View sample David Ricardo Research Paper. Browse other research paper examples and check the list of research paper topics for more inspiration. If you need a religion research paper written according to all the academic standards, you can always turn to our experienced writers for help. This is how your paper can get an A! Feel free to contact our research paper writing service for professional assistance. We offer high-quality assignments for reasonable rates.

Among the educated public only a few names of economists stand out: Adam Smith, the spokesman for capitalism; (T.) Robert Malthus, who earned for economics the title of ‘the dismal science,’ by virtue of his belief that any temporary gain in well-being would self-destruct by inducing population explosion that would entail diminishing returns and a retreat back to a subsistence ration of real wages; Karl Marx, the prophet of capitalism’s doom and the exponent of allegedly scientific socialism; John Maynard Keynes, proponent of the Mixed Economy, who rescued capitalism from the post-1929 Great Depression by activistic governmental macroeconomic policies and public regulation.

Academic Writing, Editing, Proofreading, And Problem Solving Services

Get 10% OFF with 24START discount code

Within the economics profession, it is a different story. David Ricardo was the archetypical classical economist, the economist’s economist who supposedly improved upon Smith and spelled out with Euclidean logic the eternal behavior of the market system. In amiable epistolary debates with his friend Malthus, Ricardo used to be reckoned the hands-down winner: Malthusian fears of recurrent depression stemming from under-consumption spending were argued to be fallacies. Like poet Robert Frost, beloved by both highbrows and lowbrows, the self-made millionaire David Ricardo captured the respect of the Victorian devotees to laissez faire as well as socialistic critics of Marxian or romantic stripe.

Schooled only in the Darwinian jungle of speculative finance, the broker Ricardo wrote as an autodidact, often in an obscure style that impressed his limited number of readers as being profound. Since 1817 literally scores of articles have appeared in learned journals debating whether or not David Ricardo did believe in ‘a labor theory of value.’ This is the stuff of which PhD theses can be made.

Ricardo was also lucky in having the learned Piero Sraffa edit for the Royal Economic Society, over a period of 25 years, a magnificent and complete edition in 11 volumes of The Works and Correspondence of Da id Ricardo (1951–73). Although this brought Ricardo’s name back into the limelight, oddly it seems to have contributed to a revisionist erosion of his analytic reputation. Whereas the late-Victorian Alfred Marshall, pillar of post-1870 neoclassicism, had idiosyncratically argued that the good modern stuff was already in Ricardo, and whereas Keynes had written in the 1920s that David Ricardo’s was ‘the finest mind that had come to economics’—neither Ricardo’s late twentieth-century admirers nor detractors could agree among themselves as to what his different virtues and vices actually were. A scholar who is much misunderstood cannot be acquitted of all responsibility for ambiguity.

Ricardo’s parents were Sephardic Jews who migrated to England from Amsterdam in the mid-eighteenth century. His ancestors had gone from Spain to Italy and then on to Holland. They seem to have been for the most part successful dealers in finance, an occupation that young David took up at the age of 14. When he married a Quaker, he was cut off by his father with the proverbial shilling; but within a score of years, working as a broker in the City of London, he had by his early forties amassed a comfortable fortune—the period of the Napoleonic Wars offered windows of opportunity for an alert and nimble financier. During vacation, when he picked up by chance Smith’s The Wealth of Nations (1776), Ricardo was hooked for political economy.

Reversing the usual order of study, Ricardo first made his mark in what has come to be called macroeconomics. His unqualified verdict typifies his non-eclectic style. To finance a very long war against Napoleon, Britain expanded its money supply of paper currency in order to procure goods at home and abroad for its armies. Price-level inflation, not surprisingly, was part of the economic history in that period. Eclectic Smithian theory would no doubt have predicted as well a worsening of Britain’s terms of trade as she and other belligerents bid up the relative prices of needed imports. Had gold and silver been the sole money used then in England and elsewhere, the 1750 theories of David Hume would have predicted a drain of specie from London to pay for the war-induced trade deficit of exports compared to imports.

However, even in those distant times much of the money employed for purchase and sale transactions involved use of paper-money currency. And, as is customary in times of war, whatever the supply of domestic gold or silver, there ensued a considerable rotation of the printing press to finance government needs and accommodate the desire for the enhanced cash necessary to conduct the enlarged volume of goods transactions and their higher average prices. Under these circumstances, whenever a government chooses not to redeem paper currency notes into specie at their previous face value, those notes will depreciate in price relative to ounces of specie. The high price of gold is what the person in the street calls this phenomenon and passionate voices debated its cause(s). Young Ricardo attributed all of the rise in gold prices to over-issue of paper notes.

