, traditional welfare programs may be highly effective and desirable. Indeed, the Supplemental Security Income program in the USA, designed to provide income support to elderly and disabled individuals, is designed as a traditional welfare program, and continues to receive widespread public support.

For groups that expected to work, a wide variety of programs can encourage work. Many of the changes in US welfare programs over the 1990s were designed to provide better work incentives and a stronger set of supports to working low-income families (as opposed to cash assistance to nonworkers). The expanded EITC wage subsidy appears to have been particularly effective in increasing labor-force participation among low-wage single mothers with young children. And the shift toward mandated participation by welfare recipients in job-search and job-preparation programs has added to these labor-force participation increases.

In the USA, as in many other nations, welfare programs are multilayered. Both the state and federal governments often have some program responsibility. These programs include a mix of cash and in-kind support programs. They include a mix of more and less work-oriented programs aimed at different groups in the population. Some are run at the local level, while others are run through the national tax system. The effect is a quite confusing array of programs, which can produce overlapping incentive effects on individuals who are eligible for multiple programs. But such a mix of programs is also a response to the multiple goals and the desire to differentiate between different groups among the poor. And many of these programs have their own community of political advocates who support them and lobby for maintaining and/or expanding them. This may produce a network of programs that in sum provide much greater overall support to lower-income families than would be achieved by a more streamlined and unified welfare system.

Bibliography:

- Anderson P M, Levine P B 1999 Child Care and Mother’s Employment Decisions. In: Card D, Blank R M (eds.) Finding Jobs: Work and Welfare Reform. Russell Sage Foundation, New York

- Blank R M 1997a It Takes A Nation: A New Agenda for Fighting Poverty. Princeton University Press, Princeton, NJ

- Blank R M 1997b Policy watch: The 1996 welfare reform. Journal of Economic Perspectives 11: 169–77

- Blank R M, Ruggles P 1996 When do women use aid to families with dependent children and food stamps? Journal of Human Resources 31: 57–89

- Blinder A S, Rosen H S 1985 Notches. American Economic Review 75: 736–47

- Cain G G, Wissocker D A 1990 A reanalysis of marital stability in the Seattle-Denver income maintenance experiment. American Journal of Sociology 95: 1235–69

- Eissa N, Hoynes H W 1998 The earned income tax credit and the labor supply of married couples. Unpublished manuscript, University of California, CA

- Eissa N, Liebman J B 1996 Labor supply response to the earned income tax credit. Quarterly Journal of Economics 111: 605–37

- Fraker T M, Martini A P, Ohls J C 1995 The effects of food stamp cashout on food expenditures: An assessment of the findings from four demonstrations. Journal of Human Resources 30: 633–49

- Gais T L, Nathan R P 1998 Overview Report: Implementation of the Personal Responsibility Act of 1996. Nelson A. Rockefeller Institute of Government, Albany, NY

- Gallagher L J, Gallagher M, Perese K, Schreiber S, Watson K 1998 One Year After Federal Welfare Reform: A Description of State Temporary Assistance for Needy Families (TANF). Decisions as of October 1997. Occasional Paper no. 6, Assessing the New Federalism Project. Urban Institute, Washington, DC

- Gueron J M, Pauly E 1991 From Welfare to Work. Russell Sage, New York

- Meyer B, Rosenbaum D 1998 Welfare, the earned income tax credit, and the labor supply of single moms. Unpublished manuscript, Northwestern University

- Moffitt R A 1983 An economic model of welfare stigma. American Economic Review 73: 1023–35

- Moffitt R A 1992 Incentive effects of the United-States-welfare system: A review. Journal of Economic Literature 30: 1–61

- Moffitt R A, Wolfe B 1992 The effect of the Medicaid program on welfare participation and labor supply. Review of Economics and Statistics 74: 615–26

- Munnell A 1987 Lessons from the Income Maintenance Experiments. Federal Research Bank of Boston, Boston

- Newman S J, Schnare A B 1992 Beyond Bricks and Mortar: Re-examining the Purpose and Effects of Housing Assistance. Urban Institute, Washington, DC

- Ohls J C, Beebout H 1993 The Food Stamp Program: Design Trade-offs, Policy, and Impacts. Urban Institute, Washington, DC

- Robins P K 1985 A comparison of the labor supply findings from the four negative income tax experiments. Journal of Human Resources 20: 567–82

- Robins P K, Fronstin P 1996 Welfare benefits and birth decisions of never-married women. Population Research and Policy Review 15: 21–43

- Winkler A E 1991 The incentive effects of Medicaid on women’s labor supply. Journal of Human Resources 26: 308–37