Today one can write counterfactual history. Somehow the British government might have taxed the populace more heavily to finance in a balanced-budget fashion the enhanced war effort and the irreducible rise in relative import prices; imposed tightness in bank lending, enforceable only at higher interest rates, conceivably could have kept the stock of paper currency unchanged, at the same time almost certainly imposing unemployment and extra loss of consumption on the civilian populace. With heroic tightness, trade balances might even have been forced to cancel out to zero. (It is hard to envisage how normal peacetime unemployment levels could have somehow been made to prevail from say 1795 to 1810 in this contrafactual scenario.) An inflation-free war can thus be painfully conjured up in contrafactual history; and with no wartime increment of paper-currency issue.

In actual history, paper notes did depreciate and price levels did soar. As happened a century later during the 1920–23 German hyperinflation, economists lined up in opposing camps. Young David argued: over-issue in currency M explained virtually all of the rise in the price of bullion. Henry Thornton, practical banker and Bank of England authority, (at first) argued that the microeconomic phenomena of adverse trade balances and war-induced buoyant business activity explained a significant fraction of the observed appreciation of bullion.

Ricardo’s 1809–10 strong assertion of what was called the ‘bullionist view’ won him instant celebrity, particularly with the dogmatic James Mill. But this economic debate was not really a zero-sum game in which Ricardo’s gain had to equal Thornton’s loss.

Both men agreed on the likely longest-run outlook. The price of gold in terms of paper would be the same in 1850 if, in the many preceding decades, the supply of paper currency was limited enough to permit free specie–currency convertibility at the old 1790 ratio. The so-called ‘Ricardian vice’ was his use of long-run true relations to characterize actual short-run patterns in economic history.

After the first decade of the nineteenth century, Ricardo concentrated mostly on microeconomics. In 1815 (and not prior to then), along with Malthus and Edward West he helped articulate the ‘law of diminishing returns’ and its consequences for land-rent determination. Society’s product, call it corn, is produced by labor and by land, both working together. When you increase labor in two equal increments, working on fixed land, you acquire two successive increments of corn. But the second gain is presumptively less than the first—a technological law of nature. Thus the wage that the competitive market can pay to labor goes down when labor land density increases; and the rent that the market will pay for land will go up. This is not a new idea—it is in Benjamin Franklin (1755) early in the eighteenth century and already in Smith (1776)—but it is an important insight that needed being made explicit.

Already Ricardo had perceived what he considers faults in Adam Smith. Posterity can be grateful that this perception tempted Ricardo into economics, even though it can be argued convincingly that Smith is mostly the more correct thinker in the cases where Ricardo criticizes him. For example, in the capitaland-land-and-produced-capital models that both writers worked with, Smith was right to jettison the ‘labor theory of value’ as soon as the interest rate and/or the land rent rate becomes significantly positive.

As between the two tasks of political economy— (a) understanding how relative scarcities of factors of production constrain the alternative availabilities of different goods and their valuation relations; and (b) how society’s harvest gets distributed among and between the different social classes of workers and owners of property—Ricardo arbitrarily declared it to be distribution that was all important. Yet nowhere in the 11 volumes of his Works and Correspondence (1951–73) will the reader find a complete and satisfactory theory of distribution that goes beyond what is in Smith, Malthus, Mill or modern mainstream writers.

Perhaps Ricardo’s lack of a university education contributed to his methodological style. Frequently he asserts general ‘truths’ that do admit of important exceptions; repeatedly he fails to distinguish between necessary and sufficient conditions for an argument. He is a superb miniaturist but with an absence of coherence, particularly in his post-1815 textbook phase. (Ricardo’s theory of comparative advantage in international trade, similar to that of the contemporary Colonel Robert Torrens, is a brilliant example of his miniaturist virtuosity.)

If it be thought that, by use of hindsight, I am a bit harsh on 1810–23 David Ricardo, let it be understood that I am even harsher on Ricardo’s twentieth-century commentators: the brightest and the best of them— Piero Sraffa, George Stigler, Samuel Hollander, Mark Blaug and scores of others—while understanding that the positive interest and time-phasing of production do generically invalidate Ricardo’s championing of the labor theory of value (as, indeed, Ricardo himself intermittently admitted), at the same time seem blind to the parallel fact that positive rent(s) on scarce land(s) must similarly invalidate the labor theory of value. (Edwin Cannan, Knut Wicksell, Jacob Viner and Lionel Robbins are honorable exceptions to this indictment of blindness about how labor/land intensities do generically invalidate any labor theory of value in the same logical way that time-intensities are known to do so.)

Around 1815, between his macro works on gold and his Principles of Political Economy and Taxation (1817, 1819, 1821), Ricardo did puzzle over a simple scenario involving a farm good (corn) and one or more manufactured goods (cloth, …), all produced by, say, homogeneous labor, homogeneous land and by one or more produced inputs (corn seed, raw materials from farming used for manufactures, durable tools). He may even have worked out, in an unpublished manuscript that has not survived, a one-sector farm-only model. In it, a determinate model of distribution could have cogently defined long-run stationary-state equilibrium for (real corn wage rate, interest rate, real corn rent rate) = (W/Pcorn = w, r, Rent/Pcorn = R*). How would it have gone?

Like Malthus and other predecessors, Ricardo would have specified exogenously a classical ‘subsistence wage’ rate, w, needed to keep population just reproducing itself. Like classical successors he would have specified exogenously a minimal interest rate, r, needed to keep capital(s) just reproducing themselves. Land being a classical constant, A, its stationary equilibrium rent rate he would residually determine once variable labor-and-capital stocks, Lt and Kt, dynamically converged to their long-run, asymptotic stationary equilibrium levels: Lt → L*; Kt → K*, when K is a single scalar. Finally, short-run determination of wt and rt would be market-clearing rates dependent on the relative transitional abundances of Lt and Kt.

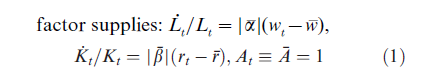

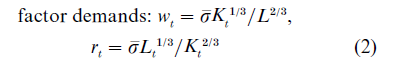

Here is how in the spirit of Prokofiev’s ‘Classical’ Symphony, an ambitious neophyte in a 1932 Hicks–Wicksell neoclassical workshop might synthesize these classical insights into a coherent simplistic dynamic equation system, using the notational convention dYt/dt = Yt:

where σ is an exogenous parameter denoting level of technical productivity.

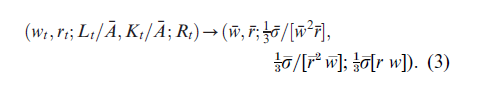

When the modern crank of deduction gets turned, Ricardo’s (1) and (2) do lead convergently to a determinate classical stationary state. From any initial (L0 K0 A)0, as t→∞,

One must commend the classical tradition for so subtle an accomplishment. (Note the version worked out here differs from the Samuelson (1978) ‘canonical’ model, which had more faithfully adhered to the conventional labor-capital ‘dose’ version.)

This above supply–demand equilibrium is definitely not independent of the problem of how consumers wish to allocate their earned incomes among the many goods, when there are many non-corn goods in the picture. Then in it there are no ‘natural prices’ definable independently of how consumers choose to spend their incomes.

Definitely goods’ relative price ratios do not remain close to proportionality with their respective embodied-labor contents, Pit /Pjt ≠ (Lit / qit) (Lj /qit).

Likewise embodied land contents (Ait /qit)/(Ajt /qjt ) and embodied capital contents (Ki t/qit )/(Kjt /qj t) similarly fail as approximations to empirical actual Pi/P+ ratios.

Since Ricardo did not coherently understand the intricacies of his own classical scenario, he never realized how unattainable was his hankering to have all relative prices determinable purely by objective technology and cost data. Subjective variabilities (a) of consumers’ utilities and demand choices and (b) of intertemporal saving-and-consuming choices—which became central preoccupations of post-1870 neo- classical successors to the classical school—were thus already unavoidable in the classicals’ own capital, land and labor models and in the competitive scenarios that Marx grappled with all his working life. This inevitability will come with pain for the small sect of Sraffian neo-Ricardians who proliferated after 1925 and especially 1960.

Ricardo was low-keyed and civil in argumentation, albeit firm in holding to his strong positions. The letters between Ricardo and Malthus, notwithstanding these scholars’ deep differences, are a model of courtesy and affection. Despite Ricardo’s typical unqualified dicta, he did not hesitate to change his mind and admit to previous mistakes. Marx, who abhorred classical authorities and for whom ‘Parson’ Malthus was a particular bete noir, was uncharacteristically soft toward Ricardo. Here is an illustrative incident. After Ricardo’s first edition of Principles, but prior to its third edition, David, Humpty-Dumpty like, had declared that technical invention must always help all factors of production, including the working man. He encouraged disciples, like J. R. McCulloch, to affirm this strong view. However, on reconsideration, Ricardo came to realize that some inventions can assuredly replace labor and reduce the demand for labor in the short and the long run. Therefore, despite friends’ warnings that this would weaken the case for laissez faire, Ricardo added a new chapter on Machinery to the third (1820) edition of the Principles, presenting exposition and numerical examples designed to show how labor’s share of national income could suffer from certain possible inventions and how long-run equilibrium populations and gross-income levels could be permanently lowered. With virtually no exceptions, ancient and twentieth century authorities agreed that for once Homer had nodded. For once David must have invoked rigidity of wage rates with its resulting unemployment, thus for once denying J.-B. Say’s sacred dogma that over-production is impossible in a capitalist system. Karl Marx praised the scholar for his honesty.

It is a story that casts discredit on virtually all. The Ricardo–McCulloch original sweeping position was gratuitously wrong. A new wind that raises an economy’s potential for production and consumption most certainly can do harm to some competitors while helping others. (Ricardo did not, as J. S. Mill and Vilfredo Pareto were later to do, argue that gainers could always bribe losers so that with intervention all could gain.) Nor did Ricardo’s new understanding motivate him to abandon a dogmatic defense of laissez faire. His critics on Machinery, both then and in our time—including Knut Wicksell, Nicholas Kaldor, Joseph Schumpeter, George Stigler, …—failed to see the absence in Ricardo’s exposition of any denial of dogmatic Say’s Law and its ruling out theoretical harm from under-consumption; instead his usual classical scenario of population decline dictated by the induced drop in the wage below an alleged equilibrium subsistence rate would, as the Machinery chapter alleged, call for an ultimate drop in population and gross product as a result of labor-saving invention(s). Just as the industrial Revolution was beginning to raise wages by a genuine filter-down process, the philosophers of the Chair were getting first intimations of the complexity of how a market system metes out its distributive awards.

In that long ago age before antibiotics, David Ricardo in 1823, at the peak of his powers, died from an ear infection. Thus he never lived to see the 1836 Repeal of the Corn Laws, a vindication of his pamphleteering for free trade; and he did not live to witness Ireland’s great famine of the 1840s, with its brutal confirmation of the laws of the free market.

In summary, David Ricardo, like the twentieth century economists Friedrich Hayek and Milton Friedman, importantly pushed voters and public opinion toward libertarian laissez faire. Victorian England’s Whig society and Manchester School owed much to him. In the modern debate about how a modern mixed economy can optimally compromise between market mechanisms and democratic rules of the road, Adam Smith and John Stuart Mill seem more subtle classical thinkers. From these two, rulers like Lenin, Stalin and Mao could have had the most to learn. But among the worldly philosophers, David Ricardo must be counted as an important shaper of the twenty-first-century mind.

Bibliography:

- Franklin B 1755 Observations Concerning the Increase of Mankind and the Peopling of Countries

- Keynes J M 1936 The General Theory of Employment, Interest and Money. [Reprinted in: 1977–81 The Collected Writings of John Maynard Keynes. Macmillan, London]

- Malthus T R 1798 An Essay on the Principle of Population as it Affects the Future Improvement of Society, with Remarks on the Speculations of Mr. Godwin, M. Condorcet and Other Writers. J. Johnson, London [Reprinted by Macmillan, London, 1926]

- Marshal A 1890–1920 Principles of Economics. Macmillan, London

- Marx K 1867, 1885, 1894 Capital, Volumes I, II, and III. Verlag von Otto Meissner, Hamburg; [Penguin Books, Harmonds-worth 1976, 1978, 1981]

- Niehans J 1990 A History of Economic Theory. Classic Contributions, 1720–1980. The Johns Hopkins University Press, Baltimore

- Ricardo D 1817 Principles of Political Economy and Taxation. John Murray, London

- Ricardo D 1951–73 The Works and Correspondence of David

- Ricardo [ed. P. Sraffa with M. H. Dobb] 9 vols. Cambridge University Press, Cambridge, UK

- Samuelson P A 1978 The canonical classical model of political economy. Journal of Economic Literature 16: 1415–34

- Samuelson P A 1989 Ricardo was right! Scandinavian Journal of Economics 91: 47–62

- Schumpeter J 1954 History of Economic Analysis. Oxford University Press, New York

- Smith A 1776 An Inquiry into the Nature and Causes of the Wealth of Nations [ed. E. Cannan]. The Modern Library, New York, 1937

- Sraffa P 1926 The laws of returns under competitive conditions. The Economic Journal 36: 535–50

- Sraffa P 1960 Production of Commodities by Means of Commodities. Cambridge University Press, Cambridge, UK

- Thornton H 1802 An Enquiry into the Nature and Effects of the Paper Credit of Great Britain. Reprinted, Frank Cass, London; Augustus Kelley, New York, 1